Artemis Global Select Fund update

Alex Stanić and Natasha Ebtehadj, managers of the Artemis Global Select Fund, report on the fund over the quarter to 31 December 2023 and their views on the outlook.

Source for all information: Artemis as at 31 December, unless otherwise stated.

- The fund's return of 6.3% in the quarter was in line with that of its MSCI AC World index benchmark.

- Its managers took profits in Japanese holdings and moved to an underweight position after the market rerated. They increased their position in emerging markets with new holdings in China and Brazil, but are still underweight the sector. In terms of industries, the fund remains overweight healthcare and financials and underweight energy and consumer staples.

- Tech may have dominated the narrative in 2023, but over two years its performance has been lacklustre.

- While equity markets remain sensitive to macro concerns, the managers remain focused on high-quality companies that are exposed to secular growth trends and trade at attractive valuations.

Performance

The Artemis Global Select Fund made 6.3% in Q4, in line with its MSCI AC World index benchmark.

US stocks led global equities in the quarter, with the Federal Reserve indicating we may be close to the peak of the interest rate cycle. Meanwhile, economic data remains robust, with inflation and unemployment falling and consumer activity at a healthy level. US bond yields rallied, with November the best month for US Treasuries since May 1985. European stocks also performed well on the back of falling inflation in the eurozone, yet the European Central Bank is maintaining a slightly more hawkish outlook, despite weakening economic conditions.

Although inflation has been persistent in Japan, its central bank decided to maintain its ultra-loose monetary policy. The yen weakened over the quarter and Japanese stocks underperformed the global market.

Emerging markets rose on the back of strong economic growth in Brazil, Mexico, India and South Korea. In China, however, house prices and new home sales continued to fall, while consumer sentiment remains subdued. The Hang Seng Index was flat over the quarter.

Global equities were led by rate-sensitive sectors, such as technology and real estate, and cyclical sectors, such as industrials and financials, which were aided by news that the US avoided a meaningful economic slowdown. Defensive sectors such as consumer staples and healthcare lagged the market. Energy was the only sector that posted negative returns, as despite OPEC cuts to oil production, non-OPEC countries led by the US markedly increased supply. As a result, the price of Brent Crude fell 19%.

US tech stocks (Amazon, Microsoft, Uber and Intel) accounted for four of the five biggest contributors to the fund's performance over the quarter. The list of detractors was far more varied in terms of sectors, although it included three US names: insurer Aon, energy firm Baker Hughes and health insurer Humana.

Recent purchase Meituan also disappointed, falling 26%. We bought the Chinese ecommerce giant in Q4 due to the scale advantages it has built in its core food-delivery business. Despite known competitive pressures in a growing industry, it has the potential to rapidly expand margins and free cashflow generation in the coming years. It was priced attractively before its fall and now looks like even better value.

Activity

Purchases

- Nvidia

- Nike

- Eagle Materials

- LSE

- Hilton Worldwide

- Meituan

- Intercontinental Exchange

- Wells Fargo

- NXP Semiconductors

- NU Holdings

Sales

- Agilent

- Rockwell Automation

- Thai Beverage

- Diageo

- Merck

- Singtel

- Unilever

- Humana

- Sumitomo Mitsui Financial Group

- Adobe

We have moved from an overweight to underweight position in Japanese holdings after the market re-rated and we took profits. Despite increasing our position in emerging markets over the quarter, with new positions in Brazil and China, we remain slightly underweight overall. Our main overweight is to Europe, although we also have a larger-than-average position in the US.

In terms of sectors, we are underweight energy and consumer staples and overweight healthcare. Although the latter underperformed last year, the secular growth drivers behind it remain intact and valuations are attractive. We increased our overweight in financials with the addition of Intercontinental Exchange, NU Holdings and Wells Fargo in the US and LSE in the UK. Sales in consumer staples included Unilever and Diageo in the UK and Thai Beverage in Thailand.

Elsewhere, we took profits in Rockwell Automation and Adobe in the US, German pharmaceutical Merck, Japan's Sumitomo Mitsui Financial Group and Singaporean communications conglomerate Singtel.

Outlook

Equity markets remain highly sensitive to macro concerns – namely US interest rates, economic weakness in China and the potential for significant policy changes in Japan. As a result, we retain an emphasis on resilient businesses with strong balance sheets and low levels of gearing. We particularly like high-quality businesses that are supported by long-term trends but trade at attractive valuations due to near-term headwinds. These include Haleon’s share overhang, HDFC Bank’s merger, disruption to Estée Lauder’s China operations and Nike’s margin recovery.

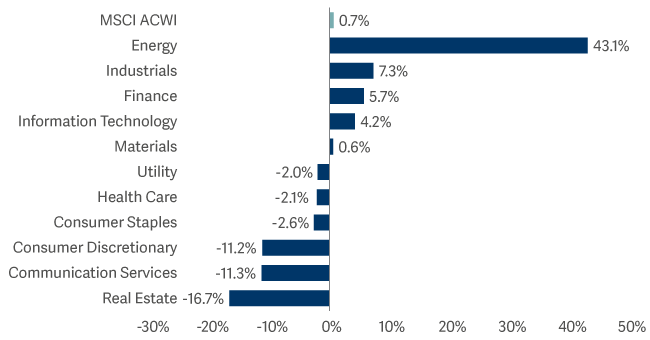

Tech dominated the narrative in 2023, with the information technology (IT) and communication services sectors returning 51.4% and 38.1% respectively. Yet this 12-month view perhaps says more about the starting point – over two years, the IT sector is up just 4.2% while communication services is down 11.3%.

Total return for global sectors over the past two years – 2021 to 2023

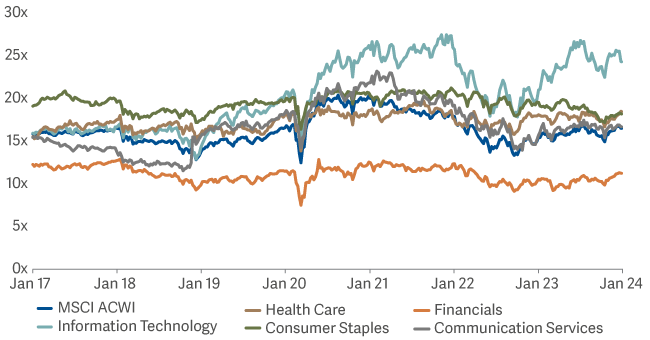

As long-term investors, we look at these abrupt short-term rotations in equities as excellent opportunities to reinforce our positions around long-term themes. For example, forward consensus price-to-earnings [P/E] ratios for the main global MSCI sectors throw up some extreme numbers.

Global sector P/E

IT has clearly rerated, while financials remain on low multiples. Most other sectors look far less dramatic, but consumer staples and healthcare have continued to de-rate from their 2021 highs.

While these are broad aggregations covering a multitude of stocks, they also provide context around our positioning. There are still attractively valued stocks in IT, especially semiconductor names such as recent addition NXP Semiconductors, which is benefiting from long-term demand drivers through increased penetration. However, we are underweight software

and even more underweight hardware, a sector dominated by Apple, which we don’t own. While the fund is slightly overweight IT, there are marked investment views within the sector.

Source: Lipper Limited/Artemis from 31 March 2023 to 31 December 2023 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmarks: MSCI AC World NR GBP; A widely-used indicator of the performance of global stockmarkets, in which the fund invests. IA Global NR; A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. These act as ’comparator benchmarks’ against which the fund’s performance can be compared. Management of this fund is not restricted by these benchmarks.