What we thought yesterday was rubbish: How we run Artemis SmartGARP UK Equity

Philip Wolstencroft says he has more faith in his process than his portfolio holdings, so if the SmartGARP tool tells him to sell one of his biggest positions, then that’s what he does.

When describing their investment process, many fund managers will talk about the importance of having faith in their convictions, even when the market appears to be telling them they’re wrong.

But for the managers in the SmartGARP team, the process is entirely dependent on being able to come into the office and say “what we thought yesterday was complete and utter rubbish”.

SmartGARP is a proprietary stock-screening-and-monitoring tool that crunches about 2 million data points a day to help identify stocks whose earnings are growing faster than the market but that are available at a reasonable valuation.

Although we carry out our own due diligence on all the stocks highlighted by the program before they are allowed to enter the portfolio, it is vital we listen to what it says. And if that means selling a stock that had been our biggest position only one day earlier, then that’s what we have to do.

Share prices follow earnings

Think about it. Share prices ultimately follow earnings. So, if earnings come in a lot lower than expected, that should automatically make you revisit your investment thesis.

This also helps to explain why, of the eight factors that SmartGARP uses to assess stocks, estimate revisions – such as profit upgrades or downgrades – are the most important and given double weighting.

When an analyst is excited about a stock, they will typically predict it will grow up to 10% faster than the market. Yet the actual outcome tends to be much wider, with some growing 20 to 30% faster.

It is a similar story when earnings move in the opposite direction. As a result, when portfolio holdings announce profit downgrades, we will often cut our position. It may be tempting to remain invested in these stocks, researching the hell out of them in an attempt to find something that confirms our original thesis; but SmartGARP shows it is better to own stocks that are upgrading rather than downgrading profits, as they tend to grow faster than average.

Does high turnover mean low conviction?

One of the outcomes of our process is that we have more stocks in our portfolio and a higher turnover than most of our peers. Conventional wisdom dictates that a low turnover and a small number of holdings are indicative of a fund manager with a high conviction in their approach – therefore, it must follow that we have a minimal conviction in what we are doing. Yet we would argue the opposite is true.

In order to keep our portfolio tilted towards the factors that drive outperformance, it is vital we can accept that what we thought yesterday may be wrong today.

And so, whereas many fund managers will highlight a favourite holding and proffer a list of reasons why they want to own it for the long term, we prefer to focus on the factors that drive performance, with our portfolio holdings simply an expression of that.

What does our portfolio look like today?

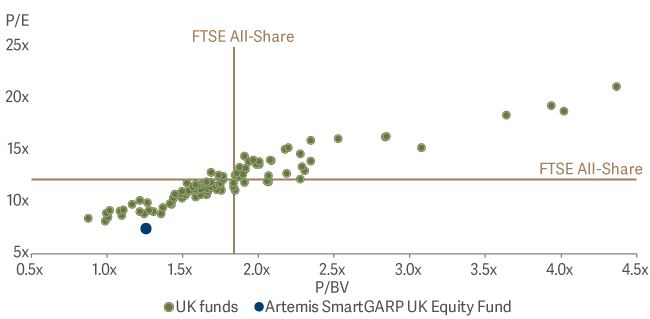

Despite our emphasis on owning companies that are growing faster than the market, we have somehow ended up with the lowest P/E ratio of any fund in the IA UK All Companies sector1. This shouldn’t be happening: by definition, deep-value investors should have cheaper portfolios than us.

But here’s the thing: in my sector, there aren’t any. It appears that value investors experienced so much pain during the post-Global Financial Crisis era that they were either fired or retired.

SmartGARP UK: Significant value bias to peers

Aside from having a higher value exposure than everyone else, our tilt is also close to extreme highs compared with our own historical levels. But perhaps ‘extreme’ is the wrong word – in our view it is perfectly rational to skew our portfolio towards value while these stocks look desperately cheap; instead, it is the investors who have paid well over the odds to hold ‘growth’ stocks that are taking an extreme position.

While growth-at-any-price strategies worked well during the period of ultra-low interest rates, those days are now over and don’t look as if they are coming back anytime soon. It is time to adjust to the new environment.

Or, to put it another way: sometimes you have to admit that what you thought yesterday was complete and utter rubbish.