Small-cap catalyst? You’re asking the wrong question

An obsession with what is going to increase earnings or bump up the share price in the short term drastically reduces the investable universe of UK smaller companies and potentially overlooks the main drivers of long-term returns, according to Mark Niznik and William Tamworth.

In the past few years of lacklustre returns for UK small caps (smaller companies), we have regularly been asked what the eventual catalyst for outperformance will be. We shouldn’t have been surprised. This is what many investors ask when analysing individual smaller companies. In both cases, we think they are asking the wrong question.

An obsession with what is going to increase earnings (profits) or bump up the share price in the short term drastically reduces the investable universe and potentially overlooks the main drivers of long-term returns.

These include merger & acquisition activity (from the start of 2019 to the end of 2024, 35 portfolio holdings in our open-ended fund were taken over at an average premium of 48%1), share buybacks2 (currently at the highest levels I can remember3) and reinvesting free cashflow (the money left over after everyone has been paid) to benefit from compounding growth.

Growth doesn’t work in small caps

There is another problem. Pinning your hopes on a catalyst means pinning your hopes on the growth style of investing (companies expected to grow faster than the underlying stockmarket), which is often associated with small caps.

It isn’t difficult to see why. In the same way that rock stars will attract an entourage of hangers on, small-cap growth stocks on a rapid ascent will attract investors hoping for a type of success by association.

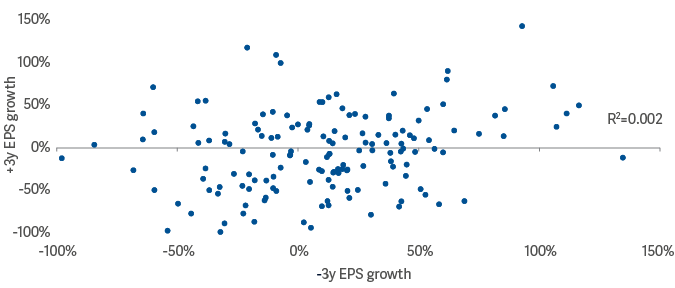

Unfortunately, the comparison with rock stars doesn’t end there. Although there is practically zero correlation between forecast and historic profit growth in small caps4, expectations get elevated until they become impossible to live up to. As a result, their spectacular rise to the top is often matched by the subsequent implosion5.

No correlation between trailing and future earnings growth 2019 constituents for DNSCI XIC

Data from Deutsche Numis shows that the small-cap premium – the amount by which smaller companies in aggregate have beaten larger ones over the long term – is 3.1% per annum6. But if you break down the small-cap market into value (those that are cheaper than the stockmarket) and growth companies, you find the former group has outperformed the latter by 3.7% per annum7. This means investing in a growth strategy cancels out a significant proportion of the small-cap effect.

Despite this, the vast majority of small-cap funds are overweight (a higher-than-average position compared with the underlying stockmarket) in growth, with only a handful either tilted towards value or balanced somewhere between the two8.

Our valuation bias doesn’t mean we are avoiding ‘growth’ – our portfolio’s EPS (earnings [profits] per share) is rising at 12% a year9. It’s just that we are refusing to overpay for it.

Catalyst for the UK

And what of the UK small-cap market as a whole? How can it possibly hope to outperform without a catalyst?

Well, when people talk about a catalyst, do they mean falling interest rates?10 Above-inflation pay rises?11 Economic growth?12 All of these are coming through, yet the more domestically focused small-cap end of the market remains on a discount to the larger end, which itself remains on a discount to the rest of the world13.

Perhaps most important is political stability, which allows companies to plan for the future.

Following the Budget, there was a sense of uncertainty around how increases to national insurance and the minimum wage would affect businesses.

Our preference for market leaders means most companies in our portfolio should be able to pass these additional costs on to customers. Take a holding such as JD Wetherspoon, which you might imagine would be one of the worst affected: the discount on what it charges for drinks has grown wider compared with other high street pubs over the past couple of years, giving it plenty of room for manoeuvre14.

Not just visible in hindsight

The policy changes announced in the Budget are likely to have a modest inflationary impact. This cements our view that although interest rates are on the way down, we believe they will not return to the near-zero level of the 2010s when ‘growth at any price’ emerged as a (paradoxical) investment mantra.

If this is the catalyst you were waiting for, we think you are likely to be disappointed. But we also think the same could be said if you are waiting for any type of catalyst in UK small caps. In our view, outperformance in this area is driven by buying solid companies for a price that underestimates their growth and profitability, then giving them the time for fundamentals to assert themselves.

Unlike so-called catalysts, these metrics aren’t only visible with the benefit of hindsight. We believe that if you fail to grasp this concept, you risk viewing the sector’s long-awaited comeback in the rear-view mirror.

2Share buybacks refer to the reacquisition by a company of its own shares. Instead of paying dividends, it is an alternative way for a company to return money to shareholders.

3Artemis, Bloomberg as at 31 December 2024

4Bloomberg as at 31 December 2023

5Source: Deutsche Numis as at 31 December 2024

6Small caps as represented by the Deutsche Numis Smaller Companies (ex Inv Trust) index. Source Deutsche Numis Indices: 2024 Annual Review by Scott Evans and Paul Marsh

7Source: Deutsche Numis as at 31 December 2024

8Morningstar as at 31 December 2024

9Source: Artemis, Bloomberg as at 31 March 2025

10https://www.bankofengland.co.uk/monetary-policy/the-interest-rate-bank-rate

11Lazarus Economics/ONS as at 30 April 2025

12https://www.theguardian.com/business/2025/may/15/uk-economy-forecasts-growth-first-quarter

13https://www.ftadviser.com/talking-point/2025/3/4/uk-small-caps-are-the-most-unloved-stocks-despite-growth-potential/

14https://www.investors.jdwetherspoon.com/wp-content/uploads/sites/3/2025/01/Q2-Trading-Update-22-January-2025.pdf/https://www.thesun.co.uk/money/27912053/wetherspoons-monday-club/

Market volatility risk – The value of the fund and any income from it can fall or rise because of movements in stockmarkets, currencies and interest rates, each of which can move irrationally and be affected unpredictably by diverse factors, including political and economic events.

Currency risk – The fund’s assets may be priced in currencies other than the fund base currency. Changes in currency exchange rates can therefore affect the fund's value.

Charges from capital risk – Where charges are taken wholly or partly out of a fund's capital, distributable income may be increased at the expense of capital, which may constrain or erode capital growth.

Smaller companies risk – Investing in small companies can involve more risk than investing in larger, more established companies. Shares in smaller companies may not be as easy to sell, which can cause difficulty in valuing those shares.