Artemis Short-Duration Strategic Bond Fund update

Stephen Snowden, Liam O'Donnell and Jack Holmes, managers of the Artemis Short-Duration Strategic Bond Fund, report on the fund over the quarter to 31 March 2024.

Source for all information: Artemis as at 31 March 2024, unless otherwise stated.

- With agreement from its shareholders, the fund’s name, benchmark and investment objective changed on 18 March 2024

- Over the course of a slightly rocky quarter for the bond market, the fund delivered a positive return of 2.5%

- The Bank of England seems likely to cut interest rates in 2024, which should offer powerful support to bond markets

We changed the fund’s benchmark, investment objective and name

On 18 March, Artemis confirmed that a proposal to change the name of the Artemis Target Return Bond Fund to the Artemis Short-Duration Strategic Bond Fund had been ratified at an EGM (extraordinary general meeting).

Artemis believes the fund’s new name more clearly represents the managers’ strategy: to invest in short-duration bonds across fixed-income sectors with the goal of delivering attractive risk-adjusted returns. We believe this fund offers a compelling alternative to short-dated investment-grade corporate bond funds, the current go-to solution for many risk-averse investors.

Along with the fund’s name, its investment objective and benchmark also changed. The fund’s comparator benchmark is now the Markit iBoxx 1-5 year £ Collateralised & Corporates Index.

The fund’s new objective, meanwhile, is “to generate a return that exceeds the Markit iBoxx 1-5 year £ Collateralised & Corporates Index, after fees, over rolling three-year periods, through a combination of income and capital growth, by investing in a portfolio of global debt and debt-related securities whilst maintaining an aggregate portfolio duration of below four years (duration is a measure of the sensitivity of the prices of bonds to changes in interest rates).”

The fund has always been run with a short ‘duration’ (a measure of how sensitive a bond or bond fund is to changes in interest rates). Shorter-duration bonds are, in theory, less affected by uncertainty about future interest rates, which should make them less volatile.

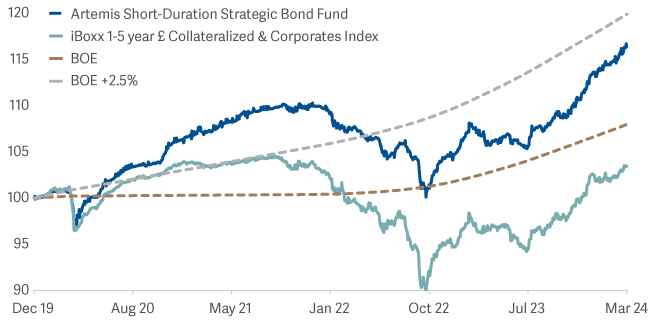

Performance since launch

Source: Bloomberg, class I accumulation shares in GBP from 3 December 2019 to 31 March 2024. The target benchmark is the Markit iBoxx 1-5 year £ Collateralized & Corporates Index; before 18 March 2024 it was the Bank of England base rate +2.5%. All figures show total returns with dividends and/or income reinvested, net of all charges. Performance does not take account of any costs incurred when investors buy or sell the fund. The fund launched on 3 December 2019.

Solid performance, with both credit and rates strategies contributing to returns

Entering the year with a short-duration bias worked in our favour

Government bond yields bounced higher in January after falling sharply in December. We then began adding duration amid the weakness in government bond markets seen through January and February. A short position in Swedish government bonds versus European bonds performed well. European government bonds outperformed significantly heading into the end of the quarter.

Micro-flattening trades in shorter-dated US Treasuries (which positioned the fund to reflect our belief that rate cuts by the Federal Reserve could potentially arrive later than expected) also performed well.

As credit spreads tightened over the quarter, the fund’s holdings in investment-grade and high-yield bonds delivered positive returns

Despite the move higher in underlying government bond yields, investment-grade and high-yield corporate bonds both delivered positive total returns on the quarter. Within that, however, the high-yield market outperformed the investment-grade market.

The best performers within the fund’s credit component were bonds issued by CPI Property and Medical Properties Trust. Both companies operate in the real-estate sector and their bonds rallied as the market became more comfortable with their respective underlying asset quality.

In terms of underperformers, bonds issued by AMS (a global producer of high-tech sensors and lighting) and Close Brothers (the UK finance group) underperformed. Both positions have contributed positively to the fund’s total return since purchase but have now been sold.

It was a busy quarter for the fund in the rates market (government bonds)

We were active in managing the fund’s duration through the quarter and also made a number of cross-market and yield-curve trades.

- Having been running over 2 years of duration heading into the pivotal meeting of the Fed’s rate-setting committee December 2023 - and having benefitted from sizeable rally that its dovish shift provoked - we reduced interest-rate risk heading into the end of the year. The fund entered 2024 with 1.7 years of duration.

- We then proceeded to increase duration risk as yields began to move higher through January and February, taking it up to a peak of 2.9 years in late March.

- A relatively dovish sequence of central bank comments then followed, driving a rally in yields into the end of the quarter. We then reduced duration slightly, taking it back to 2.5 years going into the quarter end.

Overall, we modestly reduced the fund’s holdings in credit (Investment-grade and high-yield corporate bonds)

A modest increase to the fund’s allocation to high-yield was more than offset by a reduction in its holdings in investment-grade credit. Most of the fund’s high-yield holdings are in higher-quality ‘BB’-rated bonds and are focused on short-dated bonds. These tend to experience lower levels of volatility and risk than lower-rated and longer-dated bonds.

After a sluggish start, the new issue market became more active towards the end of the quarter. We added new positions in:

- Coventry Building Society

- KBC

- Athene

- Virgin Money

- Medline

We were also active throughout the quarter in the secondary market, adding positions in:

- Unique (borrowing secured against a pub estate at low loan-to-value ratios)

- IDS (Royal Mail’s parent company)

- Meadowhall (a large shopping centre in Sheffield)

On the high-yield side, we added short-dated positions in:

- Hilton (the global hotel group)

- Iron Mountain (the data storage company)

- Albertsons (the US grocery chain)

- Cloud Software Group (Citrix; software for remote working)

Outlook: the US Federal Reserve, the Bank of England and the European Central Bank have all stated that they intend to cut rates

Central banks’ stated goal is to prevent financial conditions from becoming too tight as inflation trends lower. They have also indicated that bringing inflation down to target (2%) isn’t a prerequisite for monetary easing to begin. This doesn’t mean that central banks will cut rates aggressively or that they are going to keep cutting if inflation remains stubbornly high. But it does suggest that the consensus amongst the global central banking community is that current policy rates are very far from ‘neutral’ even if their assessment of what represents a neutral rate could be revised higher.

Services inflation is sticky, but we shouldn’t mistake stickiness for reacceleration

That inflation got so far above target was due to a price-wage spiral. Prices accelerated rapidly as supply chains collapsed due to Covid, with demand remaining intact thanks to fiscal support. Ballooning prices spurred wage demands and wage agreements given tightness in the supply of labour.

More recently, however, goods prices have been falling and headline inflation will continue to trend lower into the middle of the year. Those arguing for bigger wage rises are now on a significantly weaker footing and wage growth will follow headline prices lower.

That’s not to say that wage growth will collapse, but the trend is clear: it is for lower wage gains in 2024.

So, while services inflation remains sticky, and wage growth remains well above pre-Covid average, the direction of travel is consistent with continued softening, albeit more slowly than central banks might prefer.

Central banks’ recent communications endorse our belief that they are certain policy is too tight. They have made it clear that the next move will be lower

It is true that economic outcomes have been slightly better than expected in the UK.

Survey indicators, meanwhile, have recently pointed higher. But the reality is the UK economy stumbled into the end of 2023. That leaves the MPC concerned that policy is far too tight at current levels. This is a view we tend to share.

While consumers still enjoy considerable real income gains from falling inflation, government spending will come under pressure. Governments are having to fund extraordinary deficits and historically high debt levels at high interest rates. So fiscal policy is a headwind.

To an extent, domestic demand can be supported through rising real incomes and stronger household consumption. But it is going to be difficult for the US consumer to maintain elevated consumption as the real income boost fades in 2024. There is the potential for the US to recouple with the UK and the eurozone, converging towards a more modest pace of growth this year. Central banks are alert to this, and the recent communication endorses our belief that they are quite sure policy is too tight.

Source: Lipper Limited/Artemis from 31 December 2023 to 31 March 2024 for class I accumulation GBP.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.