Artemis UK Special Situations Fund update

Derek Stuart and Andy Gray, managers of the Artemis UK Special Situations Fund, report on the fund over the quarter to 30 June 2023 and their views on the outlook.

The fund outperformed over the quarter

Over the quarter, the FTSE All-Share fell by 0.5%. The fund outperformed, returning 1.0%.

FirstGroup, Melrose, ICG and 3i were key positives

FirstGroup reported strong results with several highlights worthy of note:

- A significant improvement in margins in its UK bus business, to 7.9%.

- Continued progress in the new, open-access rail services.

- Another share buyback, returning the proceeds of the US disposal to shareholders.

- Continued investment in fleet electrification.

The demerger of Melrose Industries and Dowlais took effect in early May. Melrose now operates as a pure aerospace business. A capital markets day highlighted the favourable backdrop for this sector as well as the company’s strength in engines. Melrose’s cash dynamics are strong and long-term margins have increased.

Intermediate Capital Group reported solid results. While raising funds has become more difficult of late, this comes after a number of successful years. The business delivered 23% growth in management fees and margins also improved in its fund management division. Rising interest rates, meanwhile, are beneficial to the company’s debt strategies.

3i’s investment in Action, the discount retailer, continues to go from strength to strength. Revenue growth, margin enhancement and continued roll out of new stores are leading to higher profits. This, in turn, is driving continued growth in 3i’s net asset value.

Stock negatives: luxury goods companies in focus

Burberry came under pressure due to questions over the near-term strength of Chinese demand following the country’s post-Covid re-opening. We retain our holding: new designer Daniel Lee is starting to make his mark and the new CEO is working on the organisational structure. Elsewhere in the luxury goods world, Watches of Switzerland also underperformed. Trading has been a bit softer in the US, particularly in jewellery. In our view, however, the long-term opportunity remains undimmed.

Elsewhere, Johnson Service Group’s shares drifted despite the news, delivered at its AGM, that its revenues over the year-to-date were 22% higher than in the same period last year. And while pressures on costs continued, the company has been able to raise full-year profit expectations even at this early stage.

Meanwhile, domestic UK banks such as NatWest Group came under pressure, perhaps due to fears over the impact that higher interest rates will have on loan impairments. Set against that, however, deposits are flowing into higher interest-bearing accounts and net interest margins are moving higher.

Activity - Buying Hill & Smith; adding to Entain; selling Flutter Entertainment and C&C Group

Hill & Smith supplies galvanising services for construction and transport infrastructure. A new management team is repositioning the business: low-growth, low-margin, businesses in France and Sweden have already been sold. The company is increasingly focused on the US, where government stimulus measures are underpinning growth.

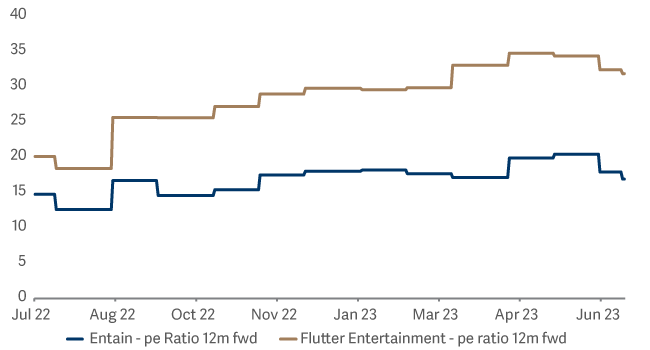

We sold the holding in Flutter Entertainment and used the proceeds to add to Entain. While Flutter’s FanDuel division brand continues to execute well in the US, this is now fully reflected in its valuation. We increased the position in Entain, which enjoys a similar opportunity in the US sports gaming market. The valuation differential between these businesses is, in our view, unwarranted.

Flutter vs. Entain: forward p/e multiples

We sold C&C Group, where ongoing downgrades contradicted our turnaround thesis. The company was experiencing issues with its ERP implementation. While it was frustrating to have sold the shares at a loss, we did avoid a subsequent profit warning and management change.

Engagement – focusing on CEO successions

Oxford Instruments’ Ian Barkshire is retiring. His successor, Richard Tyson brings useful operational experience. Elsewhere, Bodycote’s Stephen Harris is to retire; we discussed the skills required to run a company with 165 sites globally. We were also pleased with the new appointments Jet2 made to its board. We engaged with the company last year on board composition and diversity and two new independent non-executive directors have now been announced: Simon Breakwell and Angela Luger.

Outlook

- Improving UK consumer confidence is being reflected in trading updates from companies such as Next.

- Chemical companies are reporting destocking in construction and electronic end markets.

- We are, however, wary of a potential slowdown into 2024 as recent interest-rate increases begin to take full effect.

Source: Lipper Limited/Artemis from 31 March to 30 June 2023 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmarks: FTSE All-Share Index TR; A widely-used indicator of the performance of the UK stockmarket, in which the fund invests. IA UK All Companies NR; A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. These act as ’comparator benchmarks’ against which the fund’s performance can be compared. Management of the fund is not restricted by these benchmarks.