Artemis Short-Duration Strategic Bond Fund update

Stephen Snowden, Liam O'Donnell and Jack Holmes, managers of the Artemis Short-Duration Strategic Bond Fund, report on the fund over the quarter to 31 December 2024.

Source for all information: Artemis as at 31 December 2024, unless otherwise stated.

Market backdrop

Government bond markets sold off aggressively in the final quarter of 2024, despite the fact that central banks continued to lower policy rates. Having kicked off its rate-cutting cycle in September with a jumbo 50-basis-point cut, the US Federal Reserve went on to deliver two more 25-basis-point cuts over the quarter, taking the effective federal funds rate down to 4.375%. The Bank of England, meanwhile, lowered policy rates by 25 basis points. For its part, the European Central Bank took rates 50 basis points lower. Despite these cuts, government bond yields moved higher as markets recalibrated their expectations for rates and inflation in 2025 and beyond.

Yet even as yields on government bonds moved higher, credit spreads tightened as investors were drawn in by the attractive all-in yields available on both investment-grade and high-yield bonds. The combination of strong demand and dwindling supply created a powerful technical set up for credit markets heading into the end of the year.

Performance

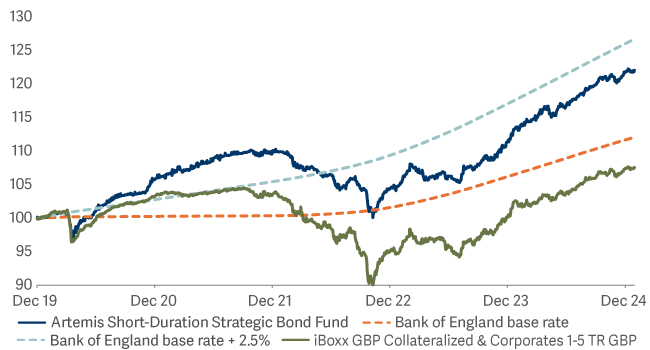

Against this backdrop, the strong performance of the fund’s credit module offset negative returns from its rates (government bonds) module. The net result was that the fund delivered another solid quarter, returning 0.9% versus 0.8% from its benchmark, the Markit iBoxx 1-5 year £ Collateralised & Corporates Index. Over 2024 as a whole, meanwhile, the fund returned 7.5%, significantly outpacing the benchmark, which showed a return of 4.9%1.

The clear highlight of the fourth quarter was our holding in Annington, which owns housing units offered to married members of the UK armed forces. The Ministry of Defence bought the houses back for £6 billion (the loss to taxpayers over the last 30 years significant). Annington announced it would use the sale proceeds to start buying back its bonds at generous levels. Fortunately, we had been adding to our holding before the announcement, making it one of the fund’s largest positions.

Fund performance relative to benchmarks (old and new)

Source: Bloomberg, class I accumulation shares in GBP from 3 December 2019 to 31 December 2024. The target benchmark is the Markit iBoxx 1-5 year £ Collateralized & Corporates Index; before 18 March 2024 it was the Bank of England base rate +2.5%. All figures show total returns with dividends and/or income reinvested, net of all charges. Performance does not take account of any costs incurred when investors buy or sell the fund. The fund launched on 3 December 2019.

Fund performance relative to money market funds

Source: Lipper Limited, class I accumulation shares in GBP as at 31 December 2024. All figures show total returns with dividends and/or income reinvested, net of all charges. Performance does not take account of any costs incurred when investors buy or sell the fund. The Artemis Short-Duration Strategic Bond Fund was launched on 3 December 2019. Performance is presented versus the IA Standard Money Market sector as a proxy for investing in a cash fund. The purpose is to demonstrate the performance of the strategy versus making an allocation to cash. Please note that these asset classes have different risk profiles and the potential for capital losses in the Artemis Short-Duration Strategic Bond Fund is greater.

Activity and positioning

The fund’s headline duration fluctuated within a narrow band of between 2.5 and 2.7 years over the quarter. In the primary market, we added four new issues to the fund’s credit module: Bayerische Landesbank (bank; investment-grade); Belron (auto repair; high-yield); Fressnapf (pet food; high-yield) and Techem (energy monitoring and services; high-yield).

In the secondary market, we topped up existing holdings in short-dated investment-grade bonds from Centrica, Schroders and Caterpillar. We trimmed holdings in Lloyds Bank and Danske Bank, both of which had performed well. We switched a holding in National Grid (which had been a strong performer) into vehicle leaser Motability (which had not). We also made a relative value switch between two different bonds issued by Avis.

On the high yield side, we added to several positions, with the focus of our additions being the higher-quality end of the market. We see the set-up for this part of the market as being favourable due to a combination of attractive yields, low duration risk, relatively low default risk and the potential for bonds to be redeemed early, giving us a useful capital uplift. Additions here included Iron Mountain (the data storage company); Coty (the global cosmetics business); IGT (the provider of gaming technology) and Live Nation (the concert ticketing company).

In the fund’s rates (government bond) module, our activity focused on re-introducing a long position in US real yields versus European real yields. In November, we closed a cross-market position through which the fund was short in Japanese government bonds versus US Treasuries. Towards the end of the quarter, meanwhile, we increased the fund’s exposure to curve-steepening strategies and inflation positions.

Outlook: The opportunity is still at the short end of the curve

The all-in yields available in shorter-dated end of the fixed income market remain very attractive. Since the upward reset in yields two years ago, it has been our view that investors don’t need to be too clever to earn a useful return in these market conditions: they can simply focus on short-dated bonds and take an attractive level of income. This remains our view.

The final quarter of 2024 saw a significant shift in global politics and in fiscal policy worldwide. In the UK, the new government’s first Budget saw the chancellor re-writing her fiscal rules to inject significant fiscal stimulus into the economy. With international investors’ perceptions of the UK’s fiscal prudence having already been dented by the country’s brief experiment with Trussonomics, Chancellor Reeves’ badly received Budget could have a long-lasting impact on sentiment towards the gilt market. More tangibly, because many of the measures announced in the Budget were unfunded, it will result in a significant increase in new issuance the market will need to digest.

The US election saw Donald Trump and his MAGA movement taking a stranglehold on American economic and geopolitical policy. A combination of tariffs and tax cuts seems likely to keep inflation in the US higher for longer. And while the Federal Reserve lowered rates again in December, the reality is that it will need to see a significant deterioration in either the economic cycle or clear signs that the labour market is slowing to cut rates again. With the election having fostered the market’s animal spirits, there is little sign of any cooling at this point.

The theme of greater fiscal slippage is not confined to the US or the UK; Europe is also struggling to rein in government spending. A new government in Germany seems likely to increase government spending. In France, the fragile coalition led by Michel Barnier collapsed because the legislature refused to sanction spending cuts designed to reduce the country’s budget deficit. As funding requirements across the Eurozone continue to grow, the pressure on government bond yields to rise will surely increase, potentially increasing the cost of servicing debt.

Any further easing of policy needs to be measured against risks of a reacceleration in inflation. While economic performance varied considerably between the US, UK and Europe in 2024, one consistent theme was that core inflation remained too high, with services inflation proving to be stickier than forecast. Domestic demand is being supported by government spending and by the strength of household balance sheets; many workers are still enjoying healthy wage gains in real terms.

The opportunity is still at the short end of the curve. While we are aware of the risks to bonds, valuations matter too. A key determinant is the current level of policy rates and their expected path. At the start of October, market pricing suggested that ‘neutral’ policy rates in the US would be below 3%. This has now increased significantly, to around 4%. Forward rates in the UK have also tightened significantly recent months. Markets are projecting that policy rate will drop – albeit only marginally - over the next few years, settling at around 4%. For us, the opportunity in these conditions exists in targeting shorter-dated bonds which are less vulnerable to the threat of rising supply and more closely tied to policy rate expectations. We are positive on prospects for risk assets (such as credit) in 2025 as the all-in yield argument is compelling. Despite this, we dialled down risk in the portfolio heading into the end of last year. This gives us room to add risk back as the new issuance season begins and activity picks up.

Source: Lipper Limited/Artemis to 31 December 2024 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Benchmarks: Markit iBoxx 1-5 year £ Collateralised & Corporates Index. An indicator of the performance of short-dated sterling denominated corporate investment grade bonds, in which the fund invests. It acts as a ‘target benchmark’ that the fund aims to outperform. Management of the fund is not restricted by this benchmark. While the fund has the flexibility to strategically invest across fixed income sectors, sterling denominated investment grade corporate bonds are likely to be the main asset class in the portfolio, and the manager believes this index is the closest proxy for the long-term asset allocation of the fund.