Hiding in plain sight – US smaller companies

While the giant US tech stocks have dominated returns over recent years, the shares of smaller US companies have languished and are now trading at a discount to larger companies. We believe this represents a very attractive entry point to one of the world’s most vibrant economies.

Everything is bigger in the US, including its smaller companies…Our hunting ground for smaller companies is the Russell 2000. But to UK investors’ eyes, the companies in this index look far from small. The average market cap in the Russell 2000 is $3.5bn and the largest stock in the index has a market cap of $15.4bn1. These companies are active in and a product of the most developed venture capital market in the world, which drives innovation and growth and makes for a highly dynamic environment.

One of the key characteristics of smaller companies is their domestic focus. Unlike the S&P500, which is dominated by global companies with international revenues, the Russell 2000 derives the majority of its revenues (almost 80%) from the home market.

As a result, as well as accessing the growth of the world’s largest economy, we see investing in US smaller companies as a way of more directly capturing the intricacies of the US economy. Given the size and diversity of the US market – essentially 50 economies in one - it is inevitable that some states will be performing better than others at any one time. The breadth of the smaller companies’ market means that we can target specific themes by buying companies focused on a particular industry, service or geographic area.

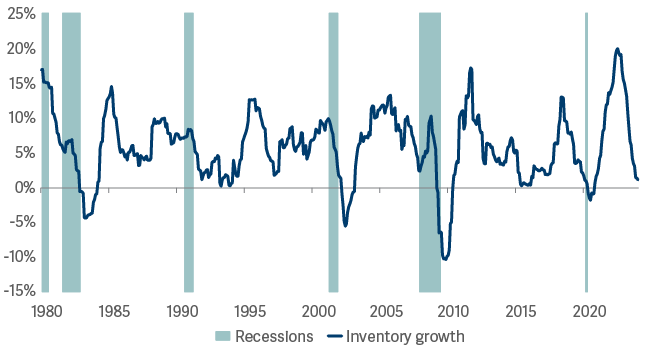

One of the themes we have played over recent years is ‘post Covid recovery’. The distortions in supply and demand produced by the pandemic years are still being played out across different industries. In many cases there has been a dynamic of rapid inventory growth leading to oversupply, followed by destocking and depressed pricing.

Covid's impact on inventory

This has resulted in a ‘rolling earnings recession’ across the market. We have found some interesting opportunities where suppliers have addressed an oversupply situation with aggressive production capacity cuts and now demand is recovering. One area we have played this is healthcare and life sciences and another is data and memory storage.

Elevated demand for consumer electronics and internet infrastructure during the pandemic created a corresponding boom in demand for hard disk drives and NAND flash storage. Once the pandemic ended, demand growth slowed, inventory ballooned and prices fell. The industry responded by cutting capacity. Demand started to return and prices stabilized. We got exposure to this dynamic by buying one of the leaders in hard disk drives and NAND flash storage.

This also forms part of another of our themes: build out of data centres. Substantial investment in AI and cloud computing has fuelled significant investment in data centres, which require a number of components that are highly complex and require specialist labour to build and service. We are exposed on the hardware side, the labour side, as well as the power side through holdings in independent power producers.

More broadly, infrastructure investment across both public and private sectors is huge. The state of roads, bridges, and water infrastructure in the US is poor after years of underinvestment. To capture this tailwind, we have exposure to a number of businesses that will provide the means to replace and repair areas that have been highlighted as key areas of focus.

Outside of holdings exposed to macro tailwinds, a large proportion of the fund is exposure to idiosyncratic stories where we the company fundamentals are the sole drivers of our conviction. This covers a broad range of holdings across clothing, cosmetics, life sciences, technology, and financials to name a few.

The current opportunity in US smaller companies

Over recent years, as the market has become increasingly focused on very large capitalisation companies, smaller companies have significantly derated. They are now at multi-decade lows in relative valuations. It is interesting to note that profitable, smaller companies – the area on which we focus – are very cheap relative to large cap stocks. According to Russell, the Russell 2000 is trading on a PE of 17.8x2, while the broader Russell 3000 is trading on a PE of 26.2x.

While the opportunity set may look very attractive, careful selection remains key. Being at an earlier stage in their development, smaller companies tend to have faster growth but are also likely to have lower profitability and higher debts. They also tend to be more cyclical. We focus our efforts on the higher-quality cohort of smaller companies and look to invest in broader structural themes.

2PE ex negative earnings 30 September 2024 (Source: Russell)