Artemis Short-Duration Strategic Bond Fund update

Stephen Snowden, Liam O'Donnell and Jack Holmes, managers of the Artemis Short-Duration Strategic Bond Fund, report on the fund over the quarter to 30 June 2024.

Source for all information: Artemis as at 30 June 2024, unless otherwise stated.

- Despite it being a weak quarter for bond markets, the fund delivered a positive return of 1.2%.

- Tactical shifts in duration allowed the fund’s holdings in government bonds to contribute positively to returns during a quarter in which bond markets fell.

- Amid wider uncertainties, we remain extremely positive on the prospects for shorter- dated investment-grade bonds.

Performance

The fund outperformed over the quarter, returning 1.2% compared to a return of 0.8% from its benchmark, the Markit iBoxx 1-5 year £ Collateralised & Corporates Index. Over the first half of the year, meanwhile, it returned 3.7% versus 3.0% from its benchmark1

That the fund delivered a positive return over the quarter was particularly pleasing given that bond markets fell. That positive return was largely due to the strong stream of income being generated by our portfolio; those income payments more than offset the modest decline in capital values.

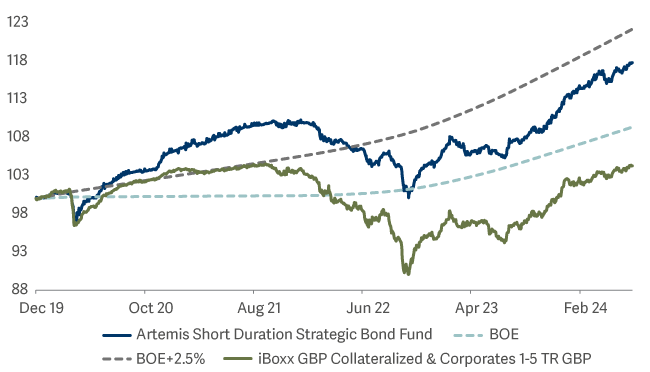

Fund performance relative to benchmarks (old and new)

Source: Bloomberg, class I accumulation shares in GBP from 3 December 2019 to 30 June 2024. The target benchmark is the Markit iBoxx 1-5 year £ Collateralized & Corporates Index; before 18 March 2024 it was the Bank of England base rate +2.5%. All figures show total returns with dividends and/or income reinvested, net of all charges. Performance does not take account of any costs incurred when investors buy or sell the fund. The fund launched on 3 December 2019.

Fund performance relative to money market funds

Returns from both the fund’s strategies – credit and rates – were positive over the quarter. This was a pleasing result in an environment in which yields rose. In our view, that the fund returned almost as much as the average money market fund shows the attractive risk/reward characteristics of investing in short-dated bonds in the current environment.

| January | February | March | April | May | June | Year to date | |

|---|---|---|---|---|---|---|---|

| Credit | 0.48% | 0.10% | 1.11% | -0.34% | 0.74% | 0.77% | 2.89% |

| Rates | 0.52% | -0.05% | 0.28% | -0.55% | 0.43% | 0.16% | 0.81% |

| Gross return | 1.03% | 0.07% | 1.39% | -0.84% | 1.16% | 0.89% | 3.74% |

Activity and positioning

| Bonds | Longs | Shorts | Overall | |

|---|---|---|---|---|

| High-yield | 25% | 25% | 0% | 25% |

| Investment-grade | 57% | 62% | -5% | 57% |

| Government | 12% | 42% | -38% | 16% |

The fund’s duration was kept relatively stable during the quarter

The fund’s duration fluctuated within in a narrow band between 2.5 years and 2.9 years. Tactical trading within this band allowed the fund’s rates module to contribute positively to returns over a quarter in which bond markets fell.

On the credit side…

Although levels of new issuance over the quarter were modest, we added new issues from:

- Carnival

- Synthomer

- Perenti

- Schroders

- Centrica

- Motability

Notable sales over the quarter were of EDF and Skipton Building Society. Both had performed strongly.

We added Telereal’s bonds

This is essentially the BT Openreach business. And while the bonds exhibit a similar risk profile to those of BT, their yield is meaningfully higher due, we believe, to their lower name recognition.

Active management: making switches

In keeping with our active management style, we switched between different bonds from the same issuer to extract additional value. These included:

- Santander UK

- Centrica

- The AA

- Motability

- CPI Property

To focus on the last of these names, we switched from CPI Property’s coupon step-up bonds into bonds without a step up. We had already benefited from the step up in the coupon when S&P downgraded it from BBB- to BB+ with a negative outlook. That downgrade was. controversial and the company continues to make progress; it could potentially regain its investment-grade status in the next 12 to 18 months. In that event, the step-up bonds would become step-down bonds. It makes sense to switch as the coupon step-up will disappear if and when investment-grade status is regained.

Outlook: Inflationary pressures continue to moderate – and rate cuts are coming

This is the central fact that informs our positive view on the bond market. It seems quite clear that most developed-market central banks (except for maybe those in New Zealand and Norway) would like to cut rates to help ensure a soft landing.

There are risks, however. Some economic indicators suggest that the global economy is doing better than expected. Admittedly, after growing at a ~3.5% rate in the second half of 2023, economic growth in the US is now showing signs of slowing to a more ‘normal’ pace. And there are early signs of weakness coming through in the labour market (Jolts data and initial jobless claims both point to a more pronounced slowdown in hiring). But this is not yet showing up in official payroll releases; we will need to see hard evidence before we can definitively say the US economy is at risk of a significant slowdown.

There are, meanwhile, reasons for optimism about the UK and European economies, which look set to reverse their recent pattern of anaemic performance relative to the US. Energy bills are falling and real incomes are rising at a faster pace than at any time since the start of the pandemic, boosting the financial positions of households who are finally putting the worst of the rate-hiking squeeze behind them. Today, there must be some risk that the Bank of England cuts prematurely, obliging it to rein in dovish market expectations later this year should economic growth and inflation come in stronger than it expects.

We continue to favour shorter-dated bonds

We cannot ignore the threats posed by political populism. This is not just a French issue and it presents risks to bond markets in two main ways. One risk is that fiscal deficits widen even further, adding to outsized debt burdens and resulting in an increased supply of government bonds. A second risk is that rising protectionism reawakens inflation.

This is one reason why we don’t see yields towards the long end of the curve (10-years and more) moving substantially lower over the next 12 months. Towards the shorter end of the curve, however, we continue to believe that the actions of central banks (rate cuts) will outweigh forces pulling in the other direction (political populism and rising bond supplies). There is a possibility that central banks will have to cut rates by more than the market is currently pricing – and the potential upside is enough to compensate us for the risks posed by the fractious political environment.

The bulk of this fund’s investments are in short-dated corporate bonds and the summer is seasonally favourable for the corporate bond market. New issuance is typically low and, with yields being healthy and many fixed income funds seeing inflows, demand for shorter-dated bonds remains understandably robust. So, in the absence of a meaningful shock to the world order, we foresee little to disrupt the typical seasonal experience of a healthy backdrop for shorter-dated corporate bonds.

Source: Lipper Limited/Artemis from 31 March 2024 to 30 June 2024 for class I accumulation GBP.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.