Bonds: How much duration is too much?

In the QE era, adding duration risk to your bond portfolio – and holding onto it – was an effective investment strategy. But as Liam O’Donnell explains, economic and market conditions have changed – and there are better ways to profit from the opportunities today’s bond market offers.

If you believe – as we do – that interest rates are heading lower, then your recent conversations about bonds have probably touched on the question of duration. How much interest-rate risk should you be taking in your bond portfolio? With rates set to move lower, adding some duration might seem like a good idea. But can you go too far? Can you have too much of a good thing?

I believe you can.

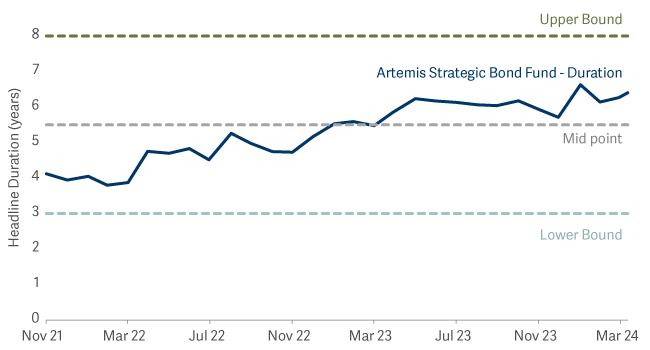

To be clear, this is a good time to take duration risk. Over the last 12 months, we have taken the duration of the Artemis Strategic Bond Fund up to a 6-to-6.5-year range, which is above its long-term average. But at the same time, we haven’t pushed its duration to the maximum that our mandate – or our risk team – will allow.

We have increased the duration of the duration of the Artemis Strategic Bond Fund up to a 6-to-6.5-year range

These are not the conditions in which to take inflexible, extreme positions nor to go ‘all in’ on duration. Why not?

1: Investors can generate returns through active, tactical duration positioning

There’s been a huge amount of volatility in the government bond market over the last six months. We don’t think that is an aberration. Compared to the disinflationary period between the financial crisis and the pandemic, when policymakers worried about deflation and bond markets were sedated by increasingly large doses of QE, the new era for bond markets seems likely to be characterised by:

- Greater uncertainty about inflation.

- Desynchronization (in both economic and monetary policy terms) between different regions of the global economy.

- Political populism, fuelling worries about deficits.

- Quantitative tightening and the retreat of central banks from government bond markets.

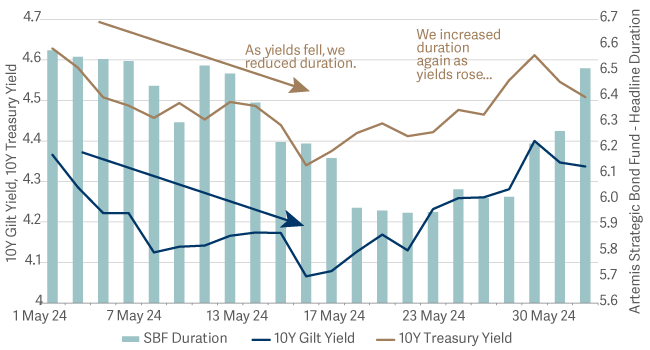

The net result seems likely to be higher volatility. That, in turn, suggests that this is the time to think tactically and to act opportunistically. Bond managers can add real value by adding and subtracting duration as sentiment shifts and valuations move. This has been the approach we’ve taken in the Artemis Strategic Bond Fund.

Dynamically managing duration amid volatility

Whenever yields have rallied (as we saw in the final week of 2023) we have tended to take profits and sold duration. And whenever rates markets have taken fright from signs of ‘stickiness’ in inflation prints, we’ve added duration back again.

2: The long end of the curve may come under pressure

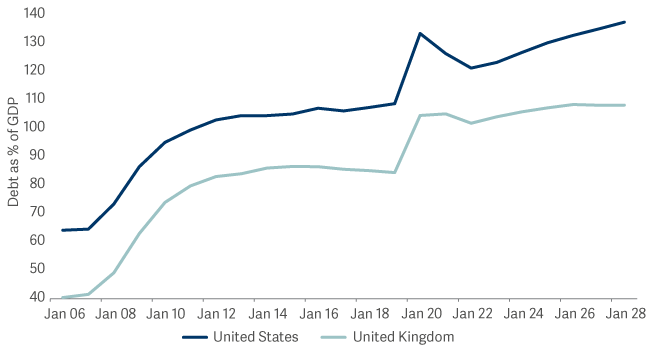

Our strategic view is clear: yields are going lower from here. But at the same time, we're not going back to pre-pandemic conditions, when price-insensitive buying by central banks drove yields down across the curve and held them there. In the QE era, taking on lots of duration risk – and sticking with it – was a pretty effective strategy. But conditions have changed:

- Debt-to-GDP levels worldwide have rocketed, particularly in the US, where the cost of servicing the federal debt is set to exceed military spending.

- Huge volumes of issuance will be needed to fund those deficits. There are already signs that the market is struggling to digest the volume of new issuance; some recent US Treasury auctions met with tepid demand1.

- The coming wave of supply would suggest that a degree of caution towards the long end of the curve (which is where you need to hunt if you want to make an aggressive call on duration) might be wise.

Debt as % of GDP has surged

So, this isn’t the time to be dogmatic and it isn’t the time to take extreme position and simply stick with it. A different approach is needed…

3: There are other ways to generate returns

Because yields today are much more attractive, you don’t need to take outsized risks on duration to derive handsome total returns from your fixed-income allocation. Today, two-year US Treasury yields are just under 5%. At more 4.4%, yields on two-year Gilts look healthy too2. That is a great position to be in when inflation is falling and when central banks are preparing to cut rates.

As Artemis’ rates specialist, it’s part of my job to ensure we get our calls on duration right. And, in broad terms, I am positive about duration. But at the same time, I don’t want to take an outsized view that would swamp every other potential source of return in our portfolio. We don’t think investors want strategic bond funds to be one-trick ponies. There are ways to enhance returns from your bond allocation other than simply adding duration risk, such as:

- Using active asset allocation to add or subtract credit risk and cyclicality by buying (or selling) investment-grade or high-yield corporate bonds.

- Using detailed credit analysis to identify the most attractive assets within each pocket of the bond market. This can dramatically enhance the returns you’ll see from making the right calls on duration.

In a world where attention spans grow increasingly short, answering a question with the words "it's complicated" is a sure-fire way to be ignored. But if you ask me how much duration is too much, that’s the only honest answer I can give you. Complexity is unavoidable when one considers the structural shifts taking in a post-QE regime – and we think it should be embraced. A flexible approach is the most suitable one for the path that lies ahead.

2Source: Artemis/LSEG as at 31 May 2024