Can high-yield bonds withstand a falling dollar?

Political uncertainty has called the status of the world’s reserve currency into question. With 80% of the global high-yield bond market denominated in dollars, how will it cope with a flight of capital out of the US?

As the American exceptionalism narrative wanes, global equity mandates are coming under scrutiny. The MSCI World index may be global in name, but it is American in nature, with the US accounting for 71% of assets as of 30 April 20251.

The global high-yield bond market is even more concentrated, with about 80% in dollar-denominated bonds2.

With the dollar’s recent weakness calling its reputation as a safe haven into question and prompting investors to reconsider their direct and indirect exposure to the currency, you could be forgiven for casting a worried glance towards high yield.

Yet we believe the asset class will prove resilient to any flight of capital from the US, for two reasons.

The high-yield bond market isn’t reliant on demand

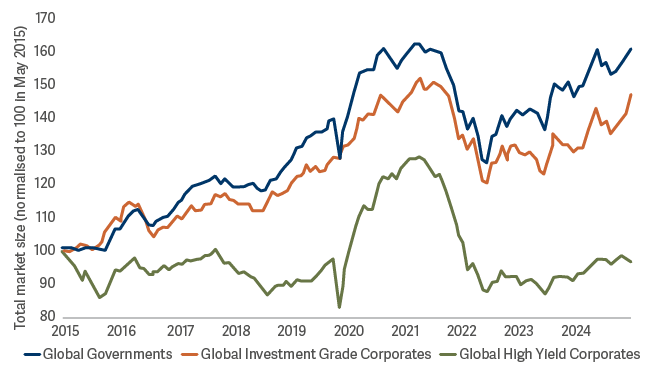

First and foremost, the high-yield bond market does not need additional demand to thrive. It has, in fact, shrunk over the past decade, whereas the opposite is the case for government debt and investment-grade credit. Government deficits have ballooned and investment-grade corporate bond issuance has ramped up significantly.

The high-yield bond market is in a completely different (and much more secure) place and has no need for a ‘marginal buyer’, stepping in to soak up excess bonds.

Global Government and Investment Grade Corporate bond markets have expanded significantly over the last decade; Global High Yield Corporate Bond market has not

The second reason is that while the high-yield market has been contracting, large institutional investors have been increasing their allocations.

Historically, much of the market was dominated by ‘tactical’ investors such as hedge funds and mutual funds. However, these have been displaced in recent years by pension funds and insurers, which tend to take more of a buy-and-hold approach, meaning they have much longer time horizons. This ‘stickiness’ should shield the high-yield bond market from sudden swings in sentiment.

Doubling down on resilience

It is also worth pointing out that our Global High Yield Bond, Short-Dated Global High Yield Bond, High Income and Monthly Distribution Funds are more diversified and less exposed to the US currency than the wider market, with around half of our exposure in dollar-denominated bonds3.

What’s more, we fully hedge all our dollar exposure, so if you own non-dollar share classes in our funds and the currency falls, your investments won’t be affected.

We are bond experts, not currency traders. Trying to time currency movements can be akin to catching a falling knife, so we prefer to hedge currency risk and focus on generating alpha from high-conviction security selection.

Where currencies throw up opportunities

Now we’ve covered the currency risks in high yield, let’s talk about the opportunities.

International companies often issue almost identical bonds from the same part of the capital structure and with the same maturity, but different yields depending upon the country in which they are issued.

One recent example is payments processor Shift4, which has a stranglehold over the US hospitality industry – if you go to a hotel in the US and settle your bill at reception, I can almost guarantee that a Shift4 logo will appear when you tap your card.

Shift4 recently bought a European business called Global Blue, which allows you to claim back VAT when you go through an airport. Now, because there’s a big European element to Global Blue’s business, it issued euro bonds to pay for the acquisition.

Yet these euro bonds have yields about 200bps above those of Shift4’s dollar bonds4. There's no logical reason why they're trading there, apart from the fact that few euro investors have previously looked at Shift4 and need to be sold on the idea.

Meanwhile, we recently switched from euro to dollar bonds of German pharmaceutical Cheplapharm for a yield pickup of about 200bps5.

This is down to the siloed nature of US and European high yield, where investors only consider bonds in their home market. About 90%6 of high-yield bond funds have a regional, rather than a global approach, while we believe that a good chunk of the remaining 10%7 is made up of a couple of regional strategies that have been shunted together with little reference to one another.

This allows us to continuously make incremental gains without taking currency risk and sets us apart from our peers. When we say we’re global, we mean in both name and nature.

2Bloomberg as at 31/05/2025

3Artemis as at 30 April 2025

4 & 5Bloomberg/Artemis

6 & 7Bloomberg as at 31 January 2021