Artemis Target Return Bond Fund update

Stephen Snowden and Juan Valenzuela, managers of the Artemis Target Return Bond Fund, report on the fund over the quarter to 30 September 2023 and the outlook.

Review of the quarter to 30 September 2023

We believe this fund offers a compelling alternative to short-dated investment-grade corporate bond funds, the current go-to solution for many risk-averse investors.

Our target is to produce a positive return of at least 2.5% above the Bank of England’s base rate, after fees, on an annualised basis (over rolling three-year periods). Over the quarter, hitting that target would have meant generating a return of 1.9%. In the event, the fund actually returned 3.7% - almost double its target.

All three modules contributed positively to that return.

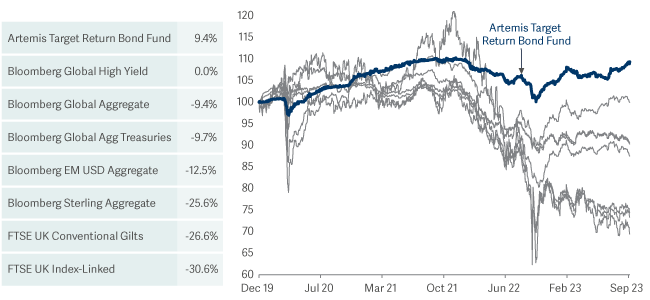

Fund performance since launch relative to the investable universe

Looking ahead: a ‘soft landing’ would be a miracle

The harsh reality is that central banks must inflict economic pain to control inflation – this means higher unemployment and negative real growth. The fact that economies have been resilient to this point does not mean that they are insensitive to (much) higher interest rates. A so-called ‘soft landing’ is not impossible but it seems rather unlikely. Effectively, we are asking the very same central banks who overshot their inflation targets (while repeatedly indicating that they would get inflation back to or below 2% within the forecast period) to perfectly calibrate monetary policy so that inflation falls back towards target without causing a material increase in unemployment.

This is all supposed to happen with interest rates having increased by between 400 and 500 basis points in most developed markets and at the same time that central banks are shrinking their balance sheets through quantitative tightening

(something that we have never before experienced). To this mix, we could also add a war in Europe, turmoil in the Near East and serious worries about Chinese economy. Given this, a ‘soft landing’ would be a miracle.

Taking cautious stance on credit – for now…

Reflecting our view that a soft landing (or no landing) scenario is unlikely, the underlying credit exposure of the portfolio is fairly modest and selective. We do own a number of high-yield bonds (around 20% of the portfolio). Crucially, however, these are short maturity and relatively high quality (the vast majority of our high-yield exposure is to ‘BB’-rated credit). We do not own any emerging market debt.

While the data does not suggest that anything sinister is about to unfold, our view is that yields in some areas of the credit market are not sufficiently high to adequately compensate investors for the risks they are taking. We are avoiding these parts of the market, safe in the knowledge that we have plenty of flexibility to take advantage of cheaper valuations when they eventually materialise.

The carry & credit modules

The carry module is the most defensive part of the fund. The focus here is on investment-grade bonds (both corporate bonds and government bonds in developed markets) that are due to mature within the next three years. In our credit module, we look for isolated, idiosyncratic pockets of value across investment-grade, high-yield and emerging bond markets.

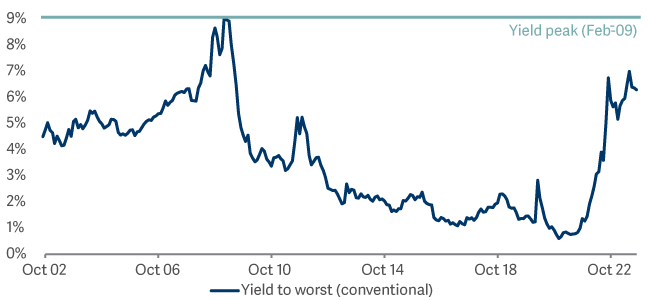

Both of these modules made a positive contribution to the fund’s returns over the quarter. As we have highlighted before, we believe that sterling, short-maturity, investment-grade corporate bonds currently appear attractive. At the end of September, they offered a yield of 6.24% which we regard as ample compensation for the risks being taken. While a simple strategy, simply holding these bonds and earning the income they pay out makes a lot of sense at this juncture.

Short dated £ investment grade corporate bonds

Bloomberg Sterling Corporate 1-3 Index

Source: Bloomberg, ICE Bank of America as at 30 September 2023

The fund’s exposure to short-maturity investment-grade corporate bonds is mostly concentrated in sterling markets. Our view is that the market’s expectations for how far interest rates in the UK will need to rise may be overly aggressive – and that it may also be underestimating how soon and how quickly the Bank may need to cut rates as the economy weakens.

Activity picked up in September after a quiet summer. We bought several new issues including Nestle, Yorkshire Building Society and Worldpay. In the secondary market we bought Vattenfall and topped up BP, Arqiva and Weir Group.

The rates module

Our rates module focuses on the opportunities – in both relative and absolute terms – that we find across the world’s major government bond markets. Our views on interest rates, inflation and on the relationship between countries’ short-term and long-term borrowing costs (as shown by the yield curve, a line illustrating the cost of borrowing over various time horizons) shape the investments we make here.

Government bond markets remained volatile over the quarter, presenting the fund with numerous idiosyncratic investment opportunities.

Directional risk

We currently have limited directional risk: the net duration contribution from the rates module is roughly zero if we exclude the short position in Japan. In broad terms, we are not taking a stance on whether government bond markets overall will move lower or higher. Instead, we have been concentrating on relative-value opportunities until a clear trend becomes more obvious.

We are net short in Japanese government bonds (expressed through 10-year futures). We believe the monetary stance being taken by the Bank of Japan (BoJ) is inconsistent with fundamentals and that yields on Japanese government bonds are likely to rise further as the BoJ adjusts its yield curve control policy.

Elsewhere, however, selected areas of government bond markets are beginning to look attractive. So the fund has some long exposure to US Treasury Inflation-Protected Securities (‘Tips’) of varying maturities and Canadian inflation-linked bonds. We think the real yields on offer here - of over 2% - are attractive. We also have some long exposure at the very front end of the yield curve in the UK. Set against this, the fund is short Europe (mostly through 30-year futures) and Australia.

Curve trades

Strategically, we are positioned in the expectation that yield curves need to steepen. Tactically, we have recently taken profits in steepener positions in the UK (where we had a bias to the front end of the curve versus the 10-year) and the US (where we were long 7-year part of the curve versus the 10-year). We retain our steepener positions in Europe.

Set against that, we have some yield-curve flatteners in Australia, where the yield curve is steeper. In the UK we are long 30-year gilts versus 10-year and 50-year tenors.

In cross-market positions, we are:

Long in New Zealand inflation-linked bonds versus Europe.

In Europe, we are long swaps versus cash bonds – we expect the cash bond market to underperform as the private sector is forced to absorb the duration risk that was previously being absorbed by the ECB.

And while we were short in Italy (versus Germany), we have closed that position (for now) and taken profits.

Inflation positions

In inflation markets, we are currently short in Europe (mostly through 20-year inflation-linked French government bonds). We are also short 10-year to 20-year inflation-linked gilts in the UK. Set against that, however, we are long US Tips and Canadian inflation-linked bonds.

* Source: Lipper Limited/Artemis from 31 December to 30 September 2023 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Benchmarks: Bank of England (BOE) base rate; BOE base rate is a measure of the interest rate at which the BOE, the UK’s central bank, lends money to other banks. It is used as a way of estimating the amount of interest which could be earned on cash. It acts as a ‘target benchmark’ that the fund aims to outperform by at least 2.5%, after fees, on an annualised basis over rolling three-year periods. There is no guarantee that the fund will achieve a positive return over a rolling three-year period or any other time period and your capital is at risk.