Artemis Funds (Lux) – Global Equity Income update

Jacob de Tusch-Lec and James Davidson managers of Artemis Funds (Lux) – Global Equity Income, report on the fund over the quarter to 30 September 2023 and their views on the outlook.

- The fund returned -2.7% in the third quarter versus -3.4% from MSCI ACWI.

- Our longstanding overweight in energy stocks helped relative returns, as did our increased allocation to Japan.

- The fund currently has an unusually low level of exposure to classic income sectors such as consumer staples, real estate and utilities.

Performance: markets rarely follow straight lines

Financial markets studiously avoid following straight lines. Before the pandemic ended, we had positioned our portfolio to benefit from a new geopolitical, economic and market regime characterised by (among other things) higher inflation, higher bond yields and deglobalisation. That broad positioning duly proved to be correct: over the last three years, our fund has returned 37.1% versus 22.1% from the MSCI AC World Index.

Inevitably, however, there have been detours, pauses and outright reversals along the way. One such detour occurred in the early part of this year. As 2023 began, there was a brief surge in performance from the long-duration growth stocks that led the market higher in the years of ZIRP and QE. The underlying logic seemed to be that a recession was imminent and would force central banks to stop pushing rates higher and start cutting instead. And although no recession arrived (investors have been waiting for the next recession for as long as Vladimir and Estragon waited for Godot) the collapse of Silicon Valley Bank and fears of contagion prompted central banks to pause in monetary tightening. In the US, the Federal Reserve expanded its balance sheet to help soothe market nerves.

A grateful market rushed to embrace the return of the ‘Fed put’. One consequence was a short but painful underperformance for our fund (not owning the ‘magnificent seven’, whose dividends are either low or non-existent, didn’t help).

| Then... Post-GFC winners (2009-20) | Now... Post-pandemic winners (2021-?) |

|---|---|

| QE | QT |

| Disinflation |

Inflation |

| Technology |

Capital equipment |

| Growth stocks | Value stocks |

|

Peace |

War |

| Globalisation | De-globalisation / autarky |

| Intangibles / intellectual capital | Tangibles / Raw materials |

| Profitless growth | Dividend yields |

Although it was brief, that first-quarter reversal was uncomfortable. Yet because we believed it to be a temporary hiatus rather than a turning point, we retained the fund’s positioning: we did not move into defensives nor did we abandon our bias towards economically sensitive, short-duration value stocks. And, over the last six months, the market has – albeit in fits and starts – rewarded that positioning. In broad terms, it has come to accept that:

- Inflation is not about to fall back to 2%.

- The recession that had been predicted for early 2023 (and then for mid-2023) hasn’t arrived.

- Although interest rates may now be at or near their peak, the Fed is not about to pivot to rate cuts. The market’s grudging acceptance of that fact goes some way towards explaining the extraordinary sell-off in long-dated bonds.

- Deglobalisation, war and geopolitical tension are (sadly) here to stay. More spare capacity is required and spending on military hardware has shifted to a new, significantly higher level.

That broadly describes the world our fund has been positioned to perform in. The market’s reluctant acceptance of those facts underpinned the fund’s outperformance over the quarter: it returned 2.7% versus a fall of 3.4% in the MSCI AC World Index. Within that broad macro template, however, we can highlight a number of themes that underpinned our outperformance:

Strong returns from our Japanese stocks

The two biggest contributors to our outperformance over the quarter were Japanese stocks: Mitsubishi Heavy Industries and MUFJ Financial. In part, that was simply because they are among our largest positions. But it also reflected the economic revitalisation of Japan, evidence of which the fund’s co-manager, James Davidson, observed first-hand during a fact-finding mission to the country in September. Japan has finally broken out of its long deflationary slump but does not face the uncomfortably high rates of inflation seen in many other parts of the world. Meanwhile, in a world where China is no longer working in partnership with the US, Japan is assuming the role of supplier of essential technological components – including advanced semiconductors – to the global economy.

We have more invested in Japan today than at any point since the strategy’s inception in 2010. In an environment where valuations in the US appear stretched and long-term bond yields are rising, Japanese value stocks trading on modest (single-digit) p/e multiples appear to be among the best places for us to hunt for income.

Mitsubishi Heavy Industries (4.1% of the fund, up 26.5%). Earnings came in well above analyst expectations, noting a significant increase in orders in its defence division. Mitsubishi Heavy appears well-placed to deliver double-digit growth in earnings per share over a multi-year time horizon, supported by a number of structural trends including increased defence spending, the resurgence of nuclear power in Japan and the energy transition.

Mitsubishi UFJ Financial Group (3.6% position, up 21.9%). This was a profitable business even when interest rates in Japan were zero. If Japan follows the rest of the world, raising interest rates and abandoning yield-curve control, it would represent a powerful earnings tailwind for MUFJ. In the meantime, its shareholders are seeing an attractive capital return through a combination of dividends and share buybacks.

Our energy stocks bounced back

For reasons we have rehearsed before, our portfolio has a significant overweight to energy stocks. During a long period of austerity in the energy industry, oil and gas fields weren’t replaced and are now depleted; rusting refineries and pipelines need to be renewed and replaced. So energy supplies are tight; it will take years to rebuild capacity. The IEA estimates that c.US $650 billion per year needs to be invested in upstream oil and natural gas to 2030, a rise of more than 50% on recent years. Oil prices, meanwhile, seem well underpinned in the $70-90 range. While the number of miles driven – and so demand for fuel – fell sharply in the recession triggered by the Covid pandemic, that was an anomaly: the number of vehicles miles driven doesn’t typically fall that much during recessions. On the supply side, OPEC is exhibiting a welcome degree of discipline.

Our exposure to energy is well diversified, with seven holdings at the end of September. We are also focusing on companies with the strongest balance sheets. We want these positions to reflect our constructive view on energy prices; this is not the time to take on too much balance-sheet risk. The quarter’s top contributors included:

- Baker Hughes (energy technology/infrastructure; 3.1% of the fund, up 16.9% in sterling terms)

- Tenaris (steel tubes for the energy industry; 3.9% of the fund, up 10.5%)

- Fluor (classed as an industrial, its core expertise is in nuclear power plants; 1.1% of the fund, up 29.4%)

Our holdings in banks performed well

At 17%, banks represented the portfolio’s largest sector weighting at the end of the quarter. In addition to the aforementioned MUFJ, they include:

- BBVA (3% of the fund, up 10.8% on the quarter)

- KB Financial (1.6% of the fund, up 11.1%)

- Abu Dhabi Commercial Bank (1% of the fund, up 11.0% on the quarter)

- BNP Paribas (2% of the fund, up 5.8% on the quarter)

- Banco Santander (1.4% of the fund, up 8% on the quarter)

Given the widespread predictions of recession, this may seem counterintuitive. Certainly, this positioning is uncomfortable (our portfolio is not designed to give its managers an easy night’s sleep) but it reflects the reality of the world we see around us. Although central banks are tightening, expansionary fiscal policy is pulling in the other direction. For now, the global economy remains in Goldilocks mode.

At the same time, we recognise that there may be stock-specific risks in the sector: country risks, management risks or exposure to commercial real estate. So we are moving cautiously: we tend to own less levered banks with the highest cash returns to their shareholders (whether through share buybacks or dividends). These are emphatically not banks like SVB, which had grown (too) quickly over the past decade; instead, these are utility banks.

Moreover, we are careful to ensure our exposure here is well-diversified: we want to capture the benefits of higher interest rates and robust economic growth without exposing our clients to an undue level of company-specific risk. So we had holdings in 12 banks at the quarter end, with a wide spread of geographic exposure (we currently have an unusually low level of exposure to US banks).We have less exposure to defensives and bond proxies than our peers

We have less exposure to defensives and bond proxies than our peers

The third quarter was a challenging one for many ‘classic’ income sectors. Real estate, utilities and pharmaceuticals were among the market's weakest sectors. Our portfolio, however, currently has an unusually low level of exposure to those areas: the fund’s ‘core’ bucket is at its lowest level since the strategy’s launch in 2010.

Offsetting that, our allocations to the fund’s ‘risk’ and ‘growth’ buckets have never been larger. Income investing does not always mean taking positions in contrarian value stocks. But it does today. A decade ago, a Fed governor gave a speech in which he made the brute power of monetary policy clear: “it gets in all of the cracks…. changes in rates may reach into corners of the market that supervision and regulation cannot.” Today, those cracks are appearing in the share prices of classic income stocks.

Activity: Our strategic roadmap remains intact

We believe in ‘regime change’ and our portfolio retains a familiar shape. So while we made tactical changes to our portfolio in Q3, our overall strategic roadmap for economies and markets remains much as it was when 2023 began. The emergency liquidity the Fed supplied to financial system in the spring hasn’t changed the basic facts: the world still needs massive investment in the physical economy – in areas such as oil, defence and food production. We believe our clients’ capital is better deployed in areas where there is objective, measurable scarcity – aircraft, refineries, roads and oil rigs – than in long-duration growth names or concept stocks. Within that, however, we have made following refinements to our positioning:

We reduced our exposure to ‘defensives’ that weren’t acting like defensives. They included pharmaceuticals (such as AbbVie), medical device maker Johnson & Johnson and utilities such as PPL. We also reduced our allocation to consumer staples, selling Kraft Heinz and reducing Unilever. Staples have not provided the defensive characteristics might have expected, so we were happy to recycle some of this capital elsewhere.

Instead, we prefer cyclical companies with clean balance sheets. As such, additions over the quarter included companies benefit from fiscal stimulus and construction spending rather than monetary stimulus:

- CRH (building materials)

- Baker Hughes (energy technology/infrastructure)

- Ferguson (plumbing and heating)

- Fluor (complex construction projects, expertise in nuclear power plants)

We increased our exposure to banks

When 2023 began, we had 6.5% of the fund invested in banks; by the end of Q3 that had increased to 17.3%. Recent additions included positions in:

- Erste Group

- KB Financial

- Standard Chartered

- Danske Bank

These additions added further to our country and currency diversification.

We increased our exposure to emerging markets, particularly Brazil.

Central bankers in emerging markets exhibited greater alacrity in tackling inflation than their counterparts in the developed world. Many started hiking rates sooner and more aggressively than the Federal Reserve, the Bank of England or the European Central Bank. Having got on top of inflation, they are now ready to start cutting rates, supporting domestic demand and equity markets. Substantial dividends are on offer in countries like Brazil, where we see good growth and attractive valuations. We added to Petrobras and have exposure to the country through Banco do Brasil. Despite improvements in balance sheet positions, some state-controlled businesses are trading at their lowest-ever valuations.

Outlook: It really is different this time.

The Federal Reserve appears to have finished pushing rates higher. Historically, the ‘pause’ between rate hikes and rate cuts has been positive for long-dated bonds and so for long-duration assets. This time around, however, things are different… Bonds are not doing what they ‘normally’ do when the Fed pauses after hiking and yields are going higher rather than lower. Bond yields look to have markedly broken out of a multi-decade cycle of compression: the US 10-year yield is at its highest level for 15 years. So the ‘usual’ investing playbook doesn’t apply. In the equity market, long-duration defensives could well remain under pressure.

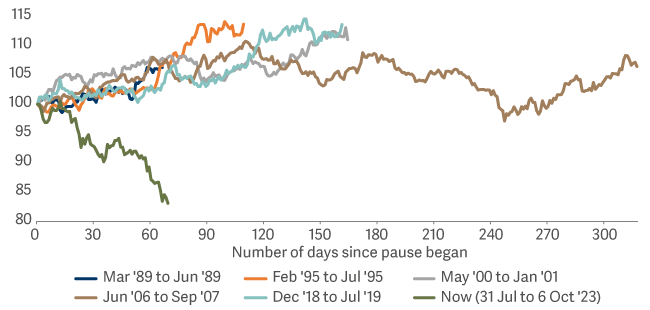

Long-term UST performance during Fed pauses

It really is different this time: The current Fed ‘pause’ has had a dramatically different impact on long-term bond prices than previous pauses.

While the future course of the economy is difficult to predict, our portfolio corresponds to a reasonably benign outlook for growth. A shallow recession could well occur – and recent signs of weakness in Europe might support this view – but the prospects of a sharp, deep recession seem to be decreasing. The bottom-up story, meanwhile, is that we continue to see strong earnings momentum and positive earnings revisions across our companies: on consensus forecasts, the portfolio’s dividend will grow by 7-8% over the next 12 months.

In a world where interest rates are going to remain higher for longer, we take comfort in the fact that our portfolio, which has always exhibited a clear value bias, has never been cheaper relative to the index than it is today: it trades on a p/e multiple of 12x versus 22x for the MSCI AC World Index. That is not due to a lack of quality among our holdings: their debts are modest (our average net-debt-to-Ebitda is around 1x) and many are growing their earnings and their dividends. We believe reasonably priced companies aligned to areas of scarcity in the physical world should be able to command pricing power – and deliver growing dividends to their shareholders – for years to come.

Source: Lipper Limited/Artemis from 31 March to 30 September for class B Acc USD.

All figures show total returns with dividends and/or income reinvested, net of all charges.

Performance does not take account of any costs incurred when investors buy or sell the fund.

Returns may vary as a result of currency fluctuations if the investor's currency is different to that of the class.

Benchmark: MSCI AC World NR; the benchmark is a point of reference against which the performance of the fund may be measured. Management of the fund is not restricted by this benchmark. The deviation from the benchmark may be significant and the portfolio of the fund may at times bear little or no resemblance to its benchmark.