Artemis Positive Future Fund update

Sacha El Khoury manager of the Artemis Positive Future Fund reports on the fund over the quarter to 31 December 2024 and the outlook.

Source for all information: Artemis as at 31 December 2024, unless otherwise stated.

Market review

The year ended on a positive note for global equity markets thanks, in part, to the clarity of the US election result. Donald Trump’s comprehensive victory prompted investors to anticipate a market-friendly agenda of tax cuts and deregulation. In terms of sectors, financial stocks were clear beneficiaries of the ‘Trump trade’. Banks are expected to benefit from tax cuts, de-regulation and an increase in dealmaking. Mega-cap technology stocks, meanwhile, continued to deliver extremely strong growth in earnings – leading to gains for their shareholders.

Set against that, materials stocks were held back by doubts over the adequacy of China’s efforts to support demand. Elsewhere, pharmaceutical companies came under pressure as President-elect Trump selected noted vaccine sceptic Robert F Kennedy Jr to lead the US Department of Health and Human Services.

Portfolio performance and attribution commentary

The fund returned +2.0% in the fourth quarter (sterling, net of fees), underperforming the MSCI ACWI index which returned+6.0%.

Negative contributors:

Synopsys: The shares have suffered from a volatile period of performance in recent months for a number of reasons including their pending acquisition of Ansys which is expected to close in the first half of 2025 and to be somewhat disruptive. Synopsys' strong competitive position in EDA (electronic design & automation), an effective oligopoly with only one other player of Synopsys' scale, should support robust pricing power and in turn healthy long-term cash flow generation and margin progression as demand for Synopsys’ software continues to grow. Unlike the broader semiconductor market, which can be cyclical in nature, Synopsys’ success is tied to technology innovation cycles, which are accelerating in pace thanks to AI.

nVent Electric: Fourth-quarter earnings were a bit mixed and the outlook was disappointing. However, management have pointed to an inflection in orders growth in 2025, and the company’s liquid cooling solution looks well underpinned thanks to the strong growth created by AI, which requires more power-efficient cooling in data centres.

Hologic (female health diagnostics): While the company reported strong results for its financial year 2024, one-off effects dampened the outlook. Those included a hurricane-driven shortage of intravenous (hydrating) fluids that has meant the postponement of some surgical procedures. It is disappointing, after a long period of post-pandemic normalisation, to have to wait one or two more quarters to finally see the quality of the business shine through. Hologic is a much better-positioned business today than it was going into the pandemic and has a much stronger balance sheet. At the end of the day, Hologic has an impressive installed base in its Diagnostics business, a dominant position in its imaging business, and is addressing a huge unmet need for women globally, which creates secular growth tailwinds. We are happy to continue to hold the stock through short-term turbulence and take solace in the attractive valuation that compensates us in the meantime. The stock’s P/E multiple is at the bottom end of its 10-year range.

Positive contributors:

Pearson: A third-quarter trading update showed growth across all divisions (North America higher education has not grown in several years and as such has been a lightning rod for negative sentiment around the stock, so this was particularly encouraging) and the announcement of a large, multi-year partnership with ServiceNow demonstrating the scale of the opportunity in workforce learning. Innovation – particularly with respect to the integration of AI into products and services – continues at pace, and as Pearson’s shift to digital continues (80% of revenues are now digital), incremental returns on capital and cash conversion should improve. The revenue opportunity is also significant, given the size of lifelong learning and education as an addressable market.

Oxford Instruments: We see an attractive collection of technologies that play important roles in a wide range of structurally growing end markets across performance, efficiency and measurement. Barriers to entry are high given the specialised nature of these capabilities, the company’s balance sheet is strong (net cash), and there are opportunities to improve costs across the business. As such we believe the risk reward to be attractive especially when compared to US peers that trade on much richer valuations for similar growth and earnings profiles. Plus, with a market capitalisation of just £1.2bn, Oxford Instruments is a credible takeover candidate.

Core & Main (water pipes and distribution products): Third-quarter results beat estimates, with revenue and EBITDA ahead of consensus. Core & Main is well positioned to benefit from a number of themes, we believe, given increasing water stress in many parts of the US in conjunction with growing water demand from US industry. The company has a strong track record of adding value through acquisitions, and full-year guidance for earnings was raised, not only as a result of the five acquisitions Core & Main made in 2024.

Portfolio activity

Buys:

- Canadian diversified engineering services company WSP. WSP is a beneficiary of global infrastructure and environmental projects/spending and has a high-quality management team with a very strong track record in M&A and capital allocation.

- Block, the US fintech/digital payments provider, which has a very good management team with an excellent track record of growth. On a 26x forward P/E we think the shares offer attractive risk-reward.

- Packaging company Smurfit Westrock, which we believe to be well placed to benefit from a cyclical recovery in demand for packaging in North America in 2025 and beyond. The shares trade at an attractive discount to peers.

- Specialist property insurer Palomar, which is focused on US catastrophe risk. The company’s approach to underwriting creates a material pricing advantage over peers, and its low share in a fragmented market results in a significant growth opportunity.

Sells:

- We sold pharmaceutical clinical research provider ICON, because of a clear breakdown in our investment thesis.

- We switched our position in health insurer Centene into Elevance. Elevance is trading on an attractive valuation following some recent weakness, but we believe it is a high-quality business, that is closing the gap to industry leader UnitedHealth.

- We sold NXP Semiconductor, given incrementally negative newsflow around the autos industry to which NXP is materially exposed. We think our existing holding in ON Semiconductor has a better margin of safety.

- Mexican bank Grupo Financiero Banorte, given a lack of visibility on the geopolitical outlook.

- Avery Dennison, a legacy position where we do not believe the risk reward to be particularly attractive.

- Lastly, we sold HVAC manufacturer Carrier Global. There remains plenty to like about the company (particularly its data centre exposure) but having re-rated strongly in the year, we are now concerned about its valuation, particularly in regards to its residential business, where there are no clear signs that the cycle is turning, especially in light of the dramatic rise in bond yields and in turn borrowing costs we have seen of late.

Impact

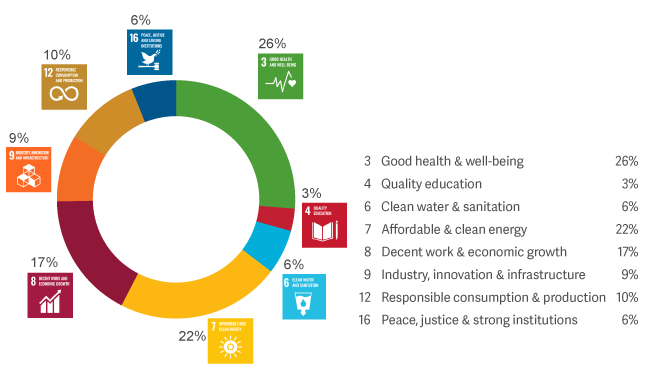

Product Impact by SDG

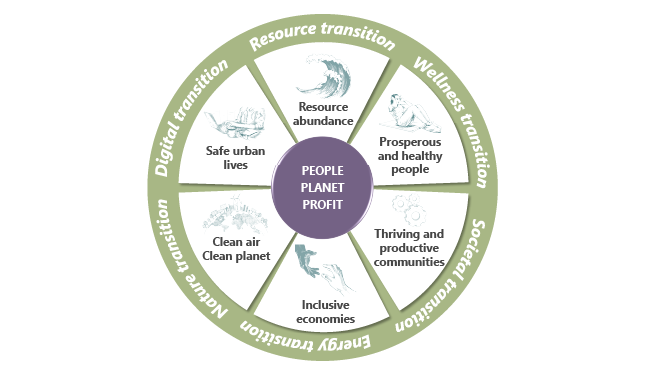

Portfolio breakdown by theme

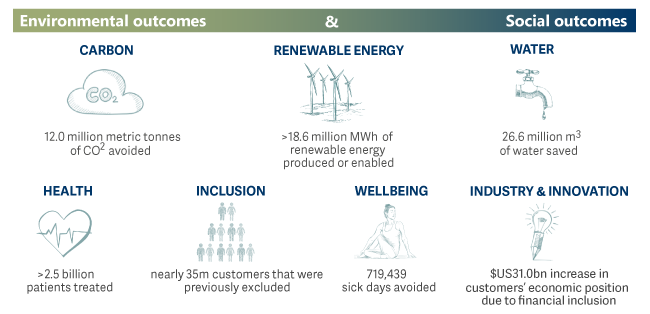

Portfolio impact metrics

Impact 2025 Outlook

2024 was a pivotal election year, with at least 64 countries heading to the polls. We monitored these outcomes closely to provide us with insights around sustainability trends and regulatory shifts across the energy transition to the labour market. In 2025, we will see long-term sustainability themes persisting.

1. Climate adaptation - While we may see reduced support for climate change mitigation efforts in the US following Trump’s election, we continue to see momentum for climate solutions as the impacts of physical climate risks this year have been undeniable (take Hurricane Helene, Milton, Beryl and LA wildfires).

2. Biodiversity - With 2025 being the first year of TNFD (Taskforce on Nature-related Financial Disclosures) early adopters, we saw positive momentum with over 500 organisations signing up to the voluntary disclosure at COP 16 this year. We look forward to greater disclosure on biodiversity risks and opportunities. However, challenges remain about the quality and availability of biodiversity data.

3. Water - We believe that the water crisis has been overlooked issue by both companies and investors. However, we expect greater attention to be paid to the topic because of the amount of water required by data centres to power AI, as well as physical risks exacerbating water stress in critical industries like semiconductor production and greater regulations on PFAS emerging globally.

4. Human rights & supply chain - We continue to see social issues rise up the corporate agenda. No doubt, this is partly due to regulations like the Corporate Sustainability Due Diligence Directive falling into national law in 2026/2027 imposing mandatory human rights due diligence processes.

5. Responsible AI - The debate between supporting AI innovation and safeguarding risks will continue into 2025. Our view is that they are intrinsically linked. Corporations proactively future proofing their models will drive greater consumer trust, adoption and ultimately commercialisation.

Finally, we see increased intersection of financial materiality and ESG. Sustainability cannot be tackled in isolation. We believe the intersection of financial materiality and ESG topics is where the opportunities lie. As such, we have been very focused and targeted in our approach to engagement, addressing a maximum of one or two material issues per company. We have received frequent feedback that, despite the political backdrop, environmental and social issues will remain a strategic priority. Companies keep telling us that systemic risks associated with long-term environmental and social challenges are not going to disappear – and we agree.

Outlook

Portfolio turnover is normalising from elevated levels. Our longer-term expectation for turnover is in the region of 20-30% per annum.

After an eventful 2024, what can we say as we enter 2025? Sentiment has rarely been this bullish, particularly around US equities, and the consensus is that US exceptionalism will continue thanks to a market-friendly regime of tax cuts and deregulation from Trump’s second term in office. However, equity markets are expensive, and we have been reminded in the last few days of the unpredictability of the incoming administration. That being said, we must be mindful of the risks of disappointment in 2025.

In 2024, less than 30% of companies in MSCI ACWI outperformed the index, and just eight companies drove half of the index’s return. With the volatility of the geopolitical backdrop, and a lack of clarity as to the future path of interest rates and inflation, 2025 can hopefully serve to usher in a more favourable environment for stock pickers like us to generate attractive returns.

There will be noise aplenty in the medium term around the sorts of areas we are exposed to being de-prioritised. However, we believe that this will likely be overstated, and that these themes will remain areas of structural growth despite some near-term policy fluctuations. As such, we remain optimistic as to the portfolio’s prospects of delivering an attractive combination of financial and non-financial outcomes to our investors.

Source: Lipper Limited/Artemis to 31 December 2024 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmarks: MSCI AC World NR. IA Global NR; A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. These act as ‘comparator benchmarks’ against which the fund’s performance can be compared. Management of the fund is not restricted by these benchmarks.