Artemis Target Return Bond Fund update

Stephen Snowden and Juan Valenzuela, managers of the Artemis Target Return Bond Fund, report on the fund over the quarter to 30 June 2023 and the outlook.

Performance

The fund returned -0.2% over the quarter, lagging its target of 1.7% (2.5% above the Bank of England’s base rate, after fees, on an annualised basis). Our rates module made a positive contribution while our carry and credit modules both detracted.

Those returns reflected a challenging environment for sterling-denominated bonds – particularly at the short end of the curve. And although it was disappointing to have posted a negative return, the fund meaningfully outperformed assets that we believe perform a similar role in clients’ portfolios over the three-month period:

- The Bloomberg Sterling Aggregate 1 to 3-year Index returned -3.17%.

- Two-year UK Gilts returned -4.22%.

We also believe this fund remains a compelling alternative to short-dated, investment-grade corporate bond funds.

The fund’s characteristics

- Duration – we are likely to maintain an overall duration in 1.25 to 2-year range.

- Credit profile – we continue to take a conservative approach to credit markets, focusing on the front end of investment-grade market, where we believe the risk-adjusted returns are most compelling.

- Carry module – we increased our allocation to the fund’s carry module as valuations became more attractive.

- Credit module – we retain a modest allocation to credit. Equally, we currently have relatively few short positions in the credit market given the cost of carry is higher than it was and because volatility is low.

- Rates module – our current focus here is on relative value trades. This module makes a neutral contribution to the fund’s overall duration (excluding our short position in Japanese government bonds). Strategically, we favour steeper yield curves and short inflation positions in France.

Carry module: increasing our allocation

The carry module is the most defensive part of our fund. Our focus here is on investment-grade bonds that are due to mature within the next three years. Over the quarter, this module suffered from an aggressive repricing of yields at the front end of the UK curve.

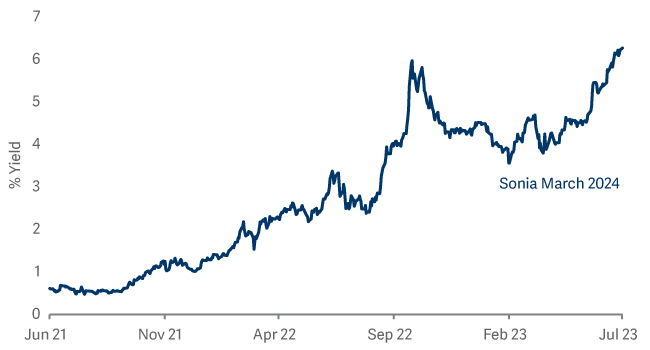

That repricing occurred because the market’s expectations for UK interest rates changed materially. When the quarter began, the expectation was that interest rates would be at 4% in March 2024. By the end of June, however, that had increased to 6.25%. Rate expectations are, in effect, back to the levels seen around the time of mini budget in October 2022.

UK interest rate expectations for March 2024 – back at their October highs

That, in turn, reflects several factors that combined to trigger a hawkish response from central banks worldwide – but particularly from the Bank of England, which raised base rates in the UK from 4% in February to 5% in June.

- Economic data generally surprised to the upside. This is true globally but especially in the UK – economists are no longer expecting a recession in 2023, something that was regarded as a near certainty at the end of last year. Economies have proven to be much more resilient to higher rates than most observers expected.

- Inflation remains uncomfortably high. This dynamic is problematic in the UK and is particularly evident in underlying or ‘core’ inflation. Ultimately the strength in the jobs market – unemployment remains at historically low levels in most economies – means that consumers continue to spend on services despite rising costs.

- An imbalance between supply and demand is pushing up unit labour costs. Despite the weakness in manufacturing (as reflected by PMI surveys), the services sector – the most labour-intensive area of the economy – remains strong. This – and abysmal trend in productivity worldwide – is maintaining the imbalance between supply and demand in the jobs market and pushing up unit labour costs.

After the meaningful increase in yields seen during the second quarter (2-year gilt yields rose from c.3.9% to c.5.3%), we believe that investors in short-dated investment-grade credit are currently being well compensated for the credit risk they are taking.

From the perspective of risk-adjusted returns, we currently view short-dated investment-grade corporate bonds as the most compelling area of the fixed-income market. This is particularly true of sterling-denominated bonds, given the relative cheapness of gilts versus German bunds and US Treasuries. As the impact of the rate hikes begins to filter through to the wider economy, we believe interest rates in the UK will come in below the market’s current expectations. We have therefore increased our allocation to the fund’s carry module.

Credit module: taking a conservative approach

In our credit module, we look for isolated, idiosyncratic pockets of value across investment-grade, high-yield and emerging bond markets. Over the second quarter, credit spreads narrowed in response to better-than-expected economic data and the reduced probability of recession. Despite this, however, our credit module detracted from performance, as an aggressive repricing of interest-rate expectations pushed underlying yields higher, more than offsetting the narrowing in credit spreads.

We are taking a conservative approach to credit markets, running roughly one year of spread duration in our credit module. Our allocations to high yield (21%) and emerging markets (zero) are low relative to a maximum permitted ceiling of 40% for the two asset classes combined. Within high yield, the fund is primarily exposed to short-maturity BB-rated issuers with modest exposure to ‘B’-rated bonds (3%). (We are not allowed to own anything rated below ‘B-’).

We have relatively few short positions. Spreads are tight but volatility is low. We prefer not to give away the carry that would be associated with running short positions, particularly given the conservative profile of our long exposure.

We only have one ‘negative basis trade’ at present - we are long in Pearson’s physical bonds versus a credit default swap in the same name.

Rates module: focusing on relative-value trades

Our rates module focuses on the opportunities – in both relative and absolute terms – that we find across the world’s major government bond markets. Our views on interest rates, inflation and on the relationship between countries’ short-term and long-term borrowing costs (as shown by the yield curve) shape the investments we make here.

The rates module made a positive contribution to returns over the quarter, offsetting part of the drag from our carry and credit modules.

Duration

The fund’s overall duration remains relatively short. Over the quarter, its duration fluctuated between 1.25 and 1.5 years, largely concentrated towards the front end of the curve. Excluding a short position in Japan, the duration contribution from our rates module is broadly neutral.

We maintain a short bias in Japan expressed through bond futures. The monetary stance of the Bank of Japan (in terms of both its yield curve control policy and quantitative easing) is inconsistent with the country’s underlying economic fundamentals. We view our short positions in Japanese government bonds as an asymmetric trade: any downside will be modest but the potential upside is significant.

Cross-market trades

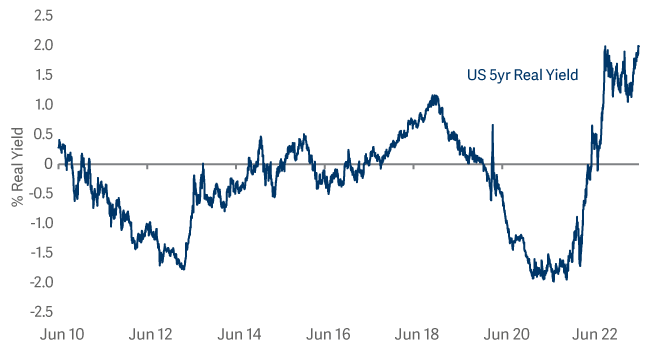

We see value in positive real yields across several economies including the US, New Zealand and Canada – particularly against Europe, where real yields remain negative.

We are long the front end of the UK yield curve (5-year) versus Canada.

We are long US (7-year) versus Australia (3-year) and New Zealand (10-year).

We retain our strategic preference for being short of Eurozone peripheral spreads. When spreads widened during the quarter, we took profits on our short position in Italy (versus Finland and France). More recently, however, we re-established that short position in response to a run of outperformance by Italian bonds.

We see value in real yields in the US

Curve trades

Strategically, we maintain a preference for steeper yield curves. After the aggressive flattening seen in June, we began to build back steepener positions in the UK (5 to 10-year) and the US (7 to 10-year).

We also maintain a short bias at the long end of the yield curve in Europe, where valuations are inconsistent with the long-term inflation profile. Inflation is priced to average 2.75% in Europe over 30 years while nominal yields on 30-year German bunds remain below 2.5%.

Set against this, we are running yield-curve flatteners in Australia, where the peak of rates is priced to be meaningfully lower than in many economies and where the yield curve is steeper.

Inflation positions

We are short 20-year inflation-linked French government bonds

We are short of French inflation-linked (20-year OATi) on an outright basis and relative to the wider European market.

In the UK, we are short 10-to 20-year index-linked gilts ahead of a period of heavy supply. Set against that, we do see some value towards the front end of the index-linked gilt market (UKTI 2029 in particular).

* Source: Lipper Limited/Artemis from 31 December to 30 June 2023 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Benchmarks: Bank of England (BOE) base rate; BOE base rate is a measure of the interest rate at which the BOE, the UK’s central bank, lends money to other banks. It is used as a way of estimating the amount of interest which could be earned on cash. It acts as a ‘target benchmark’ that the fund aims to outperform by at least 2.5%, after fees, on an annualised basis over rolling three-year periods. There is no guarantee that the fund will achieve a positive return over a rolling three-year period or any other time period and your capital is at risk.