Artemis Global Income Fund update

Jacob de Tusch-Lec and James Davidson, managers of the Artemis Global Income Fund, report on the fund over the quarter to 30 June 2024 and their views on the outlook.

Source for all information: Artemis as at 30 June 2024, unless otherwise stated.

- Investors’ renewed enthusiasm for AI stocks saw a handful of mega-cap US technology stocks driving global market indices higher on the quarter.

- The fund outperformed the index and its peer group over the first half of 2024.

- We regarded the politically inspired volatility in the French stocks as a buying opportunity, adding Vinci, BNP Paribas and AXA.

Performance

| Three months | Six months | One year | Three years | Five years | |

|---|---|---|---|---|---|

| Artemis Global Income Fund | 2.2% | 18.3% | 31.9% | 39.2% | 66.9% |

| MSCI AC World | 2.8% | 12.2% | 20.1% | 28.1% | 67.8% |

| IA Global Equity Income | 0.7% | 7.1% | 13.4% | 25.4% | 49.4% |

Despite signs of slowing growth and political turmoil, the second quarter of 2024 saw market indices building on the gains made in the first quarter. Once again, investors’ enthusiasm for AI-related stocks meant that the gains were led by mega-cap US technology companies. Nvidia rose by 37% (in sterling terms) over the quarter, adding $780 billion in market cap. Apple rose by 23%, increasing its market capitalisation by $581 billion as the market welcomed its new partnership with Open AI.

Mega-cap technology stocks tend not to pay meaningful dividends. That – along with their challenging valuation multiples - means our portfolio remains materially underweight here. Despite not owning Apple, Nvidia or Microsoft, good stock selection in other parts of the market – and the fund’s exposure to less-celebrated beneficiaries of the boom in AI-related spending such as Broadcom – meant that, with a return of 2.2%, it only marginally lagged the 2.8% rise in the MSCI AC World Index. It also outperformed its peer group, where the average return was just 0.7%.

Moreover, at 18.3%, returns from our portfolio over the year to date remain substantially ahead of both the index (up 12.2%) and the peer group (up 7.1%).

What worked

Broadcom (up 26%)

Broadcom’s shares built on the gains made in the first quarter with the result they have returned 51% (in sterling terms) over the first half of the year. It has a long track record of adding value through M&A and its recent acquisition of cloud provider VMWare already looks to have been a shrewd move. Its second-quarter earnings came in above expectations and it raised its revenue guidance for the year by US$1 billion largely on the strength of faster-than-expected adoption of its AI networking chips1.

Kinross Gold (up 37%)

Gold producer Kinross continued to play catch up with the rise in the gold price. Its first-quarter earnings announcement showed both production and earnings coming in ahead of expectations. While the gold price has retreated from the all-time highs it set in late May, the fiscal stimulus taps in the US remain firmly jammed in the ‘open’ position, with the national debt forecast to expand by around $1 trillion every 100 days2. This should provide support for the gold price, resulting in a favourable earnings environment for Kinross and Newmont, the fund’s other gold miner.

Mitsubishi Heavy Industries (up 12%)

That Mitsubishi Heavy Industries is a beneficiary of a significant rise in global defence spending is already understood. Its exposure to growing demand for reliable sources of low-carbon energy needed to power AI data centres is perhaps less familiar but it is starting to gain the attention of investors. Mitsubishi Heavy has a de-facto monopoly on nuclear power in Japan, where attitudes towards atomic energy have been transformed over the last two years. Last year, Prime Minister Kishida’s government said it will utilize renewables and nuclear “to the fullest extent.” Mitsubishi Heavy also has a 33% share of the global market for gas turbine combined cycle (GTCC) power plants. These are the most efficient power plants of their kind in the world. It is also developing carbon capture technologies, which could, in future, be paired with GTCCs to significantly reduce carbon emissions.

HSBC, Commerzbank (up 16% and 13%)

Financials have continued to generate strong excess returns for the portfolio. HSBC and Commerzbank were particularly strong performers over the quarter. HSBC announced another £3 billion of share buybacks while Commerzbank rallied in line with other European financials. Despite the strong run of performance from European banks over the last 12 months, the returns on offer to shareholders remain compelling. UBS forecasts that the 2024 ‘distribution yields’ (dividends plus share buybacks) for HSBC and Commerzbank will be 13% and 15% respectively.

What didn’t work

Ryanair (down 20%)

Ryanair’s share price fell sharply after it lowered guidance for fares over the summer holiday season. Projected price increases in the 5-10% range were lowered to a range of 0-5%, resulting in earnings downgrades and ending a strong run of performance for the shares. We think that, over the longer term, the investment story here remains attractive, given that demand for travel remains resilient and capacity remains constrained relative to its pre-pandemic levels.

Tenaris (down 20%)

Tenaris shares fell despite its earnings significantly beating expectations, as the market was disappointed by its guidance. Although we shared that disappointment, a number of factors remain in Tenaris’ favour. Its shares trade on a price-to-earnings multiple of less than 6x and offer a 13% free cashflow yield. It is also buying back its own shares: the third tranche of its $1.2 billion buyback programme began in June. It is, meanwhile, one of very few Western producers of high-quality steel tubes used by the energy industry. Quality is increasingly important in an industry whose environmental impact is being scrutinised closely: for example, the cost to stakeholders of a pipe rupturing in the sea would be enormous.

Rheinmetall (down 9%)

Rheinmetall was caught up in the sell-off that swept across the European market when the far right made gains in EU elections. This was despite the fact that the company announced two significant orders from the German defence ministry during the quarter. One, for military trucks, was worth €3.5billion; the other, for ammunition, was worth €8.5billion – its largest-ever order. As the 90% rise in its share price over the past 12 months suggests, expectations for Rheinmetall have increased significantly. But these latest orders provider a reminder that the grim conflict in Ukraine continues to consume military hardware. This provides a structural tailwind to demand for defence companies. At the end of the quarter, it traded on a forward price-to-earnings multiple of 19%. So its shares certainly aren’t cheap. However, consensus estimates suggest that its earnings per share will grow by 63%, 35% and 30% in 2024, 2025 and 2026 respectively. This is faster than many AI beneficiaries, so we would argue that this multiple is justified.

Activity & positioning

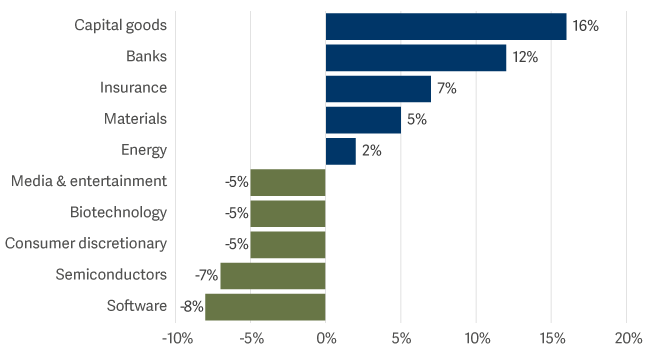

Broadly speaking, the fund’s top-level positioning did not change over the quarter. It continues to have significant overweight positions in industrials (particularly defence stocks) and financials (particularly banks). It still has material underweights to (expensive) technology companies and in a number of traditional income sectors such as tobacco, fast-moving consumer goods and real estate.

Active sector allocation vs MSCI AC World Index

| Top Five Overweight Stocks | Fund | MSCI ACWI |

| Mitsubishi Heavy |

4.19% | 0.05% |

| BAE Systems | 3.56% | 0.07% |

| HSBC | 3.14% | 0.22% |

| Samsung | 3.07% | 0.44% |

| Rheinmetall | 2.61% | 0.03% |

| Top Five Underweight Stocks | Fund | MSCI ACWI |

| Microsoft | 0.00% | 4.28% |

| Apple | 0.00% | 4.19% |

| Nvidia | 0.00% | 4.19% |

| Alphabet | 0.00% | 2.73% |

| Amazon | 0.00% | 2.45% |

Sell BBVA; Buy Banco BPM and Caixabank

We sold BBVA, which had performed well since we invested in it towards the end of 2022. We recycled the capital into two smaller European banks: Banco BPM and Caixabank. In effect, we sold a bank that is looking to acquire one of its peers (BBVA recently made an approach for Sabadell) and shifted into two banks that have the potential to become bid targets.

Buy BNP Paribas, AXA and Vinci

Share prices across the European market fell in the wake of a surge in popularity for the far right. A snap election in France saw spreads on French government bonds widening sharply, putting banks under particular pressure. Vinci’s shares, meanwhile, fell on concerns around what a Le Pen government might mean for its toll-road monopoly (nationalisation had been discussed by the National Rally in its 2022 manifesto).

On balance, we viewed the sell off as a buying opportunity. Our interpretation of the first round of the French election was that National Rally would be unlikely to secure a majority and that the centre would retain more seats than some commentators feared. The second round of voting resulted in a hung parliament, with centre-ground and left-wing parties combining to keep the far right out of power. France now likely faces a long period of tense negotiations to form its next government and political gridlock thereafter. The good news is that the threat of radical policies (such as the nationalisation of Vinci) has receded for now.

Buy GE Vernova

GE Vernova is the number-two player in the global market for gas turbines behind another of the fund’s holdings: Mitsubishi Heavy. It also manufactures wind turbines, energy storage and grid solutions and is therefore a beneficiary of structural growth in demand for clean energy.

Buy Oracle

Oracle is focused on expanding its cloud infrastructure unit, which rents computing power and storage to AI companies such as OpenAI. Despite being a direct beneficiary of AI spending boom it trades on a more reasonable valuation (23x forward p/e at the quarter end) than many of the market’s favourite AI names.

Sell Petrobras, Banco do Brasil

As capital began to flow back into Chinese equities, we reduced our exposure to Latin America, exiting Banco do Brasil and reducing Petrobras, both of which had begun to weaken.

Outlook

In the wake of the US presidential debate, a second Trump presidency now seems more likely. This could result in a radical shift in both US domestic and foreign policy. And while the advance of the far right in France has been largely thwarted, anti-establishment political parties continue to grow in popularity in Europe. The success of political populism more broadly suggests that government finances across the developed world will remain a cause for concern.

We still believe that we are in a radically different economic and market regime to the one that prevailed prior to the pandemic and that inflation and interest rates will be structurally higher going forward. Nevertheless, the more mixed data that has emerged on the US economy offers a reminder that there will be times when inflation and rates move lower. We do not believe, however, that we are returning to a world of zero rates and deflationary worries.

We have talked about the structural challenges faced by traditional ‘core income’ sectors for a number of years, but if a recession is around the corner and interest rates are cut meaningfully, it could be that some of these sectors start to look interesting again given valuations have fallen substantially. This is something we are monitoring closely.

Against this backdrop of unpredictability, many equity markets look expensive. Our benchmark, the MSCI AC World Index trades on 22x earnings. Our portfolio trades on a significant discount: 14x. This does not come at the expense of quality or growth, however, at around 15%, forecast growth in earnings per share for both our portfolio and the index are comparable.

2U.S. Debt Interest Payments Reach $1 Trillion (visualcapitalist.com)

Source: Lipper Limited/Artemis as at 30 June 2024 for class I accumulation GBP. All figures show total returns with dividends and/or income reinvested, net of all charges. Performance does not take account of any costs incurred when investors buy or sell the fund. Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class. Classes may have charges or a hedging approach different from those in the IA sector benchmark. Benchmarks: MSCI AC World NR GBP; A widely-used indicator of the performance of global stockmarkets, in which the fund invests. IA Global Equity Income NR: A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. These act as ’comparator benchmarks’ against which the fund’s performance can be compared. Management of the fund is not restricted by these benchmarks.