Artemis Target Return Bond Fund update

Stephen Snowden and Juan Valenzuela, managers of the Artemis Target Return Bond Fund, report on the fund over the quarter to 31 March 2023 and the outlook.

- The fund returned 0.8% over the quarter*, with positive returns from our carry and rates modules.

- We have increased our allocation to short-maturity, investment-grade corporate bonds.

- At current valuations, fixed-income markets offer compelling yields without obliging investors to take meaningful credit risk.

Performance

The fund returned 0.8% over the quarter, lagging its target of 1.6% (2.5% above the Bank of England’s base rate, after fees, on an annualised basis). Our carry and rates modules contributed to those returns; our credit module was a modest detractor.

Carry module

The carry module is the most defensive part of our fund. Our focus here is on investment-grade bonds that are due to mature within the next three years. It performed well over the quarter, contributing 0.72% to returns.

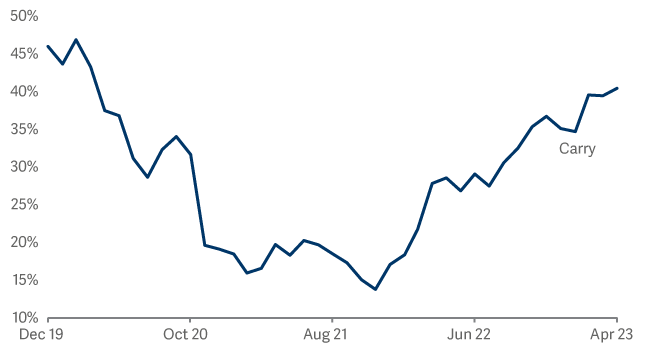

Prospective returns from short-maturity, investment-grade corporate bonds appear compelling on a risk-adjusted basis. At the end of the quarter, the Bloomberg Sterling Corporate 1–3-year maturity index offered a yield of 5.88% with 1.9 years of duration. Accordingly, we have further increased our allocation here; by the end of the quarter, this module represented just over 40% of the portfolio.

Chart 1 – We have increased our allocation to the fund’s carry module

The average maturity profile of our holdings in this module is short, at just over two years. At the same time, those holdings generate an average yield of 5.85% with limited credit risk. At these levels we believe we are being very well compensated for the (limited) default risk we are taking.

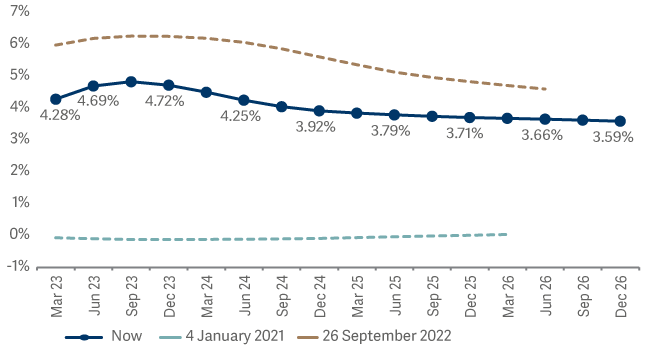

From a valuation point of view, the front end of the UK yield curve appears to be extremely reasonably priced. The market expects interest rates in the UK to peak at around 4.6% (which is, in our view, high enough) and for rate cuts beyond that point to be modest. As a result, we are very comfortable running duration risk towards the front end of the UK curve.

Chart 2 – The market now expects UK interest rates to peak at around 4.6% - significantly lower than it expected last September

Over the course of the last 15 months, interest rates in the UK have risen by over 4%. As the effects of that tightening begin feeding through to the economy, and as headline inflation readings begin to roll over, we would expect the market to begin to price in further rate cuts. That should support our short-dated bonds.

Credit spreads, meanwhile, have begun to contract – but they remain elevated in a historical context. Spreads on the Bloomberg Sterling Corporate 1-3 year Index ended the quarter at 189 basis points. This is, in our view, an attractive level given the underlying credit risk.

Rates module

Our rates module focuses on the opportunities – in both relative and absolute terms – that we find across the world’s major government bond markets. Our views on interest rates, inflation and on the relationship between countries’ short-term and long-term borrowing costs (as shown by the yield curve) shape the investments we make here. This module contributed 0.45% to returns over the quarter.

Duration

The portfolio’s overall duration fluctuated between 1.5 and 2 years over the course of the quarter. Towards the end of March, however, we shifted to a short bias in our rates module after the meaningful rally in government bond yields.

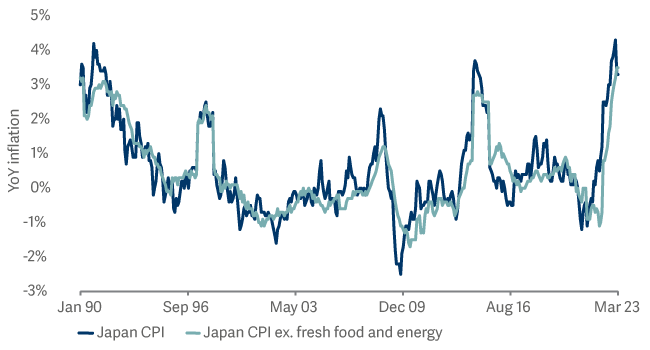

That short position is concentrated in Japan (using 10-year futures) where we view current monetary policy as being inconsistent with the economic fundamentals. Even a modest change the policy stance by the Bank of Japan would represent a meaningful headwind for Japanese bonds.

We are also short towards the very front end of yield curves in Canada and the US. There is no doubt that we are approaching the peak of rates for this cycle, but we disagree with the rate cuts that shape of the yield curve is currently implying. We expect there to be a reassessment of interest-rate expectations as elevated uncertainty dissipates.

Chart 3 –Inflation in Japan is inconsistent with negative rates and the BoJ’s yield curve control policy

Curve trades

We maintain a preference for yield-curve steepeners; we believe there is a distinct lack of value in longer tenors relative to the short end and belly of the curve.

Quantitative tightening comes at a time when governments’ funding requirements are elevated. There is a increasing possibility that central banks might have to compromise their commitment to calming inflation in order to preserve financial stability. The escape valve in the government bond market is likely to be steeper yield curves as investors demand a greater premium to lend for longer.

We are expressing this view that yield curves will need to steepen in the UK and Europe. Set against that, we are running flatteners in Australia where the yield curve is comparatively steep.

Cross-market trades

In cross-market trades, we are still running short positions in the eurozone’s periphery versus its core (Germany). As quantitative tightening progresses in Europe, peripheral spreads are likely to widen from current levels. This also offsets part of the credit risk we are running in our credit and carry modules. We are also long New Zealand and US versus Australia and Europe (in both nominal and real yields).

Inflation

Our net inflation exposure is modestly short. We believe that inflation breakevens are too high in France and that they are also too high both in the belly and at the long end of the UK yield curve. Set against that, we see value in the front end of the curve in Italy. We also see value in the front end of the UK inflation-linked market, where real yields are back towards zero with inflation breakevens at reasonable valuations.

Our short inflation bias also complements the positioning of our carry and credit modules, which tend to be positively correlated to wider credit spreads.

Credit module

In our credit module, we look for isolated, idiosyncratic pockets of value across investment-grade, high-yield and emerging bond markets. It modestly detracted from performance over the quarter, contributing -0.18%.

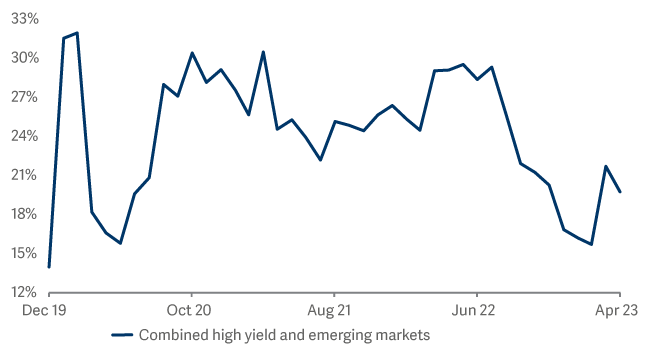

Over the course of the last few months, we have reduced our credit risk of the portfolio. We shortened the maturity profile of the holdings while also increasing the credit quality, so reducing the sensitivity of the portfolio to changes in credit spreads (Chart 4). We also lowered the net exposure to high-yield and emerging market bonds to less than 20% (Chart 5).

Chart 4 – We have reduced the portfolio’s sensitivity to changes in credit spreads

Chart 5 – We lowered the net allocation to high yield and emerging market debt

In the short term, our view on credit spreads is actually quite positive. A reduction of uncertainty from elevated levels and reduced volatility in the government bond market should help. We do not believe that the recent issues seen at banks in the US (SVB and Signature) or Europe (Credit Suisse) are systemic in nature; they are not the prelude to another global financial crisis. Accordingly, after a meaningful widening in credit spreads towards the middle-end of March, we closed some of the short positions we were running here, taking profits in our EM CDX short exposure and closing shorts (through single-name credit default swaps) on three European banks.

Outlook

We are positive for the prospects for credit markets in the near term. Beyond the near term, however, the recent troubles seen in the US banking sector do seem likely to result in a tightening of financial conditions. That will have important macroeconomic implications: US regional banks are part of the glue that holds the US economy together, linking small and medium-sized enterprises to the credit market.

We maintain our view that hopes of a ‘soft landing’, while clearly desirable, are somewhat unrealistic. An outcome in which central banks hike rates by just enough to bring inflation back down towards target without causing meaningful economic pain seems unlikely. Despite the wishful thinking that is evident in some quarters, the most likely outcome will be a painful recession – one whose timing is open for discussion.

Fortunately, at current valuations, fixed-income markets offer compelling yields without obliging investors to take meaningful credit risk.

* Source: Lipper Limited/Artemis from 31 December to 31 March 2023 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Benchmarks: Bank of England (BOE) base rate; BOE base rate is a measure of the interest rate at which the BOE, the UK’s central bank, lends money to other banks. It is used as a way of estimating the amount of interest which could be earned on cash. It acts as a ‘target benchmark’ that the fund aims to outperform by at least 2.5%, after fees, on an annualised basis over rolling three-year periods. There is no guarantee that the fund will achieve a positive return over a rolling three-year period or any other time period and your capital is at risk.