Artemis SmartGARP Global Emerging Markets Equity Fund update

Peter Saacke and Raheel Altaf, managers of the Artemis SmartGARP Global Emerging Markets Equity Fund, report on the fund over the quarter to 31 December 2022.

Summary

- Q1 relative return +1.4%. Fund +2.5 % vs index +1.1% (in sterling terms)

- Performance in top quartile vs. IA sector for one, three and five years and since inception

- Value bias in the fund remains substantial, 48% discount to the market

- Fundamental value per share of our holdings has outgrown the market by 10% per annum since the fund's launch in April 2015

- This highly favourable combination of growth and valuations should provide support ahead

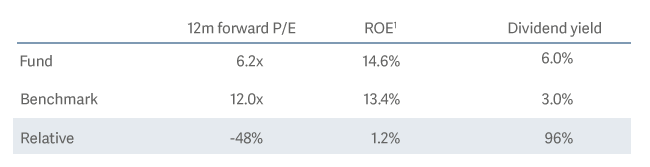

Artemis SmartGARP Global Emerging Markets Equity Fund - Key financial metrics

Performance – Outperformance in a volatile quarter

Optimism around China’s reopening, coupled with more accommodative monetary policy, has restored some investor faith in emerging markets this year. Yet, concerns around global financial conditions following banking worries in the US and Europe and downward pressures to global growth have created volatility more recently. Against this backdrop, the fund outperformed the market in the quarter.

Stock picking opportunities in China

Our preference for deep value names in China contributed positively to performance in the last quarter and remains a significant exposure in the fund. Top contributors were in telecommunications (China Mobile), energy (Sinopec and CNOOC) and household appliances (Gree Electric).

Brazil exposure contributed positively

Elsewhere, positive contributions came from our holdings in Brazil. Banco do Brasil performed strongly despite the volatile environment for banks elsewhere in the world. Tailwinds are coming through in the agribusiness sector, with higher loan growth and lower non-performing loans. Banco do Brasil has a strong market position in a higher yielding credit environment. While having a higher return-on-equity than its private counterparts, it still trades on a forward P/E of 3x. We expect the share price to continue to keep pace with the improving outlook.

Lighter weighting to Tech and internet detracts from relative performance

Our caution around richly valued parts of the market has meant that we remain lightly weighted in technology and internet names compared to the index. In the last quarter this proved a headwind for relative performance, in particular within semiconductors and interactive media and services.

Activity – Q4 results trigger some rotation on company-specific news flow

Additions – improving fundamental trends

Asia recovery – PingAn (insurance), Novatek (semiconductors), Hankook Tire (auto parts)

India – Amara Raja (batteries), Redington (software)

Good Q4 results – Bancolombia, Banco do Brasil and Tisco Financial (banks), Ennoconn (tech hardware), Kia Motors (autos)

We have commented for years about our gradual transition towards value parts of the market as a result of their attractive characteristics. Despite the outperformance of value stocks over their growth counterparts in the last year, our valuation discount to the market has not changed much. The fund continues to offer an attractive combination of extremely low valuations and attractive growth prospects. The price/book ratio of the fund is 0.9 and it offers a forward P/E of 6.2 vs 12.0 for the index (48% discount).

Fund characteristics

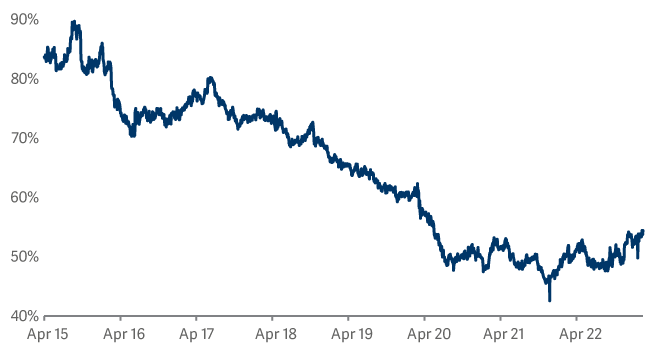

Relative P/E ratio of the fund versus market

The gap in valuations between cheap and expensive stocks remains at extremely high levels compared to history. We see this across a range of metrics we look at: earnings, cash flows, dividends, book values and operating profits. This suggests that value stocks are unusually cheap. They have been for some time now. With the end of the low interest rate world, we think our discipline around valuations is likely to be a rewarding strategy as we progress through 2023 and for the years ahead.

Outlook - Emerging market equities are cheap and unloved, with catalysts for outperformance…

Today EM stocks are trading on discounted valuations against developed markets across a range of metrics. They remain out of favour and extremely cheap relative to US stocks. China appears to be on a different policy path to much of the rest of the world. The potential unleashing of substantial excess savings amongst consumers is creating opportunities. More recently, data releases have signalled a broad pickup in economic activity. We believe the diversification benefits from investing in EM are highly favourable and continue to see this as a good entry point.

Improving fundamentals to provide further tailwinds

We continue to see positive trends in the fundamental value per share of our holdings relative to the market. In the last fivw years, our holdings have outgrown the market’s fundamentals by 10% per annum. The fundamental value per share we construct tracks cash flows, dividends, operating profits and asset values for our companies and the broader market. Despite this superior growth, the gap between fundamentals and share prices of our holdings remains substantial. The potential for catch up presents an opportunity.

Source: Lipper Limited/Artemis from 31 December 2022 to 31 March 2023 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmarks: MSCI EM NR GBP; A widely-used indicator of the performance of emerging markets stockmarkets, in which the fund invests. IA Global Emerging Markets NR; A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. These benchmarks act as ‘comparator benchmarks’ against which the fund’s performance can be compared. Management of the fund is not restricted by these benchmarks.