Artemis Funds (Lux) – Global High Yield Bond update

David Ennett and Jack Holmes report on the fund over the quarter to 30 June 2024 and their views on the outlook.

Source for all information: Artemis as at 30 June 2024, unless otherwise stated.

Objective

The fund is actively managed. It aims to increase the value of shareholders’ investments through a combination of income and capital growth.

Performance

The Artemis Funds (Lux) – Global High Yield Bond Fund made 2.0% during the quarter, compared with 1.4% from its ICE BofA Merrill Lynch Global High Yield Constrained USD Hedged index benchmark.

Among the elements responsible for this performance were:

- European high yield (particularly sterling-denominated bonds) outperforming US dollar high yield. We have found better opportunities in the European space over the past year, which helped us outperform both the dollar-denominated index and our benchmark-hugging peers.

- Our exploitation of opportunities at the front end of the curve for outsized returns with limited volatility. If you’ve spoken to us over the past year, you’ve probably heard us bang the drum on the mis-pricing of earlier redemptions (and associated capital upside) in this segment of the market.

Yields appear to be settling at around 8%. That makes the market attractively priced compared with most of the past decade. Given high yield has typically had half the volatility of equities, this appears to be an attractive risk/reward trade-off. A higher-yield environment also creates more opportunities for active alpha generation – as our recent performance neatly demonstrates.

Our high-conviction approach has led to significant outperformance over the course of our careers, on both our current and previous funds. However between the Global Financial Crisis and 2022, the market was dominated by quantitative easing and liquidity-driven beta moves; we believe the current environment is inherently better suited to our index-agnostic, high conviction, highly active approach.

| Discrete performance, 12 months to 30 June |

2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|

| Artemis Funds (Lux) – Global High Yield Bond | 5.5% | 10.8% | -11.5% | 7.6% | - | - | - | - | - | - |

| ICE BofA Merrill Lynch Global High Yield Constrained USD Hedged Index | 3.5% | 12.9% | -11.4% | 6.5% | - | - | - | - | - | - |

Source: Lipper Limited/Artemis from 31 December 2023 to 30 June 2024 for class I Acc USD

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Positives

Among the biggest contributors to performance during the quarter were German engineered wood-products maker Pfleiderer, Swedish real estate company Heimstaden and flooring manufacturer Victoria.

Pfleiderer had received a negative reaction to soft first-quarter earnings figures in April. After a part recovery in May, its bonds rallied further as its shareholders announced an equity injection. They are now trading well above their starting level for the quarter.

Heimstaden rebounded along with the rest of the European property sector, while Victoria reassured markets with its outlook and a clarification over a subsidiary’s accounting.

Negatives

Performance was hampered by positions in Sotheby's, which saw a softening auction outlook for the remainder of 2024; medical device maker Owens & Minor, whose chief financial officer left the group unexpectedly; and Ocado, which terminated an agreement with Canadian supermarket chain Sobeys.

Activity

The fund participated in a number of new issues, particularly in Europe. Our process for analysing bonds in the primary market is the same as for bonds in the secondary one – we are looking for resilient business models, robust market positions and strong cash generation (alongside attractive valuations).

For example, we bought bonds from cruise operators Carnival and TUI Cruises. These offer a high degree of revenue visibility, impressive pricing power and buoyant demand due to a trend for spending on experiences over physical goods. In our opinion, Carnival will likely re-enter investment-grade territory in two to three years given its prodigious cashflow generation and modest capex plans.

Our switch in Modulaire, which rents out portable cabins across Europe, is also worth touching on. We moved out of its higher-rated secured bonds into lower-rated unsecured ones. The latter should trade with a discount, but recent oscillations are more related to sentiment and market technicals than any fundamentals. By playing these ranges we can extract additional income as well as potentially significant capital gains. We will continue to actively exploit these opportunities – be they across different parts of the capital structure, different currencies or comparable companies – which we expect to provide a continuous source of alpha in future, as they have done since we launched the fund.

We continue to like the opportunity in short-dated high yield. To briefly recap: this tends to be much less volatile than the rest of the high-yield market and bonds in this space tend to be redeemed early by the companies that issue them, creating capital upside for holders. It is this capital upside that we believe isn’t being recognised by the broader market.

On the sales side of the equation, we sold a number of positions where strong performance meant relative valuations looked less appealing. This is a core part of running a fund with a focus on higher-yielding bonds. Unlike equities, we need to continuously rotate our winners into new ideas for the simple reason that the upside is – unlike an equity – absolutely capped.

Outlook

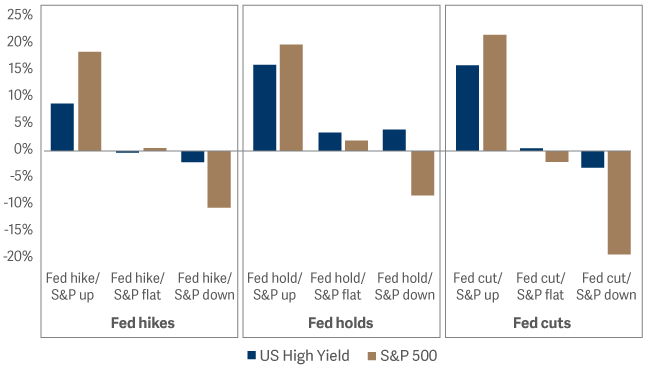

The chart below shows average one-year total returns across a number of scenarios experienced in US high yield and the S&P 500 when the former has started the period with a yield of more than 7%. I’ve used US high yield and the S&P 500 as the data goes back further for these markets than their global counterparts. Two elements in particular stand out.

1 yr total returns in different scenarios where starting yiled >7%

S&P defined as ‘flat’ when returns are +/-5%, ‘up’ when returns are more than 5%, and ‘down’ when losses are more than -5%. 1984-2024.