Artemis High Income Fund update

David Ennett, Ed Legget and Jack Holmes, managers of the Artemis High Income Fund, report on the fund over the quarter to 30 June 2025.

Source for all information: Artemis as at 30 June 2025, unless otherwise stated.

Overview

The second quarter began with the shock of ‘Liberation Day’ and tariff-induced market trauma, but May and June saw a welcome recovery. We believe this was warranted, given the strength of macro data and comments from management teams on recent earnings calls.

Tariff concerns and subsequent ‘deals’ will continue to rumble on, but we feel their ability to torment risk markets has waned, not least because markets now have a response function in the so-called TACO trade (Trump always chickens out).

Performance

Against this backdrop, the fund returned 3.7% during the second quarter – the second-best return in the entire IA Strategic Bond sector and considerably higher than the peer group average of 2.3%.

May was a particularly strong month for the fund, during which it delivered a 1.8% total return, well above the 0.1% made by its peer group average. The fund’s holdings in short-dated high yield and equities, along with its relatively light government bond exposure and avoidance of longer-dated bonds, contributed significantly to performance. It also benefited from strong stock selection.

The fund’s long-term track record remains robust: it is the best performer in the IA Strategic Bond sector over three years and the second best over five, illustrating the benefits of allowing higher income to compound. These returns have been unlocked by higher bond yields over the past three years.

| Three months | Six months | One year | Three years | Five years | |

|---|---|---|---|---|---|

| Artemis High Income Fund | 3.7% | 5.4% | 10.3% | 31.1% | 32.4% |

| IA Strategic Bond | 2.3% | 3.8% | 6.9% | 15.6% | 9.7% |

| Sector quartile | 1 | 1 | 1 | 1 | 1 |

Contributors

Our top-performing holdings during the quarter included bonds issued by game-maker Asmodee, shipping company Seaspan and footwear retailer Foot Locker. Additionally, healthcare logistics provider Owens & Minor saw its bonds rally after it cancelled a proposed acquisition of Rotech, a peer in the medical-supply distribution industry.

On the equity side, our top contributors were Barclays, NatWest, private equity company 3i Group, Tesco and the sports betting and gaming group Entain, whose share price jumped following improved guidance from its joint venture with MGM Resorts, BetMGM.

Detractors

Mobico, the UK and US transport operator formerly known as National Express, was a poor performer during the quarter. It has suffered from difficulties in its US school bus business as well as its German bus networks, but we see the sell-off as being overdone. The company has successfully disposed of its US school transport business and plans to use the proceeds to deleverage. While its German business remains in a restructuring phase, earnings are dominated by Mobico’s strong Spanish operation, which continues to see good growth and earnings.

Our small, distressed position in the US budget furniture retailer At Home, which announced it had entered Chapter 11 bankruptcy, was another detractor.

Equities that disappointed this quarter included oil & gas company TotalEnergies, biopharma company Sanofi and Deutsche Telekom.

Activity

The new issue market roared back into life in May and June, and we bought bonds from the following companies:

- Aggreko, the producer of industrial generators

- Arqiva, the UK communications infrastructure owner, which benefits from long-term inflation-linked contracts with broadcasters and telecom operators

- Clariane, the French care-home provider

- Clarivate, which provides a range of data sets and services for use in academia, life sciences and the intellectual property management sectors; we like the high barriers to entry and mission-critical nature of its offering

- Currenta, which owns the largest chemical production facility in Europe

- Cvent, the US event-management software provider

- DNO, the Norwegian oil & gas company

- Flutter, the online gaming company

- Shift4, the US payment processing company

- TeamSystem, the Italian software development company

- Together, the UK specialist lender

- Urbaser, the Spanish waste management business

- Voyager, which was formed after Apollo Global Management acquired gaming company Everi and IGT’s gaming and digital business, then merged them together

Elsewhere, we topped up our position in W&T Offshore, the oil & gas producer, at the start of May given it had significantly lagged the broader recovery. We also increased our exposure to Nufarm, the Australian crop science specialist, which we believe is getting closer to disposing of its seed business in a potentially deleveraging transaction.

Meanwhile, we switched our shorter-dated (2027) exposure to the video game producer Ubisoft Entertainment into longer-dated (2031) bonds, given the underperformance of the latter, which in our view was unjustified.

In the secondary market, we added some new exposure in US sports apparel maker Under Armour, which we see as benefiting from a strategic turnaround and growing strength in its category. We also added a position in 2028 bonds issued by UK and US transport operator Mobico.

Alongside these additions, we bought some short-dated bonds in Energean, the Mediterranean oil & gas producer. Its bonds have underperformed since a deal to dispose of its non-core assets to private equity firm Carlyle fell through. This deal would have allowed the business to focus on its Israeli fields, which are highly profitable with low lifting costs (post-drilling extraction costs). However, while this was undoubtedly a disappointment, the underperformance of the bonds looks extreme considering the high levels of underlying cash generation.

In terms of sales, we trimmed our position in Cloud Software, which owns the Citrix remote login software. We have held these bonds for the past few years and initially believed investors were underestimating the massive cashflow generation potential of this business under its new owners. It appears the market has come to agree with us and these bonds have performed well. They now offer lower levels of potential excess return than when we bought them.

We made a few sales in June where valuations had become too stretched to ignore, including US domestic services website Angi, desktop game maker Asmodee, North American waste disposal operator GFL Environmental, German tier 1 auto supplier IHO and US agricultural and mining chemical producer LSB Industries.

We also trimmed our holdings in the government bond space given the strong performance seen over the past few months, reducing our holdings of US Treasury Inflation-Protected Securities (TIPS) and UK gilts.

Outlook

One of the questions we are often asked is whether in a world of higher ‘risk free’ rates, we should be owning fewer high-yield bonds and instead focusing our efforts on government bonds. In effect, if we can get a decent income on government bonds, why take the additional risk from going into corporate bonds?

We are firmly of the belief that in periods such as today when interest rates are higher, investors should be leaning into higher-yielding bonds, not away from them.

Why? Well, somewhat counterintuitively, investors actually benefit more from the beauty of compounding the same additional spread on high yield if base rates are higher.

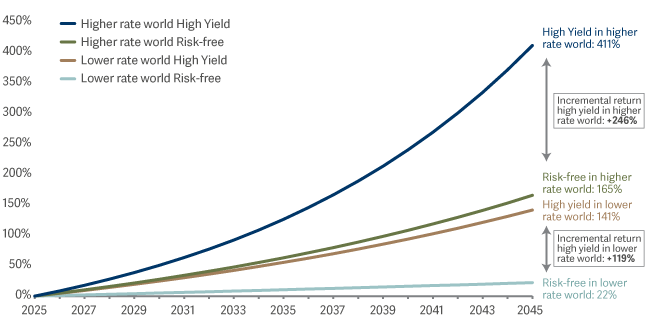

By way of example, let’s look at two different environments: a ‘higher rate’ world (5% risk-free rate, 8.5% high yield) and a ‘lower rate’ world (1% risk-free rate, 4.5% high yield). The additional spread from high yield is exactly the same in both of these scenarios.

However, the additional return from being in high yield in the higher-rate scenario would be 246% over the next 20 years, compared with 119% for the lower-rate environment, as the chart below illustrates.

Counter-intuitively, the additional yield from high yield matters more in a higher interest rate environment

Granted, risk-free rates give a more respectable return on government bonds in a higher rate environment – but investors are losing out on a lot more in this environment by not holding high-yield bonds.

We retain our conviction that investing in high-yielding assets in a diversified fashion with strong security selection – and increasing the income over time with the equity allocation – is a compelling strategy, enabling investors to benefit from the compounding of high levels of income for years to come.