Artemis Global Income Fund update

Jacob de Tusch-Lec and James Davidson, managers of the Artemis Global Income Fund, report on the fund over the quarter to 31 December 2024 and their views on the outlook.

Source for all information: Artemis as at 31 December 2024, unless otherwise stated.

Review

The year ended on a positive note for global equity markets thanks, in part, to the clarity of the US election result. Donald Trump’s comprehensive victory prompted investors to anticipate a market-friendly agenda of tax cuts and deregulation. On a sector level, financial stocks were clear beneficiaries of the ‘Trump trade’; banks are expected to benefit from tax cuts, de-regulation and an increase in dealmaking. Mega-cap technology stocks, meanwhile, continued to deliver extremely strong growth earnings – and gains for their shareholders.

Set against that, materials stocks were held back by doubts over the adequacy of China’s efforts to support demand. Elsewhere, pharmaceutical companies came under pressure as President-elect Trump selected noted vaccine sceptic Rober F Kennedy Jr to lead the US Department of Health and Human Services.

Performance

With a return of 5.8% in sterling terms over the quarter, the fund marginally underperformed the benchmark MSCI AC World Index, which returned 6.0%. At the same time, however, it significantly outperformed its IA peer group, where the average return was just 1.5%.

Over the year as a whole, the fund was significantly ahead of the index, returning 26.8% versus 19.6% from MSCI ACWI. This was despite its significant underweighting to the US and, within that, to mega-cap technology stocks, which were once again the dominant drivers of returns from market indices over the year.

In addition to outperforming the index, the fund was the IA Global Equity Income sector’s best performer in 2024. This points to the lack of commonality between our portfolio, the index and the majority of global equity income funds.

After a strong year for returns in both absolute and relative terms, we are wary of complacency. We cannot necessarily depend on the areas of our portfolio that underpinned its outperformance in 2024 to drive its returns in 2025. For example, while the outlook for defence companies remains extremely robust, there is less scope for their shares to be re-rated than there was a year ago. For similar reasons, we have reduced the fund’s exposure to gold miners. We increasingly look to modestly rated, dividend-paying stocks in other areas of the market – particularly financials – to drive returns in the months to come.

| Q4 2024 | One year | Three years | Five years | |

|---|---|---|---|---|

| Artemis Global Income Fund | 5.8% | 26.8% | 35.6% | 72.1% |

| MSCI AC World | 6.0% | 19.6% | 26.8% | 70.8% |

| IA Global Equity Income | 1.5% | 11.2% | 20.5% | 49.3% |

Contributors

Siemens Energy

Siemens Energy made the biggest contribution to the fund’s returns over the quarter. It was also one of the best performing stocks in the European market in 2024. Like another of our holdings, Mitsubishi Heavy Industries, it is a beneficiary of the rapid growth in orders for gas turbines; the datacentres on which generative AI relies are highly energy hungry. Siemens Energy is also witnessing a surge in demand for the equipment needed to build and upgrade power grids and integrate a greater proportion of renewables into the energy mix.

Rheinmetall

The war in Ukraine and ongoing geopolitical tensions worldwide mean governments are racing to replenish their depleted stockpiles of ammunition and to modernise their armed forces. This dynamic has seen Rheinmetall’s earnings per share growing at an annual rate of between 30% and 40% in each of the last three years, outpacing many technology companies. If it closed its order books today, its factories would still be busy for the next six years. We do not believe the structural factors underpinning demand for tanks and ammunition are about to fade. But we are conscious that Rheinmetall’s shares have re-rated to a price-to-earnings multiple of 21x1, encouraging us take profits and reduce the size of the position.

Banco BPM

European banks remain a significant theme in the portfolio, reflecting the attractive cash returns they offer through a combination of dividends and share buybacks. The potential upside from M&A is the icing on the cake. With more than 5000 lenders, the European banking industry is ripe for consolidation. In November, Banco BPM became the subject of a surprise all-share takeover bid from Italian peer UniCredit worth €10 billion. While the company’s board rejected the bid, the potential for it to play a part in the consolidation in the European banking sector has not disappeared. In December, Crédit Agricole increased its holding and now owns 15% of Banco BPM’s shares.

Equitable Holdings, Baker Hughes, Tenaris, GM

Some elements of the portfolio were clear beneficiaries of the ‘Trump trade’. They included US financials (such as Equitable), energy services companies (Baker Hughes and Tenaris) and autos (General Motors).

Detractors

Tesla, Nvidia, Amazon, Apple, Alphabet and Broadcom (not held)

Six of the 10 biggest negatives for the fund’s relative returns over the quarter came from not owning mega-cap US technology stocks. Most of these stocks do not pay (meaningful) dividends and, while their earnings growth has been impressive, that is fully reflected in the valuation multiples on which their shares trade. All of these stocks posted strong returns and, given their growing dominance in global indices, this was a headwind for the fund’s relative returns.

Commerzbank

Shares in the German lender pulled back in response to UniCredit’s surprise bid for Banco BPM, which the market believes made it less likely to bid for Commerzbank. That may be true, but given the size of the stake UniCredit has already amassed (it owns around 20% of its shares) a takeover bid at some point would appear to remain on the table. Commerzbank’s shares are, however, likely to drift a little until the outcome of the German election becomes clear.

Activity and positioning

The fund’s positioning did not change materially over the quarter. It continues to have significantly less invested in ‘core income’ stocks (12%) relative to its own history (the average since its inception has been 39%). Traditional income-paying stocks in areas such as real estate, pharmaceuticals and consumer staples tend to employ high levels of leverage (debt) and perform better when interest rates are low, and the economy is weak.

The fund also remains highly differentiated relative to the IA Global Equity Income peer group. Our calculations indicate that the overlap in holdings between our fund and average global equity income fund is just 7%.

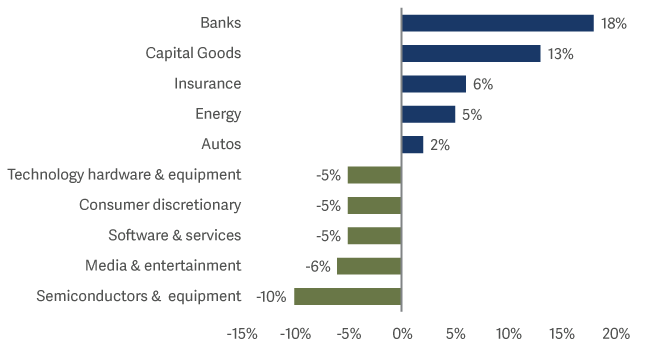

Active sector allocation vs MSCI AC World Index

| Top Five Overweight Stocks | Fund | MSCI ACWI |

|---|---|---|

| Siemens Energy | 3.84% | 0.04% |

| Mitsubishi Heavy | 3.84% | 0.06% |

| General Motors | 3.52% | 0.08% |

| Oracle | 3.74% | 0.36% |

| Commerzbank | 2.94% | 0.02% |

| Top Five Underweight Stocks |

Fund | MSCI ACWI |

|---|---|---|

| Apple | 0.00% | 4.91% |

| Nvidla | 0.00% | 4.25% |

| Microsoft | 0.00% | 3.84% |

| Amazon | 0.00% | 2.67% |

| Alphabet | 0.00% | 2.67% |

Buy: Hon Hai

Hon Hai assembles servers containing Nvidia’s AI chips. It thereby gives the fund some exposure to the boom in AI spending at a significantly more palatable valuation multiple (its price-to-earnings multiple of 12x) than higher-profile AI beneficiaries. It also pays a 4% dividend yield.

Buy: Trump-sensitive US equities

We added to holdings in a number of US financial stocks (Wells Fargo and Capital One), autos (GM) and construction (Fluor, CRH). All of these companies could potentially benefit from President Trump’s deregulation efforts and from attempts to increase America’s domestic manufacturing capacity. Despite these additions, however, the fund remains materially underweight in the US, with just 31% of our portfolio invested there versus 67% of the benchmark.

Buy: HSBC, Ping An, People’s Insurance Co

We increased the fund’s exposure to China in response to the stimulus measures unveiled by Beijing. These additions give the fund exposure to the growth – and growing wealth – of China’s middle class. Valuation multiples have plenty of room to rise and, in the meantime, their dividend yields are attractive.

Reduce: Vinci, AXA

This move was less about valuations, which remain compelling, than it was an acknowledgment that ongoing political noise and uncertainty in France could eclipse their underlying fundamentals.

Sell: Kinross Gold, Newmont

Having made impressive gains in the first half of 2024, the share prices of gold miners began to catch up with the gold price. As result, their valuation multiples are less attractive than they were a year ago. It seems prudent to lock in profits and recycle capital.

Outlook

Our observations heading into 2025 are that.

(i) After two consecutive years of extremely strong returns, equity markets are expensive. Our benchmark, the MSCI AC World Index, is close to an all-time high and trades on 23x earnings. On a price-to-book basis, the S&P 500 has never been as expensive as it is today.

(ii) The bond market is indicating that there is a bigger risk that inflation surprises to the upside than to the downside. Unusually, bond yields have risen significantly since the Fed first cut rates and the US fiscal deficit is continuing to grow.

(iii) Sentiment has rarely been this bullish. Confidence among US consumers that the stockmarket will rise over the next 12 months is at an all-time high.

(iv) President Trump’s hostile rhetoric towards US allies such as Canada and Greenland offers a reminder that his administration is likely to be unpredictable.

Given all this, exercising a degree of caution seems prudent. Economic growth in the US is still strong – and our portfolio reflects that. But given high expectations and elevated valuation multiples, we must be mindful of the risks of disappointment. Equally, we need to find pockets of safety without relying too heavily on traditionally ‘defensive’ areas of the market. Consumer staples companies tend to be highly levered and are not growing their dividends. The real estate sector is also under pressure due to the prospect of ‘higher for longer’ rates. So, we need to think quite critically about what constitutes a defensive stock in this environment.

Given this unpredictability, we take comfort from the significant discount on which our portfolio trades relative to the wider global market. Our portfolio trades on an average P/E of 14x versus 23x for the MSCI AC World Index. The discount has rarely been this wide. It also generates a dividend yield of around 4%. This is roughly double the dividend yield on the wider market and is well supported by a free cashflow yield of almost 7%.