Artemis Monthly Distribution Fund: a simple approach to multi-asset investing

Economic, political and market conditions have changed beyond recognition over the past 12 years, but the Artemis Monthly Distribution Fund’s straightforward multi-asset approach to delivering returns has remained consistent. We believe the returns it has produced speak for themselves.

When we launched the Artemis Monthly Distribution Fund 12 years ago, the world was a different place. Donald Trump was best known as the eccentric host of The Apprentice. Greece, rather than the UK, looked likely to become the first country to quit the EU. And conditions in financial markets were entirely different.

In May 2012...

- Interest rates in the UK stood at just 0.5%;

- In the US, the Fed funds rate was 0.25%.

Meanwhile, in the bond market, a traditional hunting ground for income-seeking investors:

- The yield on 10-year UK Gilts was just 1.85%.

- 10-year US Treasury yields were lower still, at 1.74%.

Viewed in one light, Artemis’ decision to launch a fund explicitly designed to deliver income into this environment might have appeared to be wilfully contrarian. It wasn’t. It reflected our awareness of the growing pressure on clients who need their investments to generate a steady stream of income.

Equally, we were conscious that many investors want an investment strategy that could deliver total returns more smoothly than is possible through a 100% allocation to equities. Stockmarkets tend to deliver excellent long-term capital gains but they do so unpredictably and with levels of volatility that many find off-putting.

A variant of the time-honoured ‘60-40’ strategy – where a 40% allocation to bonds helps to offset the volatility of a 60% allocation to equities - seemed to offer a simple solution. Our refinement was to place the emphasis on targeting bonds and equities that generate a useful level of income and give clients the option to harness the power of compounding by patiently harvesting or reinvesting their distribution payments.

What we invest in

| Bonds | Equities |

|---|---|

| Predominantly High Yield bonds with some Investment Grade and Government Debt too. | Modest valuation multiples (potential for shares to be re-rated). |

| Income is the priority – but with awareness of the potential for capital gains. | Companies worldwide producing high and/or growing dividends. |

| Index-agnostic: smaller issuers often produce superior returns. | Profitable companies with attractive free cashflows. |

| Bond issuers with stable or improving fundamentals. | Companies who return cash to their shareholders through dividends and share buybacks. |

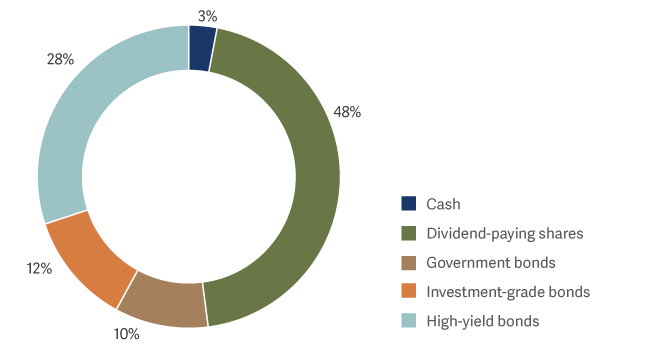

Artemis Monthly Distribution Fund breakdown

The power of compounding

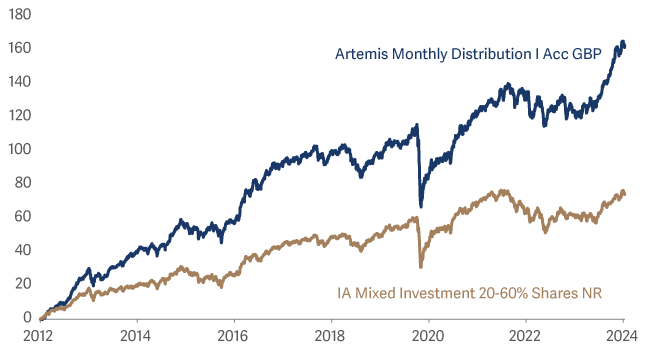

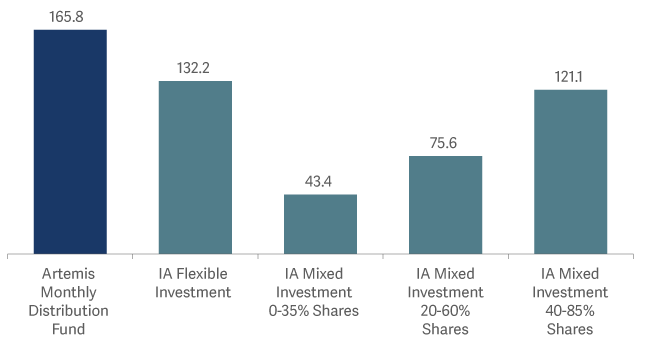

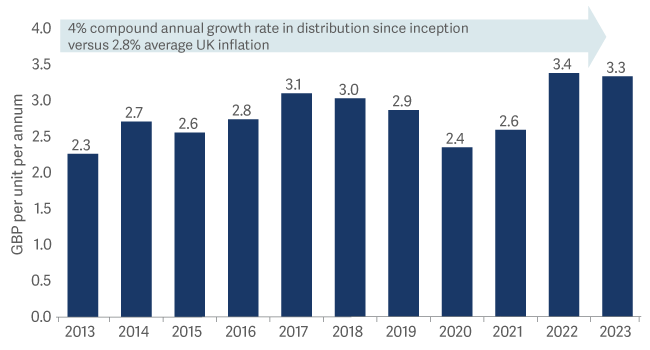

Over the 12 years since its launch, the Artemis Monthly Distribution Fund has not only delivered a regular stream of income, but it has also, through the powerful effect of compounding, delivered a compelling total return. By the end of June 2024, the fund had returned 166% since its launch versus an average return of 76% from its peer group, the IA’s Mixed Investment 20-60% Shares sector, a large and broad peer group of 180 multi-asset funds.

Percentage growth

Cumulative return

Those returns have been delivered through a 12-year period that was initially defined by sluggish economic growth, deflation worries, near-zero interest rates and QE. More recently, returns continued to compound through a spike in energy prices, a land war in Europe, rampant inflation, sharp hikes in interest rates and the withdrawal and reversal of QE.

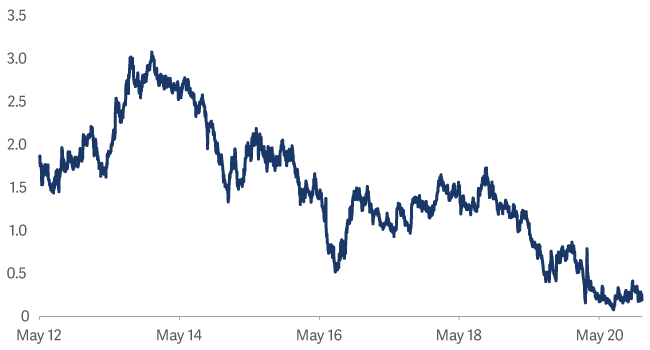

The fund maintained a stable income against a backdrop of falling yields

Almost as soon as we launched the fund, the pressure to find sources of investment income intensified. In July 2012, the Bank of England signalled that, in response the Eurozone crisis, it would resume quantitative easing (QE). Initially, it signalled that it would increase the total value of bonds it had bought since the financial crisis to £375 billion. By the time it eventually called time on QE in late 2020, the Bank would have poured £895 billion into the bond market. For its part, the US Federal Reserve was about to embark on third round of quantitative easing (QE3). It would eventually commit US$ 8 trillion to QE1.

10-year UK Gilt yield %

Stable income over time against a backdrop of falling yields

While the merits of QE are still a matter of debate, it had a number of unpleasant side effects. One was to push government bond yields lower, making life progressively harder for investors who needed their capital to generate a meaningful stream of income. Our simple, multi-asset income-focused strategy offered a solution. Its high-yield bonds continued to generate a satisfactory level of income while its equities delivered a growing stream of dividends and the potential for capital gains.

Performance annualised

| One year | Three years (p.a.) | Five years (p.a.) | 10 years (p.a.) | Since inception (p.a.) | |

|---|---|---|---|---|---|

| Artemis Monthly Distribution Fund | 19.2% | 5.5% | 5.6% | 6.5% | 8.4% |

| IA Mixed Investment 20-60% Shares | 9.4% | 0.9% | 2.9% | 3.8% | 4.8% |

| Relative | 9.8% | 5.4% | 3.5% | 3.3% | 4.3% |

A straightforward, ‘plain-vanilla’ approach

Since inception, the fund has outperformed its peers and generated a compelling total return – or a steady stream of income payments – by consistently applying the same straightforward multi-asset approach:

- It doesn’t rely on exotic derivatives.

- It doesn’t employ leverage (debt) to enhance returns.

- It doesn’t invest in unlisted ‘private’ assets.

- It doesn’t invest in the riskier end of the high-yield market or in emerging-market debt.

- It doesn’t invest in volatile (and often expensive) ‘growth’ stocks - companies that are prepared to forgo profits today in the hope of delivering profits the distant future.

Instead, we take a ‘plain vanilla’ approach to asset allocation, investing in:

- The shares of profitable, dividend-paying companies around

the world; - Investment-grade government and corporate bonds; and

- High-yield bonds.

While the managers fine-tune the balance between bonds and equities to reflect the shifting balance of relative opportunities and valuations, its ‘neutral’ asset allocation is a roughly 50-50 split between the two asset classes.

So, the returns that the Artemis Monthly Distribution Fund has produced over the past 12 years haven’t been borne from aggressive asset allocation or in deploying exotic financial instruments. Instead, those returns have been amassed drawing on Artemis’ longstanding expertise in investing for income.