Artemis Strategic Assets Fund update

Kartik Kumar, manager of the Artemis Strategic Assets Fund, reports on the fund over the quarter to 31 March 2023 and his views on the outlook.

The fund had a reasonable quarter with its NAV rising 3.8% compared to a 1.1% increase in its inflation-linked benchmark.

Developed market equity indices increased in value by 7% (in US dollar terms), led by the NASDAQ and European markets. Government bond yields were volatile, rising early in the quarter before falling in response to issues in the banking sector. US 10-year bond yields declined by 40 basis points, whereas European yields declined by 20-40bps. Our equity allocation averaged 66% in the quarter (versus 64% in the previous quarter) and made a positive contribution of 5%.

Long positions modestly underperformed short positions (11% vs. 14%) owing to shorts in the NASDAQ proving costly. Government bond shorts detracted 1% from performance.

In absolute terms, our top three contributors were easyJet (+50% absolute/1.5% contribution), Meta Platforms (+71%/1.2%) and Dignity (+27%/1.1%). Our top three detractors were Delivery Hero (-31%/0.5%), Nintendo (-9%/0.4%) and Anglo American (-16%/0.3%).

Key developments in markets that impacted the fund and our positioning were as follows:

Monetary policy: The future path of inflation and interest rates (both peak and terminal) remain the key driver of markets in the near-term. Expectations remain highly volatile due to economies facing various crosscurrents. Over the quarter, long-term interest rates declined in response to March’s banking sector issues and weaker US economic data.

Input costs falling: Gas prices fell markedly as high storage levels met with lower demand due to warm weather and reduced consumption, alleviating pressures on European consumers and governments. Other commodities (e.g. copper) have also declined, meaning input cost pressures are abating.

Geopolitical risk: The Russia/Ukraine conflict is ongoing with no apparent resolution in sight. Ukraine is being supported by Western aid, and China-US relations are getting further strained by concerns over whether China will support Russia.

China reopening: The Chinese government’s abrupt end of its zero-COVID policy in December marked the true end of the global pandemic, and had a positive impact on supply and demand factors.

It remains a difficult backdrop for investing. Forming a clear view on the path of economies and corporate profits is complicated by the effects of 3 consecutive shocks – a pandemic, a war and high inflation – whose distortions are overlapping.

Economies are facing weak consumer confidence and higher interest rates, while employment markets remain strong and input cost headwinds ease. On a corporate level, sudden and drastic changes in the macro and geopolitical environment are moving us along to new stages of the capital cycle across several industries, most notably banking (higher interest rates) and energy (unstable supply).

Activity

Our key action in the period was to further reduce our government bond short position from 50% of NAV to 12%. We closed our Japanese bond short (21% to 0%) early in January as the yield curve control cap was increased. We progressively reduced our position in Europe (25% to 12%) through the quarter.

The yield offered by long-dated government bonds is now approaching levels we would consider to be close to fair. 10-year bonds yield 2.3% in Germany, 2.8% in France, and 3.5% in the UK. These levels are above inflation targets set by central banks. Both market-implied and survey-based long-term inflation expectations have not risen materially, despite high current inflation. In effect, monetary policy is still deemed to be credible.

Additionally, we see the potential for inflation to fall. The actions of central bankers have reduced money supply growth and may cause a recession. Energy prices have been falling materially and this comes at a time when weighting of energy in inflation indices has risen. Importantly, as mentioned above, long-term inflation expectations remain grounded, a key upside risk which should impact labour negotiations going forward.

We have often explained that shorting government bonds was an attractive way of reducing duration in a portfolio risk assets. In our judgement, duration was a greater risk factor when rates were 0% than when they are 4-5%. The duration risk in equities has reduced and the rise in bond yields has made government bonds a less attractive hedge.

The fund also increased its net equity position through the quarter from 64% to 70%.

We increased our exposure as prices fell in response to the banking crisis, starting new holdings in HSBC, Ferrovial and Hargreaves Lansdown, while increasing several existing positions. The position in Glencore was sold to zero and switched in to Anglo American. Reductions were made to positions in Bellway, EasyJet and Prosus.

The long equity portfolio has 46 positions with an average weighting of 1.9% and the short book has 47 positions with an average weighting of 0.4%.

Outlook

Our view that inflation and interest rate rises are likely to moderate has strengthened and we believe the economic outlook is improving for the following reasons:

Energy and commodity prices – supply and demand factors have responded to prices leading to substantial price falls from 2022 peaks.

Declining money supply – 2-year money supply growth rates in Europe and the US are now below the pre-COVID long-term averages, while remaining slightly above in the UK.

Upswing in consumer sentiment – is likely to occur as confidence rebounds from historically low levels and real wage inflation turns positive.

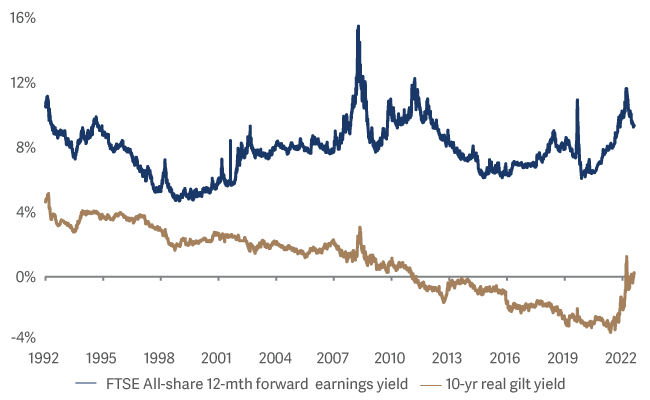

However, as ever, the key reason to be positive about the prospects for equities is not because of macroeconomic factors, it is because of value. Equities are the best long-term hedge against inflation. The equity risk premium, the return you receive for the uncertainty of investing in equities, remains elevated. To illustrate this, 10-year inflation-linked bonds offer real returns of 0% compared to the earnings yield on UK equities of 9%.

FTSE All-Share earnings yield (%) vs. 10 year real bond yield (%)

In an uncertain environment, we feel that portfolio diversification is key. The varied composition of the portfolio gives us confidence in being able to take advantage of future opportunity and respond to emerging risks.

Our largest investment remains in high-quality franchises in US internet (Alphabet/Meta), EU infrastructure (Vinci/Ferrovial), and financial services (Visa/LSEG/S&P) that have a strong record of growing earnings in real terms. We continue to have considerable exposure to UK discounted cyclical assets in housebuilding (Barratt/Bellway), airlines (EasyJet/Ryanair) and retail (Frasers) that provide exposure to any upswings in economic activity and trade on low valuations. Our positions in financials (Lloyds/NatWest/HSBC) should benefit from higher interest rates.

Source: Lipper Limited/Artemis from 31 December 2022 to 31 March 2023 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmarks: CPI +3%; A widely-used indicator of UK inflation. It acts as a ‘target benchmark’ that the fund aims to outperform by at least 3% per annum over at least five years. IA Flexible Investment NR; A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. It acts as a ‘comparator benchmark’ against which the fund’s performance can be compared. Management of the fund is not restricted by these benchmarks.