Artemis Corporate Bond Fund update

Stephen Snowden and Grace Le, managers of the Artemis Corporate Bond Fund, report on the fund over the quarter to 30 September 2024 and their views on the outlook.

Source for all information: Artemis as at 30 September 2024, unless otherwise stated.

Performance

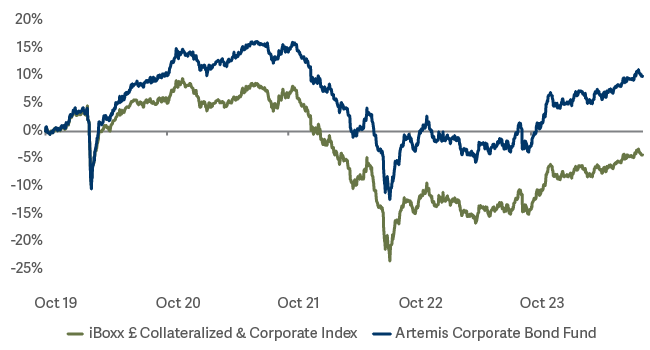

The third quarter passed without too much drama and brought a gradual move lower in bond yields. With a return of 2.6%, the fund added another tranche of outperformance relative to its benchmark index and its peer group. Good credit selection in the financial and real estate sectors was once again key to that strong performance.

The fund is now more than a percentage point ahead of the benchmark index over the year to date and is almost six percentage points ahead of the index over three years.

| Three months | Year to date | One year | Three years | Since launch (*) | |

|---|---|---|---|---|---|

| Artemis Corporate Bond Fund | 2.6% | 3.3% | 12.6% | -3.5% | 10.0% |

| iBoxx £ Collateralized & Corporate index | 2.4% | 2.1% | 11.0% | -9.3% | -4.2% |

| IA £ Corporate Bond | 2.5% | 3.1% | 11.1% | -5.7% | 0.1% |

Performance since launch

A challenging quarter for water companies – and German car manufacturers

In part, the water sector’s poor performance over the quarter was due to cheap new issues from Welsh Water, Anglian Water and Yorkshire Water. The pattern we saw was a familiar one. The sector sold off as new deals were announced as pricing readjusted to reflect the wider spreads at which the issuance was being offered. The sector then stabilized and spreads recovered somewhat, with the newly issued bonds tending to outperform in the recovery.

Our policy over the last two years has been to run with relatively modest exposure to the water sector but to buy into (cheap) new issues, hold them briefly before selling them for a profit. This is a dance we have repeated numerous times and it has worked well. Eventually, it will be time to buy and hold water-company bonds – but we are not there yet. The water sector is an easy target for a government which is already unpopular with voters. So it may still be too soon to close this underweight.

It was also a challenging quarter for German car manufacturers, to which the fund had zero exposure. Given that all three major brands (BMW, VW and Mercedes) have now warned on profits, that was helpful. We should not overstate the weakness, however: spreads only widened by c15 basis points over the quarter.

Activity

New issuance was sparse through July and August but picked up in earnest in September. The fund bought into several of these new issues. At the end of the quarter, we still held newly issued bonds from:

- Anglian Water Services

- Comcast

- CPI Property Group

- East of Japan Railway

- Dwr Cymru Financing

- Great Portland Estates

- Haleon

- ING Group

- Land Securities

- MassMutual Global

- Nordea Bank; and

- Pearson.

Meanwhile, we made a number of switches between different bonds from the same issuer. These switches included Centrica, CPI Property Group, EDF, ING Group, Land Securities, Motability, Rothesay and across the UK water companies.

We sold our holding in Bayer in September. Its legal problems, which largely arose from its disastrous acquisition of Monsanto, have ebbed and flowed over the years. Of late, the judgements have been in Bayer’s favour and its bonds have performed well. But we are conscious that Robert F. Kennedy Jr (RFK), who has been at the forefront of pursing Bayer for damages, has joined Donald Trump’s team. While the result of the election is too close to call, a Trump victory would likely to be an incremental negative for Bayer.

We sold the fund’s remaining exposure to French banks. The political situation in France is clearly not helpful for the country’s perennial deficit problems and French government bonds have weakened in sympathy. Despite that, French corporate bonds have proven to be immune to the weakness in the sovereign market thus far. It seems prudent to move on in case that doesn’t last.

Outlook

Yields, technicals and fundamentals all appear supportive but valuations are not cheap…

Yields

In our view, the prospects for corporate bonds look good heading into the year end. Most obviously, their all-in yields look healthy. That matters – especially when interest rates are being cut.

Yields look attractive

Technicals

The technical setup in the investment-grade market appears to be strong. Despite a surge in new issuance in September, corporate bond spreads moved only slightly wider over the quarter. New issuance was easily absorbed and there appears to have been little selling in the secondary market to pay for it.

Typically, a post-summer seasonal ‘wobble’ in response to September’s new issuance will last to mid-October before a straight-line tightening in credit spreads through to the end of the year, when issuance tends to drop away. That spreads this year have already begun to recover we regard as a bullish signal. Market technicals appear to be strong.

Fundamentals

Fundamentally, meanwhile, things look supportive for risk assets. Central banks are mostly in rate-cutting mode (albeit not at a uniform pace) and markets typically respond well to that. We can debate the incremental effectiveness of China’s policy stimulus, but it would appear to be positive in the near term. There are pockets of concern, but they aren’t new. While auto companies have been issuing profit warnings, the weakness was easy to predict. And while their credit spreads have widened, these companies are far from being in trouble. Weak car sales are a classic sign of consumer fragility – but airports and holiday resorts are full. Perhaps people are using the time by the pool to decide whether to make the leap to electric vehicles.

Valuations

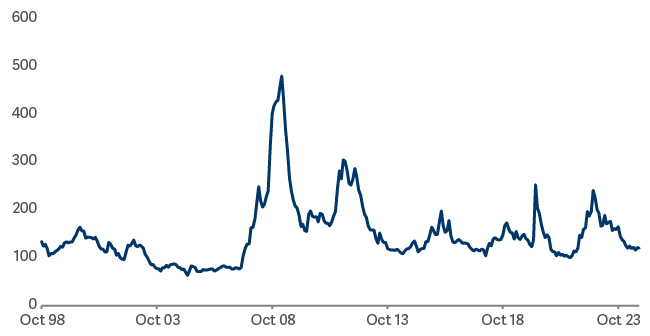

The one challenge to this otherwise bullish backdrop for corporate bonds are their relative valuations. Spreads are such that corporate bonds do not appear outright cheap. Equally, however, with spreads at around 120 basis points relative to gilts, they aren’t hitting the rev-limiter either. If spreads were narrow to 100 basis points over gilts, then valuations would be a higher hurdle to clear.

ICE BofA Sterling Corporate & Collateralized Index - Spread to Worst

Benchmarks: iBoxx £ Collateralized & Corporates Index; A widely-used indicator of the performance of sterling-denominated corporate investment grade bonds, in which the fund invests. IA £ Corporate Bond NR; A group of asset managers’ funds that invest in similar asset types to the fund, collated by the Investment Association. These act as ‘comparator benchmarks’ against which the fund’s performance can be compared. Management of the fund is not restricted by these benchmarks.