Artemis Funds (Lux) – Global High Yield Bond update

David Ennett and Jack Holmes report on the fund over the quarter to 31 March 2024 and their views on the outlook.

Source for all information: Artemis as at 31 March 2024, unless otherwise stated.

The Artemis Funds (Lux) – Global High Yield Bond Fund returned 3.5% in the three months to the end of March, compared with 2.0% from its ICE BofA Merrill Lynch Global High Yield Constrained USD Hedged index benchmark.

Although the market has tightened from the wide levels we saw in October 2023, we are still at the upper end of the yield range in the post-Global Financial Crisis period. From these kinds of levels, average historic one-year returns have been in mid/high single digits.

However, the market is currently in an unprecedented situation. Outside the Global Financial Crisis and the bursting of the dotcom bubble, cash prices of bonds are at all-time lows.

Because of the intricacies of the high-yield market and callable bonds, these low cash prices provide a potential boost to the likely return. It also means investors can reasonably expect a better outcome than what is being reflected in the yield-to-worst figures.

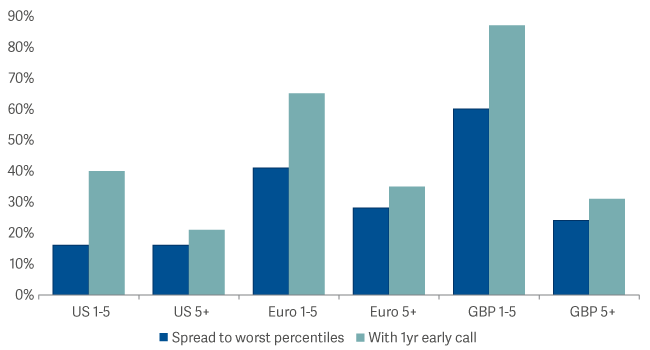

The chart below demonstrates the current spread-to-worst percentiles versus history – and then the percentiles adjusting for the fact that high yield bonds tend to get called a year in advance. Adjusting for this, valuations look historically attractive, particularly in the 1-5yr Euro/GBP part of the market.

Spread to worst and to call 1yr ahead of maturity percentiles

Positives

Among the biggest contributors to performance during the quarter were Catalent, Aroundtown and Miller Homes.

Bonds in global drug-delivery device manufacturer Catalent did well following the news that Novo Nordisk was set to take over the company. December acquisition Aroundtown, a Luxembourg-based real estate company, rebounded along with many other names in the European property sector. The size and speed of the rally led us to take profits via a complete sale.

For Miller Homes, our view was that market sentiment on UK assets in general, and the housing sector in particular, was overly negative. We were also attracted to its customer segment, strong asset backing, flexible cost structure and experienced management team. M&A activity in the sector underlined how well covered its bonds were.

Negatives

In terms of detractors, we suffered from our positions in Isabel Marant, ams Osram and Close Brothers.

French luxury clothing brand Isabel Marant has suffered as retailers have cut orders and inventory after a Covid-driven overstocking. The company adjusted its strategy towards ‘premiumisation’ which has reduced volume in the short term but will drive margin and brand equity in the long run. We remain confident in management and supportive of the strategy.

Electric light and sensor manufacturer ams Osram was one of our best performers last year, making 19.9%. However, it fell during the quarter after announcing one of its cornerstone contracts supporting its investment in MicroLED production had unexpectedly pulled out. We sold the position.

Financial services firm Close Brothers cancelled its dividend after warning of "significant uncertainty" over the outcome of the Financial Conduct Authority’s review of motor-finance commission arrangements. Its shares and bonds sold off as a result and we subsequently exited the position.

Activity

We participated in a selection of primary deals in US companies offering solid fundamentals and attractive pricing. These included housebuilder The New Home Company and healthcare products and distribution business Medline.

These deals were used for ‘refi’ trades – bonds that the market is pricing to remain outstanding for a while, but that companies are more likely to refinance sooner rather than later (and in the process potentially provide a capital gain to investors).

Another example of this was our holding in CBR Fashion – the German ladies fashion wholesaler had bonds trading at a price of 94c at the beginning of November last year. That was a yield to worst (the convention in the market) of just over 8% to the bond’s maturity in April 2026. An attractive yield, but hardly a table thumper. However, the bonds were being redeemed at a price of 101.375c, and repaid with the proceeds of a bond that the company was going to have to pay an interest rate of almost 1 percentage point more in.

The end result was that rather than delivering a rate of return of just over 8%, from the start of November the bonds delivered an annualised internal rate of return of 28%. This is happening across the market and we have actively been setting up the portfolio to take advantage of these opportunities. In the secondary market, for example, we added positions in Albertsons (the US grocery chain) and Iron Mountain (the global data storage business).

While we have historically been positive on certain parts of the oil & gas sector – most notably in the North Sea and eastern Mediterranean – February saw the sale of all our holdings in these two geographies. In the North Sea, the government’s hostile approach to taxing the sector made long-term investment seem unlikely. This didn’t seem like a huge issue for our holdings, but we felt it would impinge on their ability to refinance in the long term. We have been gradually reducing our positions over the past year or so, selling the last of our holdings in February.

In the eastern Mediterranean, we exited holdings in bonds secured on assets in Israeli waters. Prices have recovered since Hamas’s attack in October, but the higher risk profile makes it difficult to justify exposure on an ongoing basis.

A tightening in the spread of bonds issued by LKQ, a US auto repair/parts distribution business, led us to sell our holding. We also exited a position in Masonite, a US producer of windows and doors, after its bonds rallied on the announcement it would be acquired by investment-grade issuer Owens Corning.

Outlook

Bond markets remain attractively priced, with yields that compare favourably with the post-Global Financial Crisis period. The resilience of the global economy in the face of higher interest rates should support risk markets, although it does mean that an immediate rally in government bonds seems unlikely. The beauty of these markets though is that unlike the quantitative-easing era (and unlike some of our peers who seem to long for a return to this environment), we can now rely on high levels of ongoing yield to provide total returns.

Elsewhere in the market, there are many over-levered, over-owned capital structures whose viability is being re-examined in the face of high funding costs.

We believe this plays into the hands of a high-conviction, index-agnostic, actively managed strategy focused on the global high-yield market.

| Discrete performance, 12 months to 31 March |

2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|

| Artemis Funds (Lux) – Global High Yield Bond | 12.6% | -5.3% | 0.5% | 34.6% | - | - | - | - | - | - |

| ICE BofA Merrill Lynch Global High Yield Constrained USD Hedged Index | 11.6% | -3.1% | -3.3% | 24.1% | - | - | - | - | - | - |

Source: Lipper Limited/Artemis from 31 December 2023 to 31 March 2024 for class I Acc USD

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Benchmark: ICE BofA Merrill Lynch Global High Yield Constrained USD Hedged Index; the benchmark is a point of reference against which the performance of the fund may be measured. Management of the fund is not restricted by this benchmark. The deviation from the benchmark may be significant and the portfolio of the fund may at times bear little or no resemblance to its benchmark.