Artemis High Income Fund update

David Ennett, Ed Legget and Jack Holmes, managers of the Artemis High Income Fund, report on the fund over the quarter to 30 September 2023 and their views on the outlook.

The third quarter of 2023 followed on where the second quarter left off, with high volatility in corporate bonds, driven by moves in underlying gilts. Credit spreads narrowed over the period.

The main factor behind these gilt price gyrations seems to be general market uncertainty. Economic data remains robust, the labour market is tight and inflation appears to be falling. Meanwhile, central banks have hiked rates faster than at any point in living memory and drummed in the messaging that rates will stay here for a while longer. Yields are near the highs of the Global Financial Crisis, but the economy does not yet appear to be slowing. The path forward for markets is understandably a little unclear.

The fund returned 0.7% over the quarter, ahead of its peer group, the IA £ Strategic Bond Average, which returned 0.4%.

Activity

July was a quiet month for activity with the fund participating in just one new issue, Energia. This is an Irish power producer with several attractive long-term power supply contracts with many of the large technology companies based in Ireland, as well as a stable retail electricity business.

In August, we added a new position in the 7-year bond issued by Veritext – a provider of discovery services in the US legal system. This is a vital part of the system, involving the gathering and provision of evidence in order for it to be admissible in court. It also has the added benefit from our perspective of not being cyclical – the American legal system has shown a pretty consistent track record of growth over all of the recent periods of economic volatility.

We also topped up positions in AMS (the producer of lighting and sensor componentry) and a short-dated Bank of America senior bond. We see a lot of value in shorter maturities in the credit markets, as inverted yield curves and a reasonable level of spread premium provide attractive levels of yield in securities that tend to exhibit much lower levels of volatility than longer-maturity parts of the credit markets.

We sold a number of positions over the month. These included Enquest, the UK North Sea oil & gas producer. We still retain a reasonable amount of exposure to this sector through our remaining positions in Ithaca Energy and Harbour Energy. We always regarded Enquest as the riskiest of our holdings within the space, and therefore decided to sell the position following a period of strong outperformance. In a similar vein, we sold our holding in TI Fluid Systems, the provider of fluid management systems for autos. Finally, we trimmed our holding in Ocado following a rally in the bonds after rumours of Amazon potentially acquiring the business surfaced.

We were reasonably active in September, adding a number of positions. These included: Arqiva, the UK broadcast infrastructure company; Concrete Pumping, the US-based provider of specialist concrete pumping vehicles; Williams Scotsman, the North American modular accommodation (read porta-cabin) provider; Worldpay, the payment processor; and Yorkshire Building Society. The majority of the positions we added to within the fund were shorter-dated bonds. We see appealing income opportunities at the front end given still inverted curves and a much lower sensitivity to duration. We continue to have exposure to US Treasury Inflation Protected Securities (TIPS) which we believe are a much better hedge than longer-dated credit at the moment.

We sold positions in: AroundTown, the German residential real estate company; ENI, the Italian energy group; Alder Pelzer and TI Fluids, two auto parts producers. All of these sales followed strong performance. We also sold one of our few remaining CCC positions, White Cap (a US speciality construction equipment distributor), again following a period of strong performance. Finally, we cut our position in MI Windows, a US windows and doors manufacturer, as a result of some rumours around the company potentially bidding on a rival group. Should this happen we would anticipate that the company would likely issue more debt to fund the deal, so we wanted to be in a good position to take advantage of this potentially cheap issuance.

Outlook

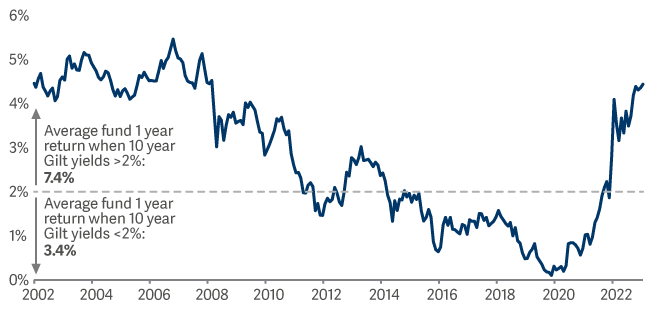

Investors looking for high levels of income in today’s market have the most favourable backdrop they’ve seen in over a decade (Chart 1). The jump in yields provides an abundance of opportunities for investors and allows for both strong income and total returns. By focusing on good-quality businesses that are now paying attractive yields we believe investors can extract attractive returns on an ongoing basis. For context, the 1-3 year BB-B Global High Yield universe – short-dated so less volatile and less duration risk, and focusing exclusively on higher quality BBs and Bs as opposed to the default-prone CCCs (average annual default rate of BBs = 0.6%; average annual default rate of CCCs = 26%) pays sterling-based investors 8.9% at the time of writing. That looks to us a very attractive place to allocate client capital. When it is combined with a small exposure to US TIPS (which, as discussed, provide some important “risk-off” protection alongside attractive real yields), a select collection of investment-grade credit exposure, and a subset of income-producing (and income-growing) UK and European equities, we believe investors can reasonably expect some very attractive both absolute and risk-adjusted returns over the next few years.

Chart 1: Returning to a more favourable market backdrop

10 year Gilt yield since fund inception

Past performance is not a guide to the future.

Source: Lipper Limited/Artemis from 31 March 2023 to 30 September 2023 for class I quarterly distribution GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmark: IA £ Strategic Bond NR; A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. It acts as a ‘target benchmark’ that the fund aims to outperform. Management of the fund is not restricted by this benchmark.