Artemis Funds (Lux) – Global Select update

The managers report on the fund over the quarter to 30 June 2024 and the outlook.

Source for all information: Artemis as at 30 June 2024, unless otherwise stated.

Objective

The fund is actively managed. Its aim is to increase the value of shareholders’ investments primarily through capital growth.

Review of the quarter to 30 June 2024

Returns for the Artemis Global Select Fund were flat during the second quarter of 2024, compared with gains of 2.9% from its MSCI AC World index benchmark.

US stocks climbed during this period, as monthly core inflation (which excludes volatile food and energy sectors) for June rose below expectations and provided further evidence that high interest rates are cooling the economy. Consumer spending appears to be slowing, while manufacturing and construction activity has flatlined. The S&P 500 was led by the technology sector, with the growing likelihood of interest rate cuts later this year supporting ‘long duration’ growth companies the most.

There was renewed interest in Chinese equities, with the Hang Seng index up nearly 9% (in local-currency terms). In addition to improving manufacturing data reported earlier this year, China’s Q1 2024 GDP print came in above market expectations, driven mostly by a rebound in global export demand as well as by infrastructure spending and manufacturing capex, which are both supported by recent policy stimulus.

India's stock market, where 4% of our fund is invested, made strong gains. It recovered after Narendra Modi’s BJP failed to secure a majority in the recent election and had to enter a coalition. Initial concerns that the results could lead to a slowdown in economic growth have since abated, with smaller regional parties likely to receive more funding in return for supporting the prime minister's nationwide economic policy.

Japanese stocks were broadly flat. The yen has continued to weaken, which will likely increase inflationary pressures from a higher cost of imports, while wage growth remains robust. A Bank of Japan board member indicated during the quarter that interest rates may rise further, given inflationary pressures on consumer confidence and spending.

In Europe, central bankers announced the first interest rate cut in eight years, while political uncertainty led to some volatility in equity markets.

The fund benefited from strong returns across semiconductor holdings, as the generative AI demand boom feeds through to the supporting hardware supply chain. On the negative side, there was a notably volatile reaction to earnings releases over the reporting season, which affected some of our holdings. In such circumstances, we reassess and test our original investment theses, which may lead to us to take advantage of short-term weakness.

Positives

- TSMC returned 22.5%. The world's leading semiconductor manufacturer is seeing its revenues and cashflows grow meaningfully as its clients attempt to meet surging demand for AI chips, while its dominant market position allows it to raise prices, expanding gross margins. Healthy free cashflow can also be reinvested into building capacity for the next generation of semiconductor chips, widening the technological advantage over its peers.

- HDFC Bank returned 16.0% on renewed interest following the Indian election, due to the likelihood of higher fiscal spending and improving liquidity conditions as the government continues with policies for economic growth.

- Meituan made 15.2%, benefiting from renewed optimism of a Chinese economic recovery and the associated market rally. We continue to like the scale network effect for this leading food-delivery business, which is at the precipice of a profitability inflection and trades at a cheap valuation.

Negatives

- Estée Lauder fell 30.5%. The business has gone through a turbulent period, driven by weakness in China as post-lockdown consumer demand remains muted and distributors work through high inventory levels. While the market focuses on a cyclical slowdown, our meetings with the company, industry experts and competitors have highlighted the strength of its product portfolio and the beauty sector’s long-term growth dynamics. Further, management’s cost-cutting programme means an expected sales recovery should be accompanied by margin expansion.

- Ryanair fell 24.1% after its chief executive warned of customer resistance to further above-inflation price increases. However, the airline has consistently taken market share across Europe by passing cost savings on to passengers and remains significantly cheaper than competitors. It could be approaching a ramp-up in free cashflow generation following a period of intense investment in new planes.

- Grupo Financiero Banorte dropped, along with other Mexican stocks, after Claudia Sheinbaum won a landslide election victory. Initial market concerns over the potential for business-unfriendly reforms appear unfounded. The president-elect has already met with some of the largest companies in Mexico, where she emphasised a collaborative approach, and Banorte’s management team appears optimistic about the political backdrop.

| Three months | Six months | One year | Three years | Five years | Since launch | |

|---|---|---|---|---|---|---|

| Artemis Funds (Lux) – Global Select | 0.0% | 9.9% | 17.6% | 7.5% | N/A | 47.4% |

| MSCI AC World NR USD | 2.9% | 11.3% | 19.4% | 17.2% | N/A | 58.6% |

Positioning

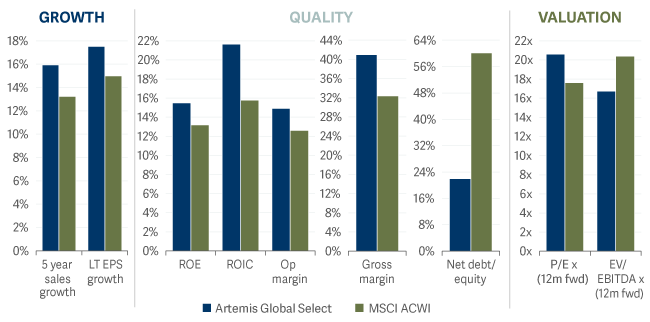

We remain focused on identifying best-in-class businesses trading at attractive valuations, delivering sustainable growth with strong profitability, protected by durable competitive moats. While the valuation of our aggregate portfolio is only slightly higher than that of the MSCI AC World index on a P/E basis, profit margins are higher, as is return on invested capital and return on equity, while leverage is lower. The aggregate sales and earnings growth rate of the portfolio is also higher.

The fund remains overweight: healthcare, where secular growth drivers remain intact and valuations attractive; consumer (following the recent additions of Shoei and Trip.com); and information technology. The largest overweight is now to industrials, following the recent addition of concessions operator VINCI to the portfolio. We retain underweights in energy, utilities and financials, as well as communication subsegments such as telecoms and media.

In terms of geographic positioning, the fund is overweight Europe and underweight the US. This is not due to any macroeconomic view, but because of where bottom-up stock opportunities have taken us. We remain overweight emerging markets, with holdings in Mexico and China, where valuations look attractive, and India. Our Japan weight has also increased moderately with new positions added earlier this year.

| Discrete performance, 12 months to 30 June |

2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|

| Artemis Funds (Lux) – Global Select | 9.9% | 14.7% | -20.9% | 17.4% | 20.8% | - | - | - | - | - |

| MSCI AC World NR USD | 11.3% | 22.2% | -18.4% | 18.5% | 16.3% | - | - | - | - | - |

Purchases

- MTU Aero Engines – a well-managed airplane engine manufacturer and MRO (maintenance, repair and overhaul) provider. As well as benefiting from the secular growth of global travel and the trend for more efficient engines, it is trading at a discount to peers.

- VINCI – a French business that operates toll roads and airports, the income from which is ‘long duration’ and well-protected against inflation. Recent political risk in France led its shares to trade below the value of existing assets.

- Following a team member’s research trip in March, we identified a number of under-the-radar Japanese stocks that should benefit from idiosyncratic growth opportunities as well as improved governance and shareholder-return standards. These included: conglomerate Fujifilm, which now generates more than a third of its sales from healthcare; Shoei, the world’s leading manufacturer of premium motorcycle helmets; and Toppan, another conglomerate, whose exposure to semiconductors is obscured from the market by its many other ventures.

Sales

- Rio Tinto – after a strong run this quarter, we switched our holding in Rio Tinto to Anglo American, as the latter’s valuation on an asset-backed basis was more attractive. Industry consolidation may also provide a catalyst for this value to be fully recognised.

- Nike – a poor set of quarterly results pushed out the sportswear giant’s timeline until recovery.

- We took profits in Mitsubishi UFJ Financial, Intercontinental Exchange and Meta.

Outlook

The MSCI ACWI index has demonstrated a high level of concentration this year, with the IT sector contributing nearly half of returns and just five stocks responsible for more than 40% of gains – Nvidia, Microsoft, Amazon, Meta and Eli Lilly. However, this concentration has been backed by a proportionate contribution to economic profits.

Macroeconomic headwinds have constrained earnings growth across a number of sectors. Notably, some consumer categories have exhausted pricing power over the inflationary post-pandemic period and are now seeing consumers trading down while volume growth remains muted.

In healthcare, growth in the biotechnology industry is supported by a strong venture-capital ecosystem which funds drug development – but a higher cost of capital is affecting this sector and the life-sciences supply chain.

The energy sector also faces tough comparative returns following profit boosts in 2022 and 2023. Meanwhile, housing markets have stalled, particularly in the US, as higher mortgage rates constrain affordability.

With inflation normalising across Europe, the UK and the US, we are now more likely to see interest rate cuts than rises (Europe has already made a start). Further stimulus in China and troughing conditions across many of its sectors should lead to stabilisation and eventually a return to growth. Improving earnings trajectories across non-IT sectors can therefore support a broadening of returns across the market.

While the fund’s performance this year has also been driven by large-cap tech and strong stock selection across the semiconductor supply chain, we have found many opportunities to buy quality companies trading at attractive valuations that are well-placed to recover along with their end markets.

These include Campari, which has a stellar track record of organic and inorganic growth, but has been held back by consumer downtrading in spirits; Thermo Fisher and Revvity, which have seen flat sales growth on constrained global biotech funding and China lab capex; and Estée Lauder and Trip.com, which are poised to benefit from the recovery in the Chinese consumer.

While the valuation of our aggregate portfolio is only slightly higher than that of the MSCI AC World index on a P/E basis, profit margins are higher, as is return on invested capital and return on equity, while leverage is lower. The aggregate sales and earnings growth rate of the portfolio is also higher, as you can see below…

Artemis Global Select: Portfolio fundamentals