Unappreciated income: Why are investors shunning “highest yields in our careers”?

High nominal rates available on cash have lured investors away from equities and even bonds. But Artemis’ fund managers say that mispricing across the market means they could be leaving income-paying asset classes at the worst possible time.

"What we're seeing is compounding, just not as we know it – it’s compounding in reverse" Nick Shenton, Artemis Income Fund

"The time to worry about high-yield excess may come at some point in the future, but not while we see opportunities like this" Jack Holmes, Artemis Funds (Lux) – Global High Yield Bond Fund

There is a peculiar irony that is observable among the income investors of today. For years after the financial crisis, income was almost impossible to come by: bond yields were pushed close to zero and a similar phenomenon was at play with dividend yields on defensive stocks, which were suppressed by the upward momentum applied to share prices.

Now, there is the opposite situation – yields on good investment-grade corporate bonds stand at close to 6%1 and those on many large-cap equities in the UK are even higher.

Yet investors’ response has been to turn on their heels and flee. Data from Calastone shows equity fund outflows hit £1.2 billion in August, of which £811 million was from UK funds2. This represented the 27th consecutive month in which investors have withdrawn capital from the domestic market3.

Bond funds are no longer flavour of the month either, seeing net outflows of £330 million in August4. The main beneficiaries have been money market funds, which took in £673 million – this was the second highest figure on record for the sector, and the seventh consecutive month of net inflows5.

Leaving money on the table

Such a trend may seem obvious in light of rising interest rates, which offer a ‘risk-free’ return. But this risk-free return is still below the rate of inflation, so is in fact delivering a real-terms loss. And by turning to cash at the expense of equities and bonds, investors could be leaving a significant amount of income on the table.

For example, so compelling have dividend yields in UK equities become that they are attracting the attention of fund managers targeting capital growth as well as those that target income.

Ed Legget, who runs the Artemis UK Select Fund, is one such manager. He pointed out the distribution yield – the amount expected to be paid out over the next 12 months – on the FTSE All Share is now at 6%6, and in the mid to high teens in some sectors, which is “among the highest we have seen in our careers”. These could be pushed higher still by the use of share buybacks.

Using the example of the energy giants, he noted sell-side models show that BP and Shell are on free cashflow yields in the low teens, assuming $70 to $80 a barrel of oil7. An upside scenario of $100 a barrel would see these figures move into the high teens.

“We would expect all this free cashflow to be returned to shareholders through buybacks and dividends and continue to believe that the rapid retiral of cheap equity will prove to be very favourable for long-term owners,” said Legget.

Compounding, but not as we know it

Outflows from UK equities have seen share prices in the domestic market continue to de-rate, which helps to explain the poor performance of the FTSE All Share over the past 10 years – the index has made 71.8% over this time, compared with 174.9% from the MSCI AC World index8.

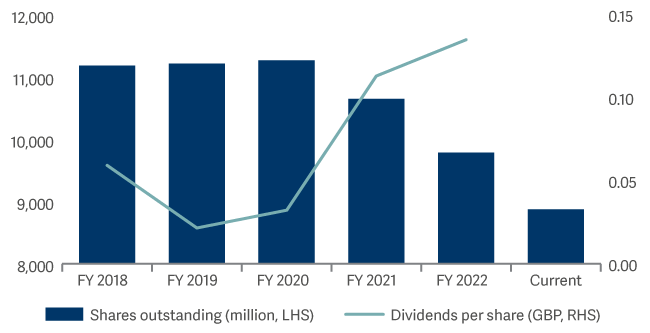

However, Nick Shenton, manager of the Artemis Income Fund, said this de-rating is the reason why share buybacks could be so effective in boosting the dividend potential of UK equities.

“Take a business trading at 25x price-to-earnings [P/E] with an earnings yield of 4% and paying half of that as a dividend,” he said. “If you start buying back shares with what you’ve got left, you don’t eat into the share count very quickly.

“If, on the other hand, you're trading at 5x P/E with a 20% earnings yield, like some UK banks, you can really eat into your share count.

“The banks have dividend yields of 7 or 8% and are buying back 10%+ of their shares per annum. This doesn't lead to a dramatic uplift in year one. But over time it leads to a significant wealth transfer to those who are patient and remain invested, and we are already two or three years into this.”

NatWest: Shares in issue and DPS

Shenton added: “Remember, if you compound value in equity markets, it's nonlinear. If you grow at 10% per annum, it only takes a little over seven years to double.

“What we're seeing is compounding, just not as we know it – it’s compounding in reverse.”

Income from growth stocks

The domestic market has long been the go-to destination for income investors, even if the potential yields on offer today are well above their long-term averages.

But the UK is not the only part of the world where low valuations have made the outlook for dividends so compelling.

Like Legget, Raheel Altaf, manager of the Artemis SmartGARP Global Emerging Markets Equity Fund, is driven by the search for long-term capital growth, rather than income. But again, like Legget, he said stocks paying high dividends could play an important role in helping him achieve this aim.

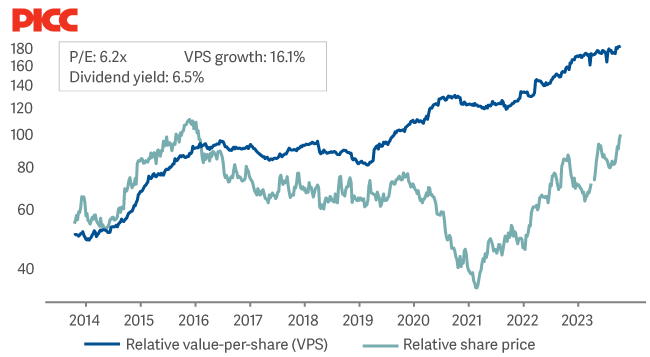

He pointed to PICC, one of the largest providers of insurance in China, as an example.

Deep value in emerging markets

“Insurance has a long-term growth story in that you’ve got an ageing population that's becoming wealthier, meaning demand for financial services and products in China is only going to go up,” he said.

“PICC has delivered good business performance on the back of those trends and has a strong balance sheet, but today trades on a P/E of 6.2x with a dividend yield of 6.5%9.

“And the value per share10 has been growing by about 16%11 over 10 years. But if you look at the share price over this time, it's pretty much gone nowhere.”

Altaf isn’t just holding this stock for its dividend – there is the potential for capital growth if the share price catches up with fundamentals. While this would result in a lower headline yield for existing investors, they would be more than compensated for this by the increase in capital.

Emotions equal opportunities

Equities are not the only income-producing asset class where fund managers are spotting extreme valuation anomalies.

Jack Holmes, manager of the Artemis Funds (Lux) – Global High Yield Bond Fund, said that nervousness on the part of both issuers and lenders means you can pick up double-digit yields in his part of the market without taking on an excessive amount of risk.

To illustrate his point, he used the example of German electronics company ams Osram. While it is regarded as a quality company, yields on its bonds reached more than 16% in July12, due to market headwinds and issues related to an expansion in capacity.

“While these yields are common in the history of the high-yield market, in this case they came about as leverage (net debt to EBITDA) was less than 3x on a revenue base of more than €4 billion13,” Holmes said.

ams Osram turned out to be the manager’s best-performing holding in Q3 after it subsequently announced an earnings upgrade and an €800 million equity raise to address its 2025 maturities14.

“The time to worry about high-yield excess may come at some point in the future, but not while we see opportunities like this,” he added.

You can lead a horse to water…

Despite these impressive figures, many people would prefer to stay in cash. NS&I recently offered a one-year bond offering 6.2%15, which was snapped up by 225,000 customers16. If this deal is offered again, is there any reason why these savers would be better off shunning this government-backed fixed-rate product for a bond fund that, while offering a comparable yield, comes with the risk of capital loss?

Stephen Snowden, manager of the Artemis Corporate Bond Fund, thinks so. He pointed out that if inflation does start to drop, so too will interest rates, which would substantially reduce the rate offered by NS&I and other savings accounts.

“By buying into a bond fund now you could potentially lock in a competitive return for three to five years or so,” he explained.

“You might consider an investment in bonds as insurance in your portfolio against a global economic slump, because if that happens central banks are likely to slash interest rates pretty quickly to jump-start it back to life.

“Locking in those yields now could look to have been a very smart move.”

2,3,4 & 5 https://www.calastone.com/insights/investors-piled-out-of-equities-and-bonds-in-august-and-into-safe-haven-money-market-funds/

6Bloomberg, Datastream, Worldscope, Goldman Sachs Global Investment Research

7JP Morgan

8Lipper

9FactSet as at 2 October 2023

10Value-per-share (VPS) is a combined measure of earnings, cashflow, operating profits, dividends and asset value

11FactSet as at 2 October 2023

12Bloomberg

13Bloomberg

14https://www.semiconductor-today.com/news_items/2023/oct/amsosram3-261023.shtml

15 https://nsandi-corporate.com/news-research/news/nsis-one-year-guaranteed-growth-bonds-and-guaranteed-income-bonds-withdrawn

16https://nsandi-corporate.com/news-research/news/nsis-one-year-guaranteed-growth-bonds-and-guaranteed-income-bonds-withdrawn