Artemis UK Select Fund update

Ed Legget and Ambrose Faulks, managers of the Artemis UK Select Fund, report on the fund over the quarter to 30 June 2023 and their views on the outlook.

Main changes to the fund

Activity levels over the quarter were low. The fund received bids for its holdings in Numis, the investment bank, and Lookers, the motor retailer. We sold the entirety of the former and have reduced the second significantly. Perhaps it is a sign of the times, but Lookers being bid for on 8x earnings (with a net cash balance sheet) felt frustrating, albeit the stock has delivered well since purchase.

We sold out of London Metric Property; prevailing swap rates now require too much in rental growth.

We reduced Hiscox, which has performed well, to top up some other financial positions, such as HSBC, NatWest, Standard Chartered and Prudential.

Our holding in 888 picked up a new shareholder – a consortium of former executives of UK-listed gaming companies. While the UK Gambling Commission has clearly taken a negative view on them, we think their presence adds significant credibility to the investment case. We are optimistic that 888’s chairman will find an experienced chief executive from the industry to lead the business, which would act as a near-term catalyst for the shares. We added to the holding.

Explaining the fund’s performance

The fund delivered a positive return of 3.8% against a 0.5% fall in the benchmark FTSE All-Share index – a relative return of 4.3%.

The contribution was driven by some stock-specific ideas, led by long-term holdings 3i and Melrose. 3i reported strong returns from Action, its low-cost discount retailer. The gains for Melrose were driven by improved disclosure (at an impressive and well-attended capital markets day) on the margins it generates in ‘aftermarket services’ for aerospace engines. Lookers performed well following the aforementioned takeover bid.

In the consumer discretionary area, we have a number of holdings in judiciously selected businesses operating in sectors where supply has contracted significantly, allowing for market-share gains. Mitchells & Butlers, for example, posted strong results as improved consumer confidence drove performance.

In the banking sector, our underweight in HSBC hurt performance, as did our holding in NatWest. As mentioned above, we have continued to add to both, expecting significant capital returns over time.

The wider context

Inflation continues to drive the debate, and with that, near and medium-term interest-rate expectations. We remain of the view that inflation is rolling over; UK PPI (factory input costs) is now running at just 0.5% year-on-year. Wage growth, meanwhile, is a double-edged sword. On the one hand, it has helped to keep consumer spending on track. On the other hand, there is the risk that inflation expectations become more systemically embedded. It seems most likely that a period of real wage growth ensues soon. We would note that the move higher in sterling versus the US dollar should help drive down inflation.

Looking ahead

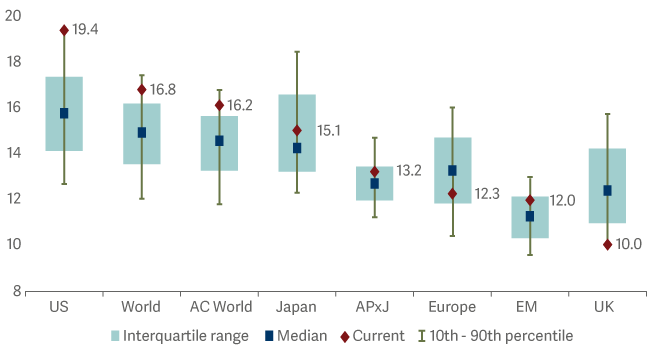

The UK remains distinctly cheap compared to other markets and relative to its own history. Furthermore, the Artemis UK Select portfolio is trading on 7.8x forward earnings versus 10.3x for the FTSE All-Share. This is despite the fund’s strong performance over the year to date.

In our view, the UK has a ‘cost of equity’ problem rather than an earnings problem. In financials, where the fund has a large overweight, we remain of the view that the significant scope for capital returns remains under-appreciated by investors, not least because the duration of those buybacks should deliver significant de-equitization over time.

We remain optimistic about the earnings outlook for our holdings and note that corporates have the appetite to buy back their own shares or, as mentioned above, to buy each other. We continue to stick to our process, focusing on strong cash-generating businesses with good capital allocation and widening economic moats.

Source: Lipper Limited/Artemis from 31 March to 30 June for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmarks: FTSE All-Share Index TR; A widely-used indicator of the performance of the UK stockmarket, in which the fund invests. IA UK All Companies NR: A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. These act as ’comparator benchmarks’ against which the fund’s performance can be compared. Management of the fund is not restricted by these benchmarks.