Artemis UK Smaller Companies Fund update

Mark Niznik and William Tamworth, managers of the Artemis UK Smaller Companies Fund, report on the fund over the quarter to 30 June 2023 and their views on the outlook.

An award…

Artemis was named ‘UK Smaller Companies Fund Manager of the Year’ at the 2023 Small Cap Awards in June.

Review of the quarter to 30 June.

The single biggest negative for our relative returns over the quarter was our holding in Jadestone Energy, which was down 49%. Although it recently resumed production at its Montara oil field (a positive) its auditors required the business to raise additional equity to replace the cash flows lost whilst it was offline. Elsewhere, RWS came under pressure (down 21%) as it indicated that its profits would be towards the lower end of expectations.

Interestingly, it was a quarter in which ‘what we don’t own’ was a significant (negative) driver of relative returns: Carnival (+77%) and Aston Martin (+55%) both bounced strongly but aren’t held in the fund.

Set against those negatives, Mears, our largest holding, reported that it “expects full-year profits to be materially ahead of current market expectations.” Its shares ended the quarter 47% higher.

Also on the plus side, we saw strong performances from Fuller, Smith & Turner, Brooks Macdonald and Halfords. And, as we discuss below, takeover bids continued to make a positive impact on returns.

The net result was that the fund ended the quarter 1.4% lower, roughly in line with the median return from its peer group but behind the benchmark index (which was up 0.1%). We are significantly ahead of our peer group (although still behind the index) over one year. The fund is solidly ahead of both the index and its peer group over three years to the end of June.

| Q2 2023 | One year | Three years | Five years | 10 years | |

|---|---|---|---|---|---|

| Fund | -1.4% | 0.1% | 36.8% | 2.5% | 117.8% |

| Index | 0.1% | 4.4% | 29.5% | 4.2% | 79.6% |

| Peer-group average | -1.4% | -0.6% | 11.5% | -1.1% | 98.3% |

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Our benchmark index is Numis Smaller Companies (-InvTrust) TR; our peer group is IA UK Smaller Companies NR.

We received two more takeover bids…

Medica is the UK market leader in teleradiology. It received a recommended cash offer from IK Partners, a private equity firm, at 212p per share, a 33% premium to the previous closing price.

Although the bid was helpful for the fund’s short-term performance, we do have some reservations here. Given Medica’s growth prospects, the offer looked fair rather than generous (the price offered was equivalent to a 5% free cashflow yield, a price-to-earnings multiple of 19x and an enterprise value to Ebit of 13x). Medica is the leader in a structurally growing market and has significant room to accelerate its growth further by expanding into adjacent areas (e.g. telepathology) and into new geographies.

The quarter’s second bid was for Lookers, the UK car dealer. Once again, this was a recommended cash offer, this time from a Canadian trade buyer, Global Auto. The bid came in at 120p per share, equivalent to a 35% premium. This was only a modest holding for the fund (1.1%) so its contribution to relative returns over the quarter was limited (+0.4%). The offer price is far from generous – around 9x this year’s earnings – but this needs to be balanced against the relatively high levels of uncertainty here.

The bid for Lookers was the 25th recommended offer the fund has received since 2019 and the ninth since the start of 2022. The average premium has been 50%. We see these bids as third-party validation of the value we see in our holdings. With fund flows into UK equity markets remaining negative, M&A (and share buybacks) continues to take on the role of the marginal buyer.

Artemis UK Smaller Companies takeovers1

We started a new holding in Alpha Group.

We first bought shares in this foreign exchange risk-management and alternative banking business (then called Alpha FX) at the time of its IPO in 2017, when it floated at 196p per share. We sold our holding for over 500p per share in 2018. We have now re-initiated a holding with the share price over 2100p. Why?

(i) Strong growth – few companies have delivered stronger earnings growth than Alpha over the past few years. Estimates suggest that its earnings per share for 2023 will be 230% higher than they were in 2018.

(ii) Cash generation – we expect Alpha to generate £65m free cashflow in 2023, equivalent to a free cashflow yield of 7%.

(iii) It is a beneficiary of higher interest rates – Alpha holds £1.6 billion of client cash in its alternative banking division. This is becoming a material source of cashflow; the cash balance is growing at the same time as interest rates are rising.

(iv) A strong balance sheet – Alpha is expected to end the year with around £200 million net cash on its balance sheet. This is more than the business requires so enhanced returns shareholders seem likely.

(v) Culture – Although this is hard to quantify (and tricky to judge from the outside) we were once again impressed by Alpha’s entrepreneurial management team and differentiated culture when we visited its offices.

We added to existing holdings and trimmed some of our stronger performers.

We topped up holdings including FDM (technology recruitment and training), Tatton (on-platform discretionary fund management) GB Group (online identity and fraud) and Vanquis Bank (a mid-cost credit provider). We also added to NCC after the shares fell heavily following a profit warning.

We funded these additions by trimming some of our stronger performers including Medica, MoneySupermarket and Dunelm. We also trimmed Mears, whose strong performance had taken the holding above 3% of the fund.

We sold out of XPS.

After a strong run, we felt that the valuation was fully reflecting the (improving) near-term outlook and we have some concerns about its longer-term potential.

ESG matters… 70% of London offices will need a major refit before 2030. Morgan Sindall can help.

We were reminded in a recent meeting with Helical, a London office developer not currently held in the fund, that there is a legal requirement that all commercial property in the UK must hold an EPC rating of ‘E’ (or better) before a new lease is signed. This minimum standard will increase to band ‘C’ by April 2027 and then to band ‘B’ by April 2030. There are a limited number of exemptions (for example for new leases that are under six months or where undertaking the work is not possible or not economically viable).

This matters to us because Morgan Sindall (1.8% position) is the market leader in fitting out London offices. And, if these legal obligations change, some 70% of London offices will require a major fit out before 2030 (or when their lease expires). This should be a helpful tailwind; office fit out accounts for close to 50% of Morgan Sindall’s forecast profits for 2023.

Outlook. UK equities – including small caps – remain deeply out of favour, creating a buying opportunity.

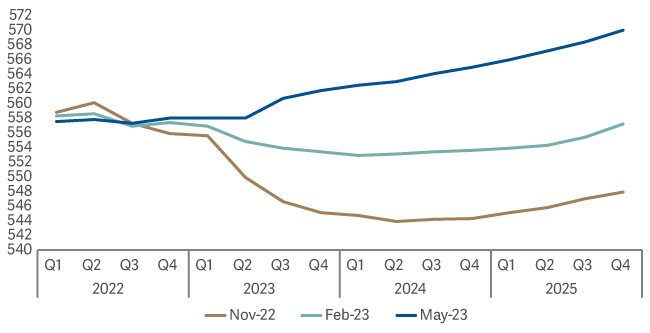

The UK economy is proving far more resilient than had been widely expected. Six months ago, the Bank of England was forecasting one of the deepest and the longest recessions in history. It is now forecasting that there will in fact, be no recession at all. Instead, it now sees real GDP picking up progressively from here.

Bank of England now expecting no recession

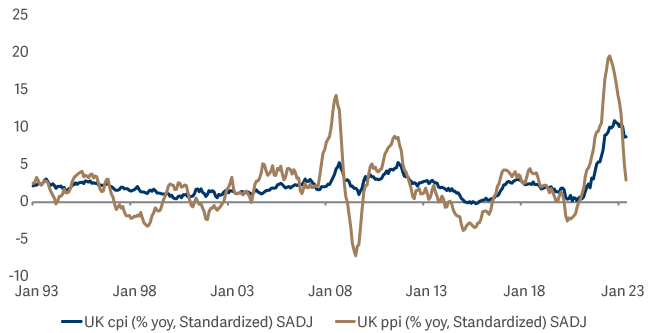

That positive shift by the Bank isn’t an outlier: economic growth, wage growth and retail sales have all come in ahead of expectations in recent months. It is true that inflation has continued to disappoint but forward-looking indicators, such as PPI input prices, sterling strength and wholesale energy prices, point to a more benign period ahead.

Producer price inflation is heading lower; consumer prices should follow

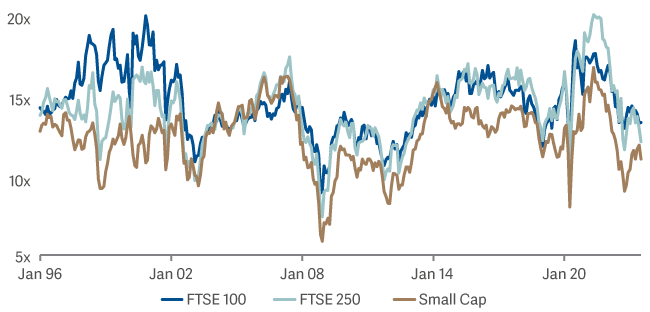

Despite an improving economic backdrop, UK equities – including small caps – remain unusually cheap relative to other regions. This re-enforces our view that this is a great buying opportunity as small caps continue to price-in a recession that we feel is increasingly unlikely.

The median mid cap (FTSE 250) company is cheaper than the median large cap (FTSE 100), with small caps cheaper still.

Source: Lipper Limited/Artemis from 31 March to 30 June 2023 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmarks: Numis Smaller Companies (-InvTrust) TR; A widely-used indicator of the performance of the UK smaller companies stockmarket, in which the fund invests. IA UK Smaller Companies NR; A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. These act as ’comparator benchmarks’ against which the fund’s performance can be compared. Management of the fund is not restricted by these benchmarks.