Who will win the tug of war in bond markets?

Inflation is vying with economic slowdown to determine the direction of the bond market. Rebecca Young, co-manager of the Artemis Strategic Bond Fund, discusses the current drivers of bond yields.

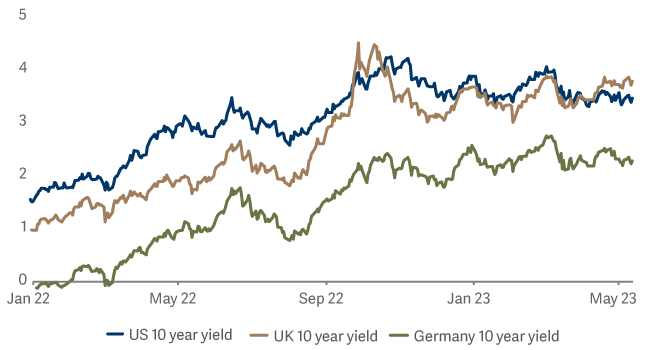

For most of 2022, bond yields moved higher in a strong uptrend driven by fears over inflation. This repricing reflected a major reassessment of how much interest rates would have to rise to fight inflation effectively.

This phase is now over and bond markets have entered a new stage. Core developed market bond yields have stopped rising and are now broadly trading sideways in a range.

Inflation – previously the dominant influence on yields – is still with us but is now fighting for centre stage with other factors. These include worries about the economy slowing down or going into recession as well as potential systemic risk from stress in the US banking sector.

And these factors are acting as an anchor to yields, preventing them from rising further.

At the moment, bond markets are trying to price-in the probability-weighted outcome of a multitude of scenarios. These range from inflation staying a persistent problem (and so more interest-rate hikes are needed) through to a nasty systemic issue (that would likely require significant rate cuts), and all potential scenarios in between.

Government bond yields

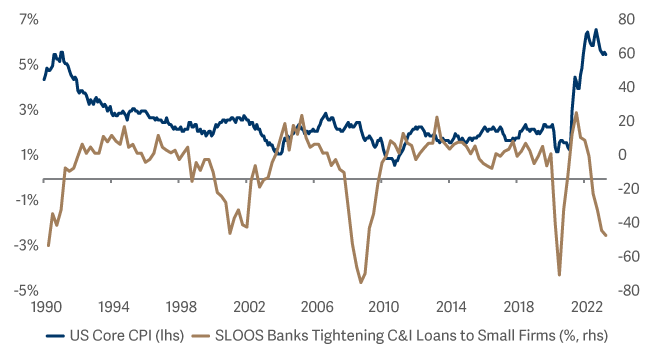

There have been some notable developments recently, including three of the four largest bank failures in US history. Concerns remain elevated about follow-on banking stress and further contraction in the supply of credit to the economy. This has added to the risk of recession. Indeed, when we look to the US (and this also holds true for Europe), current bank lending standards are at recessionary levels.

Bank lending standards are also at depressed levels, according to the April US Senior Loan Officer Opinion Survey (SLOOS – Chart 2); demand for commercial and industrial loans from small firms was only weaker in 2009 (with the series going back to 1991). This comes at a time when core inflation remains sticky and close to multi-decade highs.

US bank lending survey and core inflation

‘Wait and see’

For the time being, we appear to be in a ‘wait and see’ phase, where inflation is not high enough for the market to worry about a meaningful reassessment of interest rates, yet growth is not bad enough to be concerned about a recession starting in short order. The market remains hypersensitive to macro data releases, looking for direction one way or the other, in search of the next clue as to how this tug of war will get resolved.

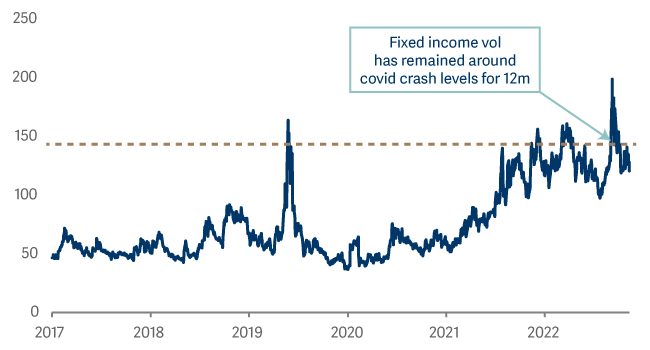

Indeed, the bond market is not so different to the central banks, who seem to be ever more ‘data-dependent’ in their approach. Against this backdrop and for the foreseeable future, we would expect bond market volatility to remain elevated (Chart 3).

Volatility in bond markets

But what if the tension in bond markets is not resolved soon?

Arguably, the longer we remain in this ‘wait and see’ phase, absent a near-term disruptive event (including of course that we get through the looming US debt ceiling deadline relatively unscathed), we should get more clarity on the cumulative impact of what has been the fastest tightening cycle in many decades. Elevated interest rates will get more of a chance to do their intended job and continue to work on bringing inflation down, providing a key support for government bonds.

What are the implications for fixed income investors today?

In short, it’s a balancing act.

The dramatic repricing of fixed income assets across the board in 2022 means bonds now offer a level of yield that looks attractive relative to many income generating alternatives. But we are also mindful of where we find ourselves with respect to the economic cycle.

The ever-growing list of casualties of a higher interest rate regime (including the UK LDI crisis and weaker business models being exposed in crypto/tech/banking) are only an on-going reminder that we are transitioning to a late phase of the economic cycle.

So we prefer to position the fund defensively. More specifically, it is tilted towards government bonds and high-quality credit. In today’s market, following last year’s repricing of yields, this defensive positioning can be achieved with a healthy level of income.