UK equities: key questions for income investors

Andy Marsh, co-manager of the Artemis Income Fund, addresses some of the key questions facing UK equity income investors and explains how he and his co-managers are reflecting these in their management of the fund.

One of the key questions for UK equity investors is what the catalyst will be for UK shares to start performing better. What’s your view?

Given the shrinking pool of domestic capital, we think it will be the return of international investors that will prove to be the catalyst for better performance from UK equities. With a more stable currency, an economy that is more robust than expected and a falling political risk premium, we can say with increasing confidence that the UK is no longer a structural outlier with respect to its macroeconomic credentials.

Although we know the strength of the domestic economy is of limited importance to the success of many UK companies, in the eyes of the international investor it is significant. As a result, as the UK’s problems ease, its equities are beginning to look increasingly attractive to global investors.

Add these factors to low valuations and plentiful share buybacks and we expect this better run for UK shares to continue.

What do you think about the trend in share buybacks in the UK market?

One of the things we have seen over the years is that share buybacks come and go. They are often used cynically, either to offset share issuance (often to employees or for acquisitions), to add debt to the balance sheet or just to support the share price. But what we have seen recently is different. The share buybacks are on a much bigger scale than previously. They are being done out of the current year’s cashflow and are not adding debt to the balance sheet.

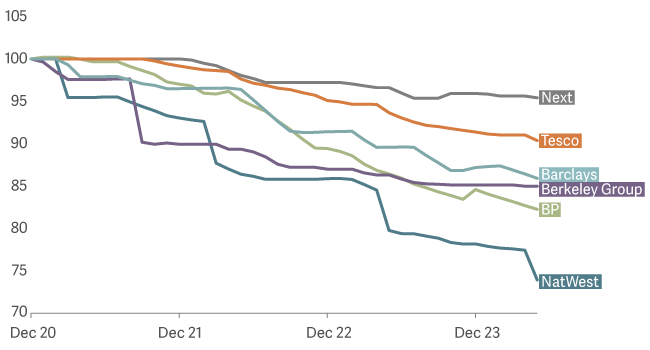

This is a trend we see across the UK market. The likes of Shell and NatWest (which have bought back 17% and 26% of their respective share counts since the beginning of 2021) are gobbling up their own shares and 60% of our portfolio by value have bought back shares in the past year.

When companies buy back shares on very cheap valuations, this can create outsized returns. If a share is trading at a single digit price-to-earnings multiple, a company can eat into its share count very quickly and drive up cashflow and dividends per share as a result.

An interesting example is Tesco, which trades at a high-single-digit free cashflow yield and a c.4% dividend yield with the balance of cash being returned to investors through share buybacks. Last year we increased our ownership of Tesco by 5% without lifting a finger, just because of share buybacks.

UK companies are eating themselves

What do you think about the trend of UK companies moving their listing to the US?

We’ve spoken to a few companies about this. It’s a real consideration for some companies, but the expected premium to valuation has to be worth the effort. Before seeking a US listing, we would argue that UK companies need to get better at marketing themselves internationally because attracting overseas investors could boost their valuations. We’ve seen a couple of examples of this recently, with more of our portfolio companies doing US roadshows.

We would also add that for our fund, we can hold up to 20% in overseas assets, so if a favoured stock moved its listing, we could continue to hold it.

For income investors, an above-average dividend is key. How do you go about managing the income in your fund?

Our mantra is cashflow first, dividends second. We’re looking for mispriced long-term cashflows over three-to-five years. We invest in companies that are creating value for all stakeholders, not just shareholders. We have diversification across the fund so as not to be overexposed to any one factor or sector.

The portfolio is something of a ‘sliding scale’ of different levels of yield and cashflow growth. At one end, you might have a company with a high single-digit yield with lower expected growth, and at the other a company with a lower yield but that can deliver higher growth. This leads to a diversified portfolio that can deliver attractive income and total returns in a range of market environments.

What have you recently added to the portfolio?

Lloyds: Over 10 years of quantitative easing, ultra-low interest rates, litigation and rebuilding capital resulted in a challenging period for UK banks. But interest rates are higher now and capital positions have significantly improved. As a result, the banking sector’s earnings power has been transformed and much of these earnings are being distributed to shareholders through dividends and buybacks. As well as buying Lloyds, we added to existing positions in NatWest and Barclays.

Shell: We switched some of our holding in BP into Shell, given its marginally lower debt and strong position in liquefied natural gas (LNG). The argument that LNG will be an important transition fuel carries significant merit, in our view. We would also note that Shell trades at a substantial discount to its US peers in a sector that is by definition commoditised and so lacks significant differentiation.