Artemis Corporate Bond Fund update

Stephen Snowden and Grace Le, managers of the Artemis Corporate Bond Fund, report on the fund over the quarter to 30 June 2024 and their views on the outlook.

Source for all information: Artemis as at 30 June 2024, unless otherwise stated.

- The fund outperformed, helped by good stock selection in the banking sector.

- The UK bond market appears to be reclaiming its former status as a safe haven at times of market stress.

- Cuts in interest rates are now a matter of ‘when’ rather ‘if’.

Performance: outperforming a falling market

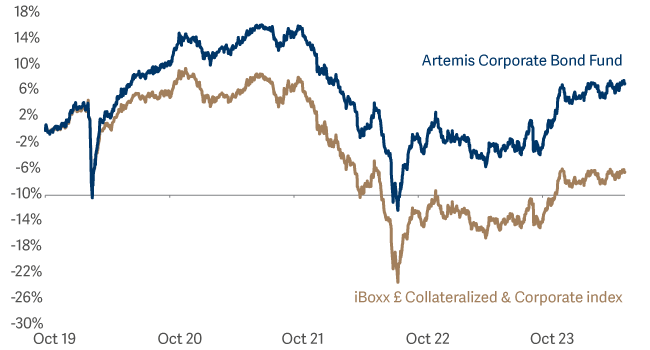

Although the fund was flat (+0.0%), over the quarter, it outperformed the benchmark iBoxx £ Collateralized & Corporate Index, which fell by 0.3%. Since the turn of the year, the fund has delivered a positive return of 0.6% versus a loss of 0.2% for the benchmark. The fund’s longer-term performance record, meanwhile, speaks for itself.

| Three months | Six months | One year | Three years | Since launch (*) | |

|---|---|---|---|---|---|

| Artemis Corporate Bond Fund | 0.0% | 0.6% | 12.2% | -6.1% | 7.2% |

| iBoxx £ Collateralized & Corporate index | -0.3% | -0.2% | 10.9% | -12.0% | -6.4% |

| IA £ Corporate Bond | 0.2% | 0.6% | 10.8% | -8.5% | -2.3% |

The fund’s outperformance this quarter was largely driven by good stock selection in the banking sector and by its overweight position in real estate, which continues to recover from its woes last year. An underweight in water utilities also proved to be beneficial; the sector continues to be a target for the press and for politicians of every persuasion.

Market environment – a challenging quarter for the bond market

The negative returns produced by the investment-grade corporate bond market over the quarter were mostly a function of a rise in government bond yields. The yield on 10-year UK Gilts rose from 3.93% to 4.17%, pushing prices lower. A large part of that fall in capital values, however, was offset by the healthy yields that bonds are currently generating.

How to explain the rise in yields? On the economic front, data was mixed. Over the past year, continued strength in the labour market supported wage growth and slowed the pace at which inflation is falling. Despite that, CPI in the UK has finally fallen back to the Bank of England’s target of 2.0%. All things being equal, that fall in inflation should have helped push bond yields lower. The positive implications of moderating inflation, however, were temporarily obscured by political developments…

The announcement of an earlier-than-expected general election in the UK was a relatively low-impact event given the fiscal plans of the Conversative and Labour parties are broadly similar. More significant was President Macron’s decision to call a snap parliamentary election in France, potentially opening a path to power for the country’s far-right or far-left parties, neither of whom are much concerned by fiscal discipline. Given France’s debt-to-GDP ratio now stands at 110% and the country continues to run a persistently high budget deficit (5.5%)1 – and given that it does not control its own currency or interest rates – French government bonds suddenly appeared vulnerable.

Concerns about debt levels in some of the world’s major economies were further compounded by President Biden’s shaky performance in a televised debate with former President Trump. The debate appeared to have shifted the odds in favour of Trump making a return to the White House and the market believes he will exercise even less budgetary discipline than the Democrats.

Not all of the quarter’s news was quite so unhelpful for bonds, however. Several central banks – notably those in Canada, the Eurozone and Switzerland – began to cut rates. And the tone of comments from the Bank of England and US Federal Reserve continue to suggest that, when it comes to rate cuts, it is a question of ‘when’ rather than ‘if’.

Activity

April – Focusing on the secondary market

Although April was a quiet month for new issuance, we bought – and promptly took profits – on new issues from Prologis, Platform Housing Association and Manchester Airport. Most of our activity, however, focused on the secondary market. We recycled capital into laggards such as Ford, Traton, Credit Agricole, SocGen, Virgin Money, Axa, Rothesay, Nestle, Places for People and Vattenfall. We also topped up or bought bonds from Wells Fargo, Rabobank, Tesco Property, Marston, Greene King, Grainger, Royal London and CPI Property.

May – A livelier month for new issuance

We bought new issues from Centrica, Pension Insurance Corp, Toyota, Tesco, United Utilities, BPCE and CPI Property. We also made relative-value switches in Pension Insurance Corp and the RAC. The only meaningful sales were of Northumbrian Water and of some long-dated gilts (we bought these back later, after government bond prices had weakened again).

June – Adding to higher quality financials

In June, we bought new issues from Reckitt Benckiser, Motability, Unite, Rothesay Insurance and Severn Trent. We also undertook several relative-value trades, switching between different bonds from the same company. These included EDF, Centrica and Motability.

The only notable sale in June was of French bank BPCE. The snap announcement of elections in France caused credit spreads to widen, with French banks initially seeing the greatest impact. The initial move wider in credit spreads on French banks was subsequently mirrored by non-French banks. We decided to switch from BPCE’s senior non-preferred bonds into higher-rated and more senior preferred bonds from BNP Paribas and BFCM. Despite the ‘up-in-quality’ nature of this switch, the terms were actually slightly better than they had been before the election announcement. We used some of the money raised from the BPCE sale to top up the fund's holdings in some UK banks.

Outlook

The overall outlook for the sterling corporate bond market is positive. Interest rates have already fallen in some jurisdictions and there would appear to be a strong possibility that the Bank of England cuts rates in September. The composure exhibited by the UK bond market at the time when French government bonds were suffering volatility in June suggests that gilts have regained their status as safe haven assets. The UK’s return to the premier league of bond markets could be down to Rishi Sunak or Sir Keir’s leadership of their respective parties, or both. But that the UK resumed its place at the top table of stable jurisdictions is to be welcomed.

The summer is seasonally a good time for the bond markets. Income continues to be generated and paid out while issuance of both government and corporate bonds tends to be low. This creates a healthy supply and demand dynamic which often helps to drive the bond market higher over the summer months. There is often renewed volatility once the world has returned from its summer holiday in September. But, for now, there appears to be little on the immediate horizon to provoke any meaningful volatility in the near term.

To reprise a familiar theme: this is a good time to be a bond investor. Interest rates seem likely to fall. Yields are currently high so we do not need to rely on interest rates falling to generate a healthy return. But when interest rates are eventually cut, the resulting capital gains should give bondholders a welcome boost.

Source: Lipper Limited/Artemis from 31 March 2024 to 30 June 2024 for class I accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmarks: iBoxx £ Collateralized & Corporates Index; A widely-used indicator of the performance of sterling-denominated corporate investment grade bonds, in which the fund invests. IA £ Corporate Bond NR; A group of asset managers’ funds that invest in similar asset types to the fund, collated by the Investment Association. These act as ‘comparator benchmarks’ against which the fund’s performance can be compared. Management of the fund is not restricted by these benchmarks.