Artemis Funds (Lux) – SmartGARP Global Emerging Markets Equity update

The managers report on the fund over the quarter to 31 March 2023 and the outlook.

Summary

- Q1 relative return +1.1%. Fund +5.0 % vs index +4.0% (in US dollars)

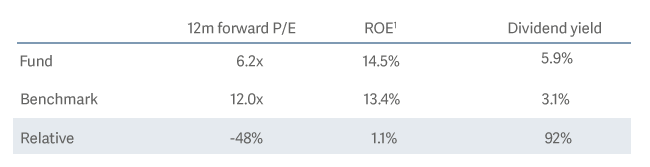

- Value bias in the fund remains substantial, 48% discount to the market

- Fundamental value per share of our holdings has outgrown the market by 10% per annum since the fund's launch in April 2015

- This highly favourable combination of growth and valuations should provide support ahead

Artemis Funds (Lux) SmartGARP Global Emerging Markets Equity fund

Optimism around China’s reopening, coupled with more accommodative monetary policy, has restored some investor faith in emerging markets this year. Yet, concerns around global financial conditions following banking worries in the US and Europe and downward pressures to global growth have created volatility more recently. Against this backdrop, the fund outperformed the market in the quarter.

Stock picking opportunities in China

Our preference for deep value names in China contributed positively to performance in the last quarter and remains a significant exposure in the fund. Top contributors were in telecommunications (China Mobile), energy (Sinopec and CNOOC) and household appliances (Gree Electric).

Brazil exposure contributed positively

Elsewhere, positive contributions came from our holdings in Brazil. Banco do Brasil performed strongly despite the volatile environment for banks elsewhere in the world. Tailwinds are coming through in the agribusiness sector, with higher loan growth and lower non-performing loans. Banco do Brasil has a strong market position in a higher yielding credit environment. While having a higher return-on-equity than its private counterparts, it still trades on a forward P/E of 3x. We expect the share price to continue to keep pace with the improving outlook.

Lighter weighting to Tech and internet detracts from relative performance

Lighter weighting to Tech and internet detracts from relative performance

Activity – Q4 results trigger some rotation on company-specific news flow

Additions – improving fundamental trends

Asia recovery – PingAn (insurance), Novatek (semiconductors), Hankook Tire (auto parts)

India – Amara Raja (batteries), Redington (software)

Good Q4 results – Bancolombia, Banco do Brasil and Tisco Financial (banks), Ennoconn (tech hardware), Kia Motors (autos)

The gap in valuations between cheap and expensive stocks remains at extremely high levels compared to history. We see this across a range of metrics we look at: earnings, cash flows, dividends, book values and operating profits. This suggests that value stocks are unusually cheap. They have been for some time now. With the end of the low interest rate world, we think our discipline around valuations is likely to be a rewarding strategy as we progress through 2023 and for the years ahead.

Outlook – Emerging market equities are cheap and unloved, with catalysts for outperformance…

Today EM stocks are trading on discounted valuations against developed markets across a range of metrics. They remain out of favour and extremely cheap relative to US stocks. China appears to be on a different policy path to much of the rest of the world. The potential unleashing of substantial excess savings amongst consumers is creating opportunities. More recently, data releases have signalled a broad pickup in economic activity. We believe the diversification benefits from investing in EM are highly favourable and continue to see this as a good entry point.

Improving fundamentals to provide further tailwinds

We continue to see positive trends in the fundamental value per share of our holdings relative to the market. In the last fivw years, our holdings have outgrown the market’s fundamentals by 10% per annum. The fundamental value per share we construct tracks cash flows, dividends, operating profits and asset values for our companies and the broader market. Despite this superior growth, the gap between fundamentals and share prices of our holdings remains substantial. The potential for catch up presents an opportunity.

Source: Lipper Limited/Artemis from 31 December 2022 to 31 March 2023 for class I Acc USD

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Benchmark: MSCI Emerging Markets Index; the benchmark is a point of reference against which the performance of the fund may be measured. Management of the fund is not restricted by this benchmark. The deviation from the benchmark may be significant and the portfolio of the fund may at times bear little or no resemblance to its benchmark.