Artemis Strategic Bond Fund update

The fund's managers review a quarter in which strong returns from its holdings in investment-grade and high-yield bonds saw the Artemis Strategic Bond Fund generating a positive return – and outperform its peers.

Source for all information: Artemis as at 31 March 2024, unless otherwise stated.

- In a choppy quarter for bond markets, the fund generated a positive return of 1.3%, outperforming the 0.9% return from its peer group.

- As credit spreads narrowed, the fund’s holdings in high-yield and investment-grade credit made a healthy contribution to returns.

- Despite worries over the ‘stickiness’ of inflation, we still expect that central banks will begin cutting rates this year.

The exuberance that characterised bond markets in the final weeks of 2023 faded

Towards the end of last year, markets rushed to embrace the idea that the Federal Reserve was poised to begin cutting interest rates – and that it could make as many as six rate cuts in 2024. The new year, however, brought a steady succession of strong GDP releases in the US and more evidence that inflation (particularly for services) remains ‘sticky’. The combined effect was to fuel worries that rates might need to stay higher for longer than markets had hoped. So, while conditions were choppy, the overall trend was for yields on government bonds to move higher, pushing their prices lower.

While central banks have pushed back against cutting rates too early, our broad view remains unchanged. Now that rate hikes are a thing of the past, it becomes a question of when and by how much interest rates will fall. In that regard, the past quarter has been a significant one:

- We had the first rate cut of this cycle by a developed-market central bank (Switzerland).

- The more hawkish members of the Bank of England’s monetary policy committee are no longer voting for rate hikes and its governor indicated that lower rates in 2024 are in line with his view.

- The ECB suggested that June was in play for the first cut.

- The Bank of Japan extricated itself from negative rates but provided a very measured, dovish guidance on its future policy decisions.

- Other central banks (Australia and Sweden) adopted a more dovish tone on rates.

It was a good quarter for performance in both absolute and relative terms

Although yields on government bonds rose, we saw strong spread compression across credit markets. A combination of strong demand, a dearth of new issuance and the supportive economic environment created ideal conditions for credit spreads – the premium companies pay to borrow relative to governments – to tighten.

So, helped by strong returns from its investment-grade and high-yield credit positions, the fund was able to deliver a positive absolute return of 1.3% on the quarter, outperforming the average return of 0.9% from its peer group, the IA’s £ Strategic Bond sector.

| Q1 2024 | Since Sept 20211 | One year | Three years | Five years | 10 years | |

|---|---|---|---|---|---|---|

| Artemis Strategic Bond Fund | 1.3% | -3.1% | 8.5% | -0.8% | 9.2% | 33.0% |

| IA Strategic Bond | 0.9% | -5.2% | 7.1% | -2.2% | 8.1% | 27.2% |

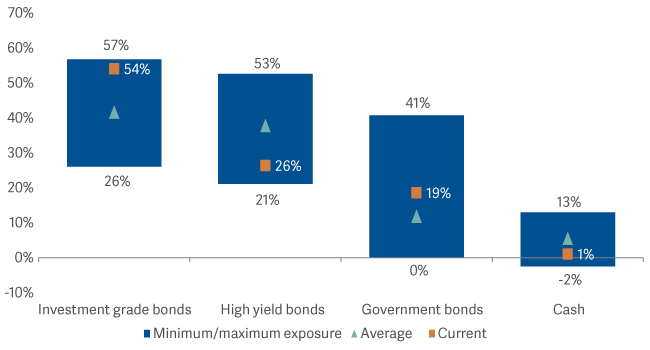

Government bonds (17% of the fund)

After generating strong returns in the fourth quarter of 2023 the fund’s government bond component showed a modestly negative return as markets repriced their expectations for rates and as supply increased, putting valuations under pressure. The biggest negatives for the fund’s relative returns over the quarter were its holdings in longer-dated US and UK government bonds.

To outline how the fund’s duration – its sensitivity to rates – has evolved:

- In line with our structural view that the hiking cycle was over, we began to increase the fund’s duration as 2023 progressed. Heading into the Fed’s pivot in December, the fund’s duration was above 6 years.

- The Fed’s dovish pivot provoked a sharp rally in government bond markets in December. We then reduced duration risk heading into end of 2023. The fund entered 2024 with 5.7 years of duration.

- As yields moved higher again through January and February, we increased duration again, taking it up to a peak of 6.7 years by late March.

- A dovish sequence of central bank decisions and statements then followed, sending yields lower. At that point, we believed markets had fairly re-priced expectations for rate cuts this year, so we felt it prudent to take duration down a little and reduced it to 6.3 years by the end of the end of the quarter.

How the fund was positioned at the end of the quarter

Investment-grade corporate bonds (57% of the fund)

In contrast to the weakness in government bond markets, credit markets proved resilient. As spreads narrowed, we saw positive returns across our investment-grade portfolio.

In January, the fund had rotated away from investment-grade euro-denominated holdings into sterling. This worked well given relatively attractive valuations in the sterling credit market and the favourable technical backdrop.

In terms of activity, the new issue market began to warm up towards the end of the quarter. We participated in a range of deals, including those from: Virgin Money; Southern Water; Coventry Building Society; Telereal; Anheuser-Busch; Land Securities; KBC; Nestle; Northumbrian Water and Paradigm Housing Association.

Within our financials, meanwhile, we added exposure to UBS, Citigroup, and French banking cooperative group, BCFM. We sold positions in Swedbank, Morgan Stanley, and UK specialist lender, Close Brothers, where we had increasing concerns around regulatory scrutiny of its auto-finance activities.

In the secondary market, we reduced our exposures to hybrid perpetual bonds from Vodafone and Bayer. We sold our holding in US media giant Warner.

Volatile markets often throw up interesting relative value opportunities. Accordingly, we completed two ‘switches’ in the generic pharmaceuticals space, moving out of the euro-denominated bonds of both Teva and Cheplapharm and into their US dollar-denominated equivalents. This allowed us to increase yield without adding risk.

High-yield bonds (27% of the fund)

Although we increased the fund’s allocation to short-dated high-yield bonds during the quarter, our exposure to high-yield bonds remains below the fund’s long-term average. Within our high-yield allocation, we added to some of our highest-conviction positions:

- Copeland dominates its sector globally and has a highly attractive business model with recurring revenues. Some 80% of its revenues arise from the replacement of mission-critical compressors used in refrigeration and HVAC applications.

- Albertsons, a US supermarket chain.

- Avis-Budget, the car hire firm.

- Miller Homes, a UK homebuilder. M&A in the sector is, in our view, further bolstering the already compelling valuation support here.

On the new issue front, we participated in new deals from:

- Sally Holdings, a global distributor of beauty products.

- Kier Group, the UK public sector building contractor.

Outlook: the US Federal Reserve, the Bank of England and the European Central Bank have all stated that they intend to cut rates

Central banks’ stated goal is to prevent financial conditions from becoming too tight as inflation trends lower. They have also indicated that bringing inflation down to target (2%) isn’t a prerequisite for monetary easing to begin. This doesn’t mean that central banks will cut rates aggressively or that they are going to keep cutting if inflation remains stubbornly high. But it does suggest that the consensus amongst the global central banking community is that current policy rates are very far from ‘neutral’ even if their assessment of what represents a neutral rate could be revised higher.

Services inflation is sticky, but we shouldn’t mistake stickiness for reacceleration.

That inflation got so far above target was due to a price-wage spiral. Prices accelerated rapidly as supply chains collapsed due to Covid, with demand remaining intact thanks to fiscal support. Ballooning prices spurred wage demands and wage agreements given tightness in the supply of labour.

More recently, however, goods prices have been falling and headline inflation will continue to trend lower into the middle of the year. Those arguing for bigger wage rises are now on a significantly weaker footing and wage growth will follow headline prices lower.

That’s not to say that wage growth will collapse, but the trend is clear: it is for lower wage gains in 2024. So, while services inflation remains sticky, and wage growth remains well above pre-Covid average, the direction of travel is consistent with continued softening, albeit more slowly than central banks might prefer.

Central banks’ recent communications endorse our belief that they are certain policy is too tight. They have made it clear that the next move will be lower

It is true that economic outcomes have been slightly better than expected in the UK. Survey indicators, meanwhile, have recently pointed higher.

But the reality is the UK economy stumbled into the end of 2023. That leaves the MPC concerned that policy is far too tight at current levels. This is a view we tend to share.

While consumers still enjoy considerable real income gains from falling inflation, government spending will come under pressure. Governments are having to fund extraordinary deficits and historically high debt levels at high interest rates. So fiscal policy is a headwind.

To an extent, domestic demand can be supported through rising real incomes and stronger household consumption. But it is going to be difficult for the US consumer to maintain elevated consumption as the real income boost fades in 2024. There is the potential for the US to recouple with the UK and the eurozone, converging towards a more modest pace of growth this year.

Central banks are alert to this, and the recent communication endorses our belief that they are quite sure policy is too tight.

Source: Lipper Limited/Artemis from 31 December 2023 to 31 March 2024 for class I quarterly accumulation GBP.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Classes may have charges or a hedging approach different from those in the IA sector benchmark.

Benchmark: IA £ Strategic Bond NR; A group of other asset managers’ funds that invest in similar asset types as this fund, collated by the Investment Association. It acts as a ‘comparator benchmark’ against which the fund’s performance can be compared. Management of the fund is not restricted by this benchmark.