Artemis Funds (Lux) – US Smaller Companies update

Cormac Weldon and Olivia Micklem, managers of Artemis Funds (Lux) – US Smaller Companies, report on the fund over the quarter to 31 March 2025.

Source for all information: Artemis as at 31 March 2025, unless otherwise stated. Artemis Funds (Lux) - US Smaller Companies is an actively managed fund. The fund's objective is to increase the value of shareholders’ investments primarily through capital growth. The fund invests principally in equities of smaller companies that are listed on a recognised stock exchange in the USA. Typically, these are companies with a market capitalisation of less than $10bn at the time of purchase.

Overview

We would normally write a summary of the quarter just passed, but that period excludes a series of monumental announcements by President Trump about tariffs. We have therefore decided to incorporate those few days at the start of April which will likely live in investors’ memories for some time. Year to date, US equities have largely been dictated by two forces: tariffs and the arrival of DeepSeek, a Chinese rival to ChatGPT. For larger companies in the US, it has been painful on both fronts. Larger companies tend to have more geographically diverse supply chains and derive more of their revenue from outside the US, making them more exposed to a trade war. It is also the case that the largest index constituents are those that have been deemed to benefit most from AI, particularly the so called ‘Magnificent 7’ and therefore experienced the most pain on the arrival of DeepSeek.

We must acknowledge from the outset that the portfolio was too optimistically positioned for economic growth, and we have since taken action to reduce our exposure. However, the fund's performance was also affected by a broad-based selling of winners, especially those with higher-than-average valuations. While we understand this reflex to lock in gains, we believe that a focus on a company's competitive advantage, as evidenced by high returns on equity, and supported by an even more attractive risk-reward ratio, will be a winning strategy going forward, as it has been for the last decade.

Tariffs

We have to acknowledge from the outset that Trump is serious about tariffs, more so than many market participants had expected when he entered office. This may be an obvious statement but an important one. Revenue generated from tariffs is absolutely central to his ambition to provide tax cuts and therefore, as we stand - and despite his temporary pause on many tariffs - it seems unlikely that he will change direction completely. This suggests to us that tariffs are here to stay.

So, how does this impact the fund? As time progressed in Trump’s presidency and it became clearer that tariffs were likely to have a negative impact on the economy, we rotated some of our more cyclical exposure into more defensive areas of the market.

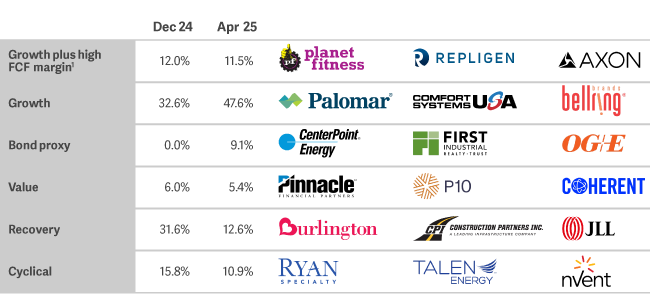

Many of you will be familiar with the ‘balanced approach’ slide in our presentation. What we have done is look at how the percentages have changed since the start of the year. As you can see, we have reduced Cyclicality and Recovery and added to Growth and Bond Proxy. We think the increase in Growth is particularly interesting. This cohort represents a mixture of businesses which we believe can sustain an attractive rate of earnings growth, despite concerns over tariffs. In many cases these businesses had weaker share prices, and, in these instances, we have been able to add capital. It also includes businesses where we see more stable growth such as BJ’s Wholesale.

In terms of the aggregate fundamentals of the fund, we have managed to increase the portfolio’s return on equity (RoE), improving overall quality, with the shift away from recovery/cyclical parts of the market and into areas with good earnings growth. The return on equity currently stands at 17.8% vs. the Russell 2000's 5.7%.

US Smaller Companies Fund

DeepSeek

Adding to growing worries around tariffs was the arrival of Chinese AI chatbot DeepSeek in January, which caused weakness across the AI supply chain. Despite a belief that this would mean companies would cut their spending on AI, we saw all the hyperscalers come out and confirm their huge (around $300bn) capital expenditure plans would remain in place. Despite this, the market began to doubt the two dominant narratives that have been driving markets: AI investment and US exceptionalism.

A great example of where we believe this reaction was unwarranted (and to which we have added on weakness) was a business called Comfort Systems, a supplier of skilled labour, as well as modular data centre construction, which is in particularly high demand at present. There is a structural shortage of skilled labour in the US, with one person entering the workforce for every three leaving. This issue is exacerbated by Trump’s immigration policies which will further constrict the labour supply. In addition, if investment in the US (in terms of building factories, data centres, roads and bridges) is an aim of Trump, then Comfort Systems is precisely the type of business that stands to benefit. Blend this with hyperscalers’ commitments to building out AI infrastructure, the decline in the company’s share price seems all the more unwarranted.

The market's reaction

Smaller companies in the US are perceived by the market to be more sensitive to the US economy given they derive a higher proportion of revenue domestically. Tariffs have caused many economists to lower growth forecasts as well as raise forecasts for inflation which until now seemed to be heading down towards the Federal Reserve’s target of 2%. In addition, uncertainty around direction of policy has stifled businesses’ appetite to deploy capital, both from an M&A and capex perspective, as well as dent consumer confidence. Poor soft data points have yet to feed into hard data, which is not yet showing signs of weakness, with the recent jobs figure showing 228,000 jobs added in March (ahead of expectations).

If you look beneath the surface, then weakness was widespread although particularly concentrated in areas sensitive to a slowing economy. Technology, energy, consumer discretionary sectors all posted large declines. On the positive side, defensive sectors such as utilities, and consumer staples held up better although absolute returns are negative.

Fund performance

At a sector level, our largest detracting sector was our industrials exposure, followed by financials, both sectors being geared towards a more predictable economic outlook. We have continued to adjust the portfolio to take on a more defensive profile.

YTD Stock Contributors:

Palomar Holdings: A specialty insurance company that focuses on niche markets underserved by traditional insurers, such as earthquake, hurricane, and flood insurance. Palomar uses data and technology to underwrite and price risk efficiently. It reported a good set of earnings during February, beating on EPS and guiding ahead of expectations. The defensive nature helped add ~1% relative performance over the quarter in what was a very weak market.

Planet Fitness: One of the largest fitness centre franchises in the U.S., known for its budget-friendly membership model and “Judgement Free Zone” branding. It targets casual gym-goers rather than hardcore fitness enthusiasts. The thesis is new management have re-energised their business model, looking to grow store count across the US.

BJ’s Wholesale: A membership-based warehouse club similar to Costco, offering bulk goods at discounted prices. It operates primarily on the U.S. East Coast and provides groceries, electronics, and household items. The business trades at attractive valuations, has a good degree of stability, and is making gains in the groceries segment of the market. These defensive characteristics are beneficial in times of economic uncertainty.

Ryan Specialty: A specialty insurance firm that acts as a wholesale broker and managing underwriter. It serves retail insurance brokers, helping them access specialty insurance products for complex or hard-to-place risks.

YTD Stock Detractors

Jefferies: A global investment bank and financial services company offering capital markets, advisory, asset management, and research services. It is known for its focus on mid-market clients and operates as an independent, full-service firm. One aspect of the Trump presidency in which we have a high degree of confidence is much higher M&A activity in the corporate market. It is clear that, outside of very large technology companies, the Trump view is very different to the Biden administration where regulators sought at every turn to impede corporate activity. We believe a more laissez-faire view of this from regulators together with strong recovery in earnings, good balance sheets, cheap corporate credit, and an acknowledgement that these drivers are unlikely to coincide in quite the same way in the future, will lead companies to make strategic decisions to consolidate. That being said, the first few months of the year, despite some eye-catching headlines, has not seen the degree of activity hoped for. We think this is just a function of lead times.

Boot Barn: A retail chain specializing in western and work-related apparel, including cowboy boots, jeans, and outdoor gear. It caters to both rural and suburban consumers with a strong presence in the American West and South. The business was particularly hard hit on tariff volatility as consumer sentiment soured. The company produced a strong and encouraging set of earnings over the quarter. We continue to have conviction in it and have used the share price weakness to add to our holding.

Herc: recently the equipment rental business announced an acquisition of H&E which the market viewed poorly. We think this makes strategic sense because increased scale helps rental companies generate steady cash flow, and HRI's specialty rental equipment complements H&E's more general fleet. While we typically don’t fully rely on revenue synergies, combining the two businesses clearly offers benefits, although it raises questions about why H&E did not expand into specialty areas sooner. The management has experience in integrating acquisitions, but we will still be careful watching how quickly they remove unnecessary costs and realize efficiencies. Our main concern is the higher debt load (3.8x leverage). So, we agree with the strategy of consolidating: it's one of the things we like about the industry. But because of the increased leverage (in the way we think about businesses) it widens the range of potential outcomes both to the upside and downside. Consequently, we have sold out of the business.

RH (Restoration Hardware): A luxury home furnishings company offering upscale furniture, lighting, textiles, and décor. It emphasizes design, quality, and experiential retail, with high-end showrooms called “galleries.” We had owned the position with a view to the improvement of the high-end consumer under Trump but shifted this view in light of deteriorating consumer sentiment trends. Following a full sale of the position the company gave poor guidance on this year's earnings and the stock sold off materially. We moved this capital into more stable names.

Activity & Positioning:

If we look generically at the changes we have made in our portfolio we could characterise them as follows. In advance of ‘Liberation Day’ we reduced our exposure to consumer companies which sourced significant amounts of their products from Asian countries. The sale of SharkNinja and Restoration Hardware fall into this camp. As observed earlier, we reduced our exposure to cyclical and recovery companies which were more economically sensitive. This included reducing our position in SAIA (trucking company), Eagle Materials (cement producer) and Jefferies (Investment Bank).

We should note that in each of the last three stocks mentioned, we think these will all be significantly bigger positions to avail of a more stable economy with better growth prospects.

In terms of how we increased protection for the portfolio, we added to companies we believe have a really attractive risk reward but are involved in services, and while some would be modestly economically sensitive, they are not at the sharp end like those companies with overseas supply chains and tariffs to negotiate. We added to Palomar, Planet Fitness, CBIZ and we bought a position in Ryan Specialty, the insurance broker.

Outlook

It is perhaps a fool’s game to predict what might occur over the next few weeks and months, but in the short term it is sensible to take a more cautious approach until such time as the path ahead becomes clearer. We are also taking advantage of share price weakness where we have high conviction in our thesis for a company.

Performance

| Three months | Six months | One year | Three years | Five years | |

|---|---|---|---|---|---|

|

Artemis Funds (Lux) US Smaller Companies Fund |

-15.8% | -11.3% | -10.5% | -4.0% | 76.3% |

|

Russell 2000 TR |

-9.6% | -9.3% | -4.3% | 1.3% | 86.0% |

|

IA US Small Cap Equity Average |

-11.4% | -10.1% | -6.8% | -2.6% | 81.4% |

Fund 10-year discrete performance

| Calendar year performance |

YTD | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Artemis Funds (Lux) – US Smaller Companies |

-15.8% | 23.2% | 18.9% | -28.7% | 17.3% | 28.6% | 30.7% | - | - | - | - |

|

Russell 2000 NR |

-9.6% | 11.4% | 16.9% | -20.4% | 14.8% | 20.0% | 25.5% | - | - | - | - |

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Benchmark: Russell 2000 TR; the benchmark is a point of reference against which the performance of the fund may be measured. Management of the fund is not restricted by this benchmark. The deviation from the benchmark may be significant and the portfolio of the fund may at times bear little or no resemblance to its benchmark.