Is China ready to bounce back?

At the start of the year, many analysts predicted a recovery in China could support the global economy. While the recovery has failed to materialise, Raheel Altaf, manager of the Artemis global emerging markets equity strategy, believes it may only be the timing of the prediction that was wrong.

Investment strategists started the year expecting a post-Covid economic boom in China. It failed to appear, but could their predictions be about to come true?

The data coming from China this year has been truly disappointing – rising youth unemployment1, underwhelming growth in retail sales2 and manufacturing output3, a slump in exports4 and a real estate crisis. Yet much of this has been self-inflicted – part of a plan by the Chinese government to deflate the property bubble and ensure growth is sustainable.

Ultimately, that should be welcomed. Investors tend to approve of conservative measures by central banks to reduce risk in the economy. They cannot then complain at the inevitable impact on short-term growth.

Worth a second look

But there are positive numbers coming through now. It may be time to revisit those earlier forecasts – the timing may have been wrong, but the analysis could prove to be correct.

Central bankers in developed markets face a serious challenge in their battle against inflation. The impact of high interest rates always takes time to emerge, so knowing when to ease off the brakes is difficult.

By contrast, in China, though growth is low, so is inflation5. That leaves room for stimulus measures from central banks without sending prices spiralling. While you shouldn’t expect the Chinese government to start implementing enormous economic stimulus packages, it does appear to be applying some measures – such as a recent cut in 12-month lending rates6.

We expect more steps like this. With investor expectations so bleak today, even a modest recovery in demand from domestic consumers could lead to a significant uplift in some share prices of Chinese companies.

Standing on its own two feet

There is still the possibility of a recession in the US. In the past, that would have caused serious pain for China, yet now it could happen without derailing the country’s recovery.

China is a lot less dependent on the US today. Through its Belt and Road infrastructure project, it has strengthened relations across Asia, Africa and Latin America. It now exports far more to Asia than to the US. And Asia has been thriving, even without the benefit of a Chinese economy on fire.

The shape of the Chinese economy has changed, too. In the wake of the Global Financial Crisis, China invested heavily in infrastructure and in smaller, less developed cities. That helped its domestic economy to grow and a strong middle class to emerge. It also caused a boom in the price of natural resources and industrial production globally. China became the world’s factory floor, often supplying cheap products and parts.

More recently, while more developed economies such as the US have been investing in infrastructure, China’s focus has been on building its capacity to create higher-value goods and services.

This year it has overtaken Japan as the world’s largest car manufacturer, and in motor shows across Europe its vehicles are attracting attention for their style, quality and competitive pricing. In the first seven months of this year, 189,000 Chinese cars were sold in Europe7. UBS estimates that by 2030, one in five cars sold in Europe could be Chinese. China is leading the world in the production of batteries, too8.

The internationalisation of Chinese brands

This is all part of a growing phenomenon – the internationalisation of Chinese brands, whether it is PDD Holdings, which owns e-commerce sites Temu and Pinduoduo, or TikTok. This development is built not just on exports, but on the continued rise of the Chinese middle class.

Along with the scope for prudent economic stimulus measures, these structural changes make the outlook for China begin to look more attractive. The same could also be said of other less developed countries, known as emerging markets.

We see real opportunities for selective exposure to China and in emerging markets more widely. The numbers support this case. Look around the world and China and emerging markets – alongside the UK – are the standout regions for value9.

For those nervous about investing in China, the fact that the country’s shares are trading at such deep discounts – compared with both their international peers and long-term averages – could mitigate risk.

On some measures, the average valuation of the US index, the S&P 500, is more than twice as expensive as Chinese e-commerce giant Alibaba10. Alibaba has seen its share price nearly halve over the past two years. By comparison, after a sharp tumble in 2022, Amazon has seen its share price shoot up 50% this year11.

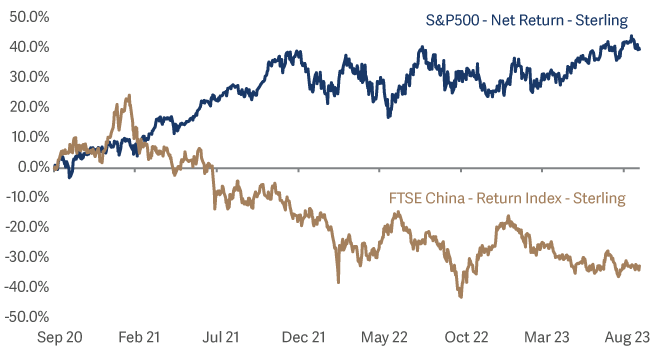

Performance of FTSE China vs S&P 500

30 Sep 2020 to 30 Sep 2023

Priced in pessimism

Investors are assuming China is in deep trouble and struggling to see the upside. The market is pricing in this pessimism. When the mood is bleakest it can be the best time to find bargains.

2 https://tradingeconomics.com/china/retail-sales-annual

3 https://www.cnbc.com/2023/08/31/china-economy-factory-activity-in-august-shrinks-for-a-fifth-month.html

4 https://www.reuters.com/markets/asia/chinas-august-exports-imports-fall-less-than-expected-2023-09-07/

5 https://www.reuters.com/world/china/chinas-august-consumer-prices-edge-higher-factory-prices-fall-2023-09-09/

6 https://www.cnbc.com/2023/08/21/china-loan-prime-rate-august-2023.html

7 https://www.economist.com/business/2023/09/14/chinese-carmakers-are-under-scrutiny-in-europe

8 https://finance.yahoo.com/news/lithium-battery-production-country-top-183050554.html

9 Bloomberg as at 31 August 2023

10 Bloomberg

11 Bloomberg