Artemis Funds (Lux) – SmartGARP Global Emerging Markets Equity update

The manager reports on the fund over the quarter to 31 December 2024 and the outlook.

Source for all information: Artemis as at 31 December 2024, unless otherwise stated. The fund is actively managed. The fund's objective is to increase the value of shareholders’ investments primarily through capital growth.

Performance

- Q4 relative performance +2.1%. Fund -6.1% vs MSCI EM -8% (in US dollar terms)

- 2024 relative performance +2.2%. Fund +9.7% vs MSCI EM +7.5% and the average peer +5.8%

- Performance in top decile vs. IA GEM sector for one, three and five years and since launch (Apr 2015)

| Three months | Six months | One year | Three years | Since launch | |

|---|---|---|---|---|---|

| Artemis Funds (Lux) - SmartGARP Global Emerging Markets Equity Fund | -6.1% | -2.2% | 9.7% | 8.1% | 9.7% |

| MSCI EM NR GBP | -8.0% | 0.0% | 7.5% | -5.7% | 7.5% |

| IA Global Emerging Markets NR | -7.5% | -1.1% | 5.8% | -9.0% | 5.8% |

Summary

- Watch our brief outlook for GEM here - Global Emerging Markets: 2025 Outlook

- Emerging market stocks remain cheap and unloved, with abundant growth and income opportunities

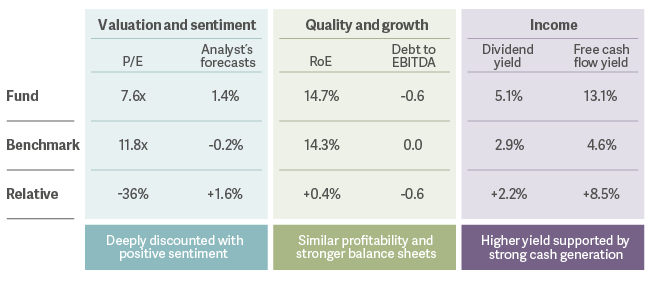

- Value bias in the fund is still substantial, 36% discount to MSCI EM…

- …with favourable quality and growth characteristics compared to the market.

Artemis SmartGARP Global Emerging Markets Equity Fund

If the fund were a stock

Key fund characteristics

Performance – Potential Trump administration dominates sentiment

External risks appear to have increased. Protectionist trade policies and aggressive tariff proposals created potential problems for emerging stocks during the quarter. 2024 ended with emerging markets underperforming developed markets by 8.5%. Clearly, EM’s role as a return-generating diversifier has been a disappointing one in the last decade. This has led many to give up on the asset class. Investors' positioning is light.

Rather than focus on which direction the market will move, we take a dispassionate approach and look at the things that might be missed by investors. There is much to be excited about. Low valuations present room for upside, particularly when sentiment changes. There are opportunities in both income and growth.

Attribution – Favourable trends supporting our holdings

The UAE appears to be booming, with its status as a global financial and trade hub being further cemented, following years of social and economic diversification efforts. Emaar Properties shares rose 60% in the quarter, as the company increased its dividend and gave a positive update on future payments to shareholders. Emirates Bank also featured among our top contributors. Elsewhere, our holdings in Asia performed well. Wiwynn (tech hardware), Geely (autos), Evergreen (marine transportation) and Bank of China all did well.

These were offset by weakness in Alibaba, Banco do Brasil and Star Bulk Carriers, among others. Taiwan Semiconductor also featured among detractors, despite our almost 7% weighting in the stock. TSMC contributed to over half the returns of the index in 2024. While much has been made of the 'Magnificent Seven' in the US, concentration risks in EM are not dissimilar. Overall, our stock selection contributed positively in Q4 and over 2024 as a whole.

Activity

Our investment process is designed to deal with volatile market conditions. We think in these environments, it is important to stick to the process and to selectively look for opportunities of indiscriminate selling, rather than make widespread changes to the portfolio.

In the last few months, we have been rotating our exposure in the technology sector. We closed our position in Samsung and reduced Hynix to fund increases to TSMC and ASUS computers. We are still optimistic about the prospects for some Chinese stocks. More recently, pessimism has reached extreme levels and with low investor positioning we felt the risk rewards became extremely favourable. There is still a clear disconnect between share prices and the financial performance of businesses in China. As investors are still sceptical about conditions in the economy improving, we believe a disciplined value approach can help unearth great opportunities. We added to our holdings in China Hongqiao, JD.com and Geely. These were funded by reductions in Eastern Air Logistics, Midea Group, Weichai Power and Jiangxi Copper.

The result of these changes is that the fund continues to offer an attractive combination of extremely low valuations and attractive growth prospects. Alongside our China overweight, in aggregate we are overweight Brazil, Korea and UAE and underweight India, Taiwan and Saudi Arabia. At the sector level, financials, consumer discretionary, utilities and industrials feature as the largest overweights. Materials, technology and consumer staples the largest underweights.

We remain heavily biased towards value stocks

The fund offers a forward price earnings ratio of 7.7 vs. 11.8 for the index (35% discount). We think our discipline around valuations is likely to be a rewarding strategy for the years ahead. While value stocks in EM have recovered from depressed levels in recent years, the gap in valuations between cheap and expensive stocks is still stretched. This suggests there is still an opportunity. Typically, significant exposure to value stocks coincides with distressed balance sheets and volatile earnings. This doesn’t appear to be the case today; the fund offers favourable quality and growth characteristics. For instance, our net debt/EBITDA is low, and our free cash flow yield is much higher than the market.

EM – Pessimism well reflected in prices, yet cyclical upturn presents opportunity

There is much to be optimistic about as we enter 2025. The excitement around AI and its adoption, monetary and fiscal easing and supportive valuations in EM all present opportunities. The Chinese economic recovery has so far been underwhelming. More broadly, geopolitics are creating uncertainty. On the positive side, potential for stimulus measures to offset a weaker growth outlook could be significant. But there are risks that make us more cautious. Most notably, the misallocation of capital from good times can create risk in excessively valued companies. Companies that are priced for perfection could well disappoint.

When times are bad, risk aversion can lead to indiscriminate selling. We believe this creates opportunities for disciplined investors. Our process has been designed to look for companies where the fundamentals are signalling good news, yet share prices are not reflecting this optimism.

Moreover, the gap in share prices and fundamentals is still significant across our holdings. The fund continues to be well diversified, with high active share and positioning that is differentiated to the index and peer group.

As we enter a new (but familiar) era under a Trump administration, there is some natural apprehension towards emerging markets. Yet, we are guarding against making rash decisions based on rhetoric. In the past, we have found many great investments against a backdrop of adversity and we believe this will continue to be the case.

Fund 10-year discrete performance

| Discrete performance, 12 months to 31 December |

2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|

| Artemis Funds (Lux) – SmartGARP Global Emerging Markets Equity | 9.7% | 12.1% | -19.0% | 44.3% | -12.6% | - | - | - | - | - |

| MSCI EM (Emerging Markets) NR USD | 7.5% | 1.7% | -25.3% | 40.9% | -3.4% | - | - | - | - | - |

Source: Lipper Limited/Artemis to 31 December 2024 for class I Acc USD

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Benchmark: MSCI Emerging Markets Index; the benchmark is a point of reference against which the performance of the fund may be measured. Management of the fund is not restricted by this benchmark. The deviation from the benchmark may be significant and the portfolio of the fund may at times bear little or no resemblance to its benchmark.