Artemis UK Select Fund update

Ed Legget and Ambrose Faulks, managers of the Artemis UK Select Fund, report on the fund over the quarter to 31 March 2023 and their views on the outlook.

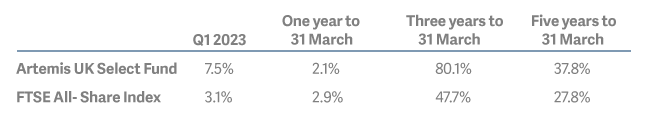

The fund returned 7.5% over the quarter while the All-Share returned 3.1%

An eclectic group of companies – including Jet2, 3i and Melrose Industries – contributed to that outperformance.

UK banks came under pressure over the quarter – but we believe the problems seen at SVB and Signature Bank appear unlikely to be repeated here.

Performance

The fund returned 7.5% over the quarter, versus a return of 3.1% from the FTSE All-Share Index.

As is often the case, a new calendar year brought a marked improvement in market sentiment. A confluence of factors helped:

- good news from the corporate sector;

- a sharp fall in gas prices in the UK and Europe;

- signs that the interest-rate cycle was nearing its peak; and

- the decision by Chinese government to scrap Covid restrictions and re-open the economy.

So while the bond market had spent much the final quarter of 2022 pricing in the near certainty of recession, the new year saw hopes of a ‘soft landing’ (or even ‘no landing’) in the economy. Meanwhile, the change in market leadership that began in December, which saw cyclicals and financial stocks starting to outperform defensives, carried over into January.

By March, however, the mood had soured in response to the demise - in rapid succession - of SVB, Signature Bank and then Credit Suisse. The cumulative effect was to raise fears about the stability of the global banking sector. While these three bank failures soon came to be recognised as results of company-specific problems rather than reflecting broader systematic issues, the likely ‘real world’ impact of the crisis was genuine cause for concern. It remains to be seen what any tighter regulation of the US regional banking sector might mean for their lending appetite and, in turn, for US economic growth.

Away from the top-down volatility, however, UK companies continued to deliver encouraging results and/or trading updates. Over the quarter, a string of companies in our portfolio – including Ashtead; Bodycote; Conduit; Hiscox; IAG; Lookers; Melrose; Morgan Sindall; Vanquis Bank (former Provident Financial); Vistry; Weir and Whitbread – reported solid results and/or upgraded their earnings forecasts.

(*) As at 31 March 2023.

3i was the biggest positive contributor to our outperformance over the quarter

An investor day provided an encouraging update on trading at discount retailer Action, the largest holding in 3i’s portfolio. On a like-for-like basis, its sales growth accelerated to 25% in the first 11 weeks of the year. Add new store openings to the mix and total sales growth is running at 37%. These are - in our opinion - outstanding numbers for a business with turnover of over €8 billion and highlight what an exceptional retail franchise Action is. With a clear plan for rolling out stores across Europe over the coming decade we expect it to continue creating value for 3i shareholders over the years to come.

Jet2’s shares rose by 37%

Jet2 is delivering strong growth in what was once seen as a mature industry. The strength of its recent bookings saw it upgrading its full-year earnings guidance by 20%. Prospects for the year ahead look strong, with all indicators suggesting that bookings in the key post-Christmas period have been good. Jet2 recently increased the number of holidays in their ATOL license. On that basis, it is likely to be the UK’s number one tour operator this summer.

Melrose delivered strong results driven primarily by the aerospace side of its business.

Looking ahead, a faster-than-anticipated ramp up in production by both Boeing and Airbus over the next few years leaves Melrose well placed to deliver strong growth in both earnings and cashflow. The demerger of its non-aerospace division will leave it as a pure play alternative to Rolls-Royce for investors looking to participate in the recovery in civil aerospace spending.

(*) As at 31 March 2023.

Banks came under pressure

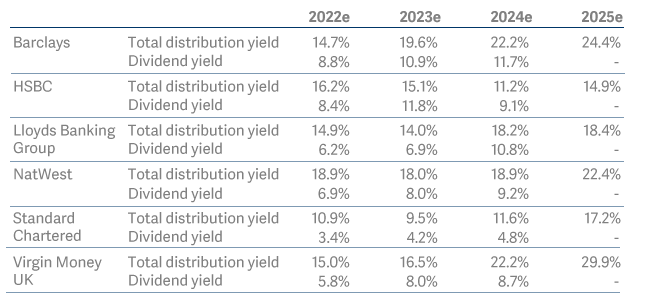

We remain of the view that there is limited ‘read across’ from the problems at some US regional banks (and at Credit Suisse) to banks in the UK. It seems clear that the issues at SVB and Signature were idiosyncratic. Both were built around esoteric business models and a regulatory regime that provided insufficient oversight of the balance-sheet risks inherent in these businesses. Moreover, liquidity coverage ratios at UK banks are much higher than they are at their US counterparts. On the regulatory front, the key difference is that the Prudential Regulation Authority requires banks here to take mark-to-market hits immediately and in full; we have already seen the impact of higher interest rates on capital in the full-year numbers for the UK banks. Furthermore, UK retail banks have sizeable sticky retail deposit franchises and significant cash balances at central banks. We have met two UK bank management teams since the start of the crisis. They report little change in deposit flows. Capital and liquidity positions remains strong and they can see very little signs of early stress across any of their credit books. We would note that Barclays trades on lower multiples than most US regional banks despite having amongst the highest liquidity in the whole pan-European banking sector…

UK banks have ample capital to return to their shareholders over the years ahead

So why the sell off? Money had been chasing the sharp rally in the financials index since the start of the year and then rushed for the exits as the news on SVB hit. With hedge funds on aggregate short bonds and long equities (and long financials within their equities exposure) the about-turn in markets was brutal. Moves were magnified by the selling of index futures as hot money scrambled to reduce its risk exposure. This hit liquid large caps such as Barclays harder than it did small caps – a pattern that we always see in the early stages of a sharp sell off. This will mean revert over time.

888’s share price fell sharply

A compliance issue in 888’s (small) business in the Middle East prompted the board to fire the CEO. A compliance breach is never good news and with the change in chief executive coming so soon after the completion of the acquisition of William Hill, the shares fell sharply. This holding has been an error on our part over the last year. We have been engaging with the board to get confidence that it will get the right executives in place to fix its problems and begin to move forward.

We sold what remained of our holding in British American Tobacco…

We took the decision to sell out of our remaining holding in BAT on the back of the improving economic outlook. The shares outperformed the market by circa 30% last year on a total return basis and their discount to the market had largely closed. Our views have not changed materially on the business itself, but we struggle to see it re-rating further against the wider UK market – particularly if investors are becoming more optimistic on the economic outlook.

… and reinvested the bulk of the proceeds in Lloyds

We put the majority of the proceeds into Lloyds, whose share price have lagged its peers. UK banks such as Lloyds remain a capital-distribution story. Helped by higher interest rates, cash returns to shareholders through dividends will continue to build over time even as share buybacks at current valuations retire material amounts of equity.

We added to Legal & General when its shares weakened

Legal & General fell in response to a profit warning from Direct Line. In our view, however, any ‘read across’ is minimal: L&G has sold its general insurance business. L&G offers an 8% (and growing dividend yield) and is a likely to be a beneficiary of a pick-up in sales in the bulk annuities market thanks to the rise in gilt yields.

Outlook

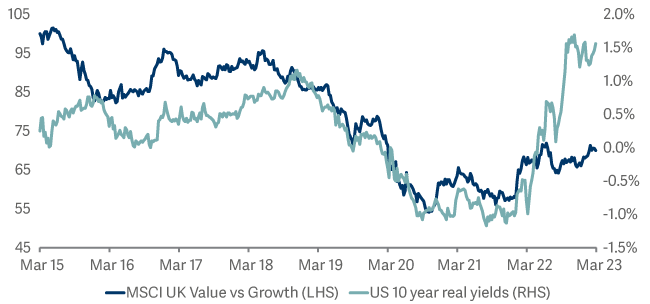

Our view is clear: the UK market remains cheap both in absolute terms and relative to its international peers. Within that, the valuation gap between ‘growth’ and ‘value’ remains unusually wide; in a world where interest rates are around 3% (as opposed to zero), that gap will close in time.

Growth vs value - where next?

Medium term real yields may provide an answer...

More narrowly, the results season was encouraging for our holdings, with circa 30% of our portfolio by value upgrading earnings guidance. Given that we are so early in the year, this suggests a reasonable degree of confidence in the outlook on the part of management teams. We remain of the view that, on aggregate, earnings across the portfolio will grow this year and with the fund still trading on c.8x forward earnings, offering a dividend yield of over 4% and with over 40% of our holdings (by value) currently buying back shares we continue to feel that the prospects of the companies we hold are not fairly reflected in their current valuations.

What might prompt the valuation multiples of our holdings to begin to reflect their earnings? We believe that greater clarity on the trajectory of inflation and monetary policy is key. The annualization of the spike in commodity prices triggered by the outbreak of war in Ukraine – as well as the ongoing normalisation of global supply chains – should allow a clearer picture to emerge over the coming months. We would expect to see p/e multiples rising to more ‘normal’ levels once investors become confident that we have seen the peak in interest rates for the current cycle.

Source: Lipper Limited/Artemis from 31 December to 31 March 2023 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmarks: FTSE All-Share Index TR; A widely-used indicator of the performance of the UK stockmarket, in which the fund invests. IA UK All Companies NR: A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. These act as ’comparator benchmarks’ against which the fund’s performance can be compared. Management of the fund is not restricted by these benchmarks.