Income v accumulation classes

This page looks at the two main forms of unit or share classes in terms of whether they pay an income to investors or not.

In terms of income and how this is distributed to investors, there are two types of class in a fund available to investors: ‘distribution’ and ‘accumulation’ classes.

- Distribution classes pass on the income received by the fund to For funds that hold shares, this income tends to come from excess profits distributed to investors in the form of dividends. For funds that invest in bonds, this income tends to come from coupon payments, which are similar to the interest paid on a loan. Distributions to investors are made at predetermined intervals, typically annually, semi- annually, quarterly or monthly. Income is expressed as a yield, which is the amount paid as a percentage of the unit price of a fund, bond or share.

- Accumulation classes reinvest any income received from the underlying assets (shares, bonds and so on) back into the fund so its capital can grow The way this works is income is ‘credited to the fund’s capital’, meaning it becomes part of the capital value of the fund. In practice, the value of each accumulation share increases as a result, but the number of accumulation shares/units remains unchanged.

Which class is more suitable?

- Investors who rely on the income from their investments, such as those in retirement, are likely to be better off in distribution classes as these will provide them with a regular amount of money paid to their bank account.

- Investors who wish to maximise their total return (also known as investing for growth), such as those who are building up a pension pot and are many years away from retirement, are likely to be better off in accumulation classes as these automatically reinvest any This allows them to benefit from compounding, or interest paid on top of interest already earned, which is one of the most powerful forces for increasing the value of wealth over the long term.

Some investors may become confused that the stated total return of a fund they hold doesn’t match what they see on their statements. This may be because of the share class they are in – all share classes express performance using total returns (meaning all income is reinvested), even income ones. This means that if you are in an income class, you will receive a regular payment rather than reinvesting it back into the fund, so your total return will differ from the stated figures.

The difference between accumulation and income share classes

The following case study has been created to help you understand the difference between accumulation and income share classes.

Take two investors:

- Inc, who has already retired and is investing for income, and

- Acc, who is saving towards retirement and wants to maximise total return.

Both Inc and Acc invest their money in the FTSE All-Share index at the start of 2014 and keep it there for the next 10 years.

Over this time, the price of the FTSE All-Share rises a disappointing 17.2%*. Yet this ignores the impact of dividend payments, which over 10 years amount to 38.3%* of the original investment.

Because Investor Inc is retired, they take the income as it is paid, which combined with the price rise in the index equates to a total return of 55.5%*. Much better.

However, because Investor Acc doesn’t need the money just yet, they automatically reinvest the income paid out by the index. This means that when it is time for the second round of income, it is paid not just on the initial sum, but on the initial sum plus the first round of income.

When it is time for the third round of income, it is paid on the initial sum, the first round of income, the income received on the first round of income, the second round of income and the income received on the second round of income. And so on.

Because Investor Inc automatically takes any income instead of reinvesting it, the income will only be paid on the initial sum.

As a result, after 10 years, Investor Acc would have made a total return of 67.6%* compared with 55.5%* from Investor Inc.

Albert Einstein referred to compounding as the Eighth Wonder of the World

Doubling up

But what happens if instead of investing their money over 10 years, Acc and Inc did so over 20?

The good news is that returns would have been much better for both investors. This is partly because their entry point at the start of 2004 was close to the market’s low point following the bursting of the dotcom bubble and the Iraq War.

Over the next 20 years, the price of the FTSE All-Share rises 91.7%*. On top of this, it pays an income worth 107.5%* of the original investment, meaning Investor Inc would have made a total return of 199.2%*. Not bad at all.

However, by reinvesting dividends, Investor Acc would have made a total return of 289.7%* – an extra 90.5 percentage points over Investor Inc.

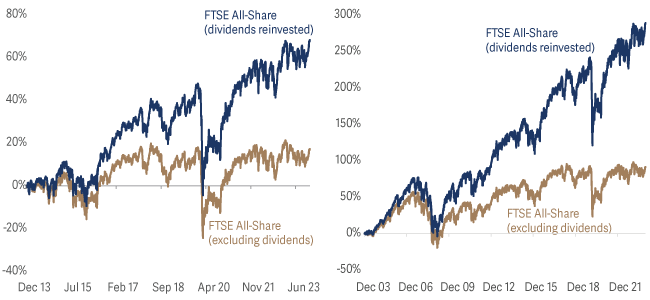

Performance of FTSE All-Share index, showing total return (with dividends reinvested) versus price only (excluding dividends)

The first graph shows 1 January 2014 to 31 December 2023; the second shows 1 January 2004 to 31 December 2023

This is why Albert Einstein referred to compounding as the Eighth Wonder of the World. However, it is not much use if you are relying on the income from your investments to pay your gas bill.

Whether an income or accumulation strategy/share class is right for you will depend on your individual circumstances. However, please bear in mind that all financial investments involve taking risk and the value of your investment may go down as well as up. In addition, the past performance of stockmarkets is not a guide to their future performance.

This information is intended to provide you with help and guidance about investing generally and about investing with Artemis. It is not a marketing communication and should not be used to make investment decisions. You should always refer to the relevant fund prospectus and KIID/KID before making any final investment decisions.

Artemis does not provide investment advice on the advantages or suitability of its products and no information provided should be viewed in this way. Should you be unsure about the suitability of an investment, you should consult a suitably qualified professional adviser.